- The volume of trading in all derivatives was 1.5 million instruments in June 2013.

- The number of open interest was 197.9 thousand at the end of June 2013.

WIG20 futures

- The volume of trading in WIG20 futures was 1.05 million contracts in June 2013.

- The number of open interest in WIG20 futures was 103.8 thousand contracts at the end of June 2013.

Options

- The volume of trading in WIG20 options was 91.5 thousand options in June 2013;

- The number of open interest in options was 35.9 thousand options at the end of June 2013.

Single-stock futures

- The volume of trading in single-stock futures was 60.3 thousand contracts in June 2013;

- The number of open interest in single-stock futures was 9.1 thousand contracts at the end of June 2013;

- The most traded single-stock futures in June were:

No. Underlying Trading volume (#) in June 2013

- 1. PKO BP SA 20 822

- 2. KGHM S.A. 17 956

- 3. PKN ORLEN SA 6 849

- 4. PGE SA 2 877

- 5. PZU SA 2 575

Currency futures

- The volume of trading in currency futures was 314.9 thousand contracts in June 2013*;

- The most traded currency futures in June 2013 were USD/PLN futures. The volume of trading in USD/PLN futures was 254.8 thousand contracts, representing 81.0% of the volume of trading in all currency futures;

- The number of open interest in currency futures was 38.8 thousand contracts at the end of June 2013.

For more statistics, see Table 1 and Figures 1 and 2 below.

*All figures concerning trade in derivatives include the change in the standard specification of currency futures contracts as of 1 May 2012 whereby the size of such contracts was divided by 10.

Table 1

Volume of trading (including block trades):

- in June 2013;

- in July 2012 – June 2013;

- number of open interest (NOI) at the end of June 2013.

|

No. |

INSTRUMENT |

VOLUME OF TRADING (#) |

NOI (#) |

||||||||||

|

JUNE |

JAN - JUNE 2013 |

JAN - JUNE 2012 |

CHANGE |

LAST 12 MONTHS JUL'12-JUN'13 |

2012 |

CHANGE |

END OF JUNE |

||||||

|

2013 |

2012 |

CHANGE |

(%) |

(%) |

2013 |

2012 |

CHANGE |

||||||

|

(%) |

(%) |

||||||||||||

|

1 |

WIG20 FUTURES |

1 046 581 |

1 021 297 |

2,48% |

4 312 787 |

5 058 805 |

-14,75% |

8 331 022 |

9 077 040 |

-8,22% |

103 769 |

98 174 |

5,70% |

|

2 |

mWIG40 FUTURES |

6 555 |

1 262 |

419,41% |

19 491 |

7 643 |

155,02% |

25 896 |

14 048 |

84,34% |

864 |

300 |

188,00% |

|

3 |

SINGLE STOCK FUTURES |

60 255 |

38 929 |

54,78% |

373 496 |

268 408 |

39,15% |

645 418 |

540 330 |

19,45% |

9 064 |

8 708 |

4,09% |

|

4 |

CURRENCY FUTURES |

314 851 |

113 407 |

177,63% |

1 414 034 |

300 395 |

370,72% |

2 074 574 |

960 935 |

115,89% |

38 806 |

16 441 |

136,03% |

|

5 |

WIG20 OPTIONS |

91 534 |

65 316 |

40,14% |

408 882 |

297 730 |

37,33% |

826 516 |

715 364 |

15,54% |

35 931 |

26 508 |

35,55% |

|

6 |

INDEX PARTICIPATION UNITS |

829 |

6 033 |

-86,26% |

4 639 |

17 118 |

-72,90% |

16 131 |

28 610 |

-43,62% |

9 444 |

11 008 |

-14,21% |

|

TOTAL |

1 520 605 |

1 246 244 |

22,02% |

6 533 329 |

5 950 099 |

9,80% |

11 919 557 |

11 336 327 |

5,14% |

197 878 |

161 139 |

22,80% |

|

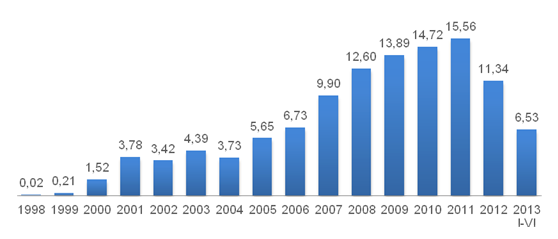

Figure 1

Annual volume of trading (including block trades) in all derivative instruments listed on the WSE in 1998 – June 2013 (million instruments).