WIG20 futures

- The volume of trading in WIG20 futures was 686.4 thousand contracts in February;

- The number of open interest in WIG20 futures was 132.1 thousand contracts at the end of February. This was a record-high number of open interest at month end.

Options

- The volume of trading in WIG20 options was 43.1 thousand options in February;

- The volume of trading in the last 12 months (March 2011 – February 2012) was 825.5 thousand options;

- The number of open interest in WIG20 options was 45.7 thousand options at the end of February.

Single-stock futures

- The volume of trading in single-stock futures was 43.2 thousand contracts in February;

- The number of open interest in single-stock futures was 12.4 thousand contracts at the end of February;

- The most traded single-stock futures were:

No. Underlying Trading volume (#) in February 2012

1. PKO BP SA 12 337

2. KGHM SA 11 571

3. PKN ORLEN SA 5 918

4. PGE SA 2 570

5. PETROLINVEST SA 2 226

Currency futures

- The volume of trading in currency futures was 21.6 thousand contracts in February, an increase of 160% year on year;

- The most traded currency futures in February were USD/PLN futures. The volume of trading in USD/PLN futures was 19.4 thousand contracts;

- The number of open interest in currency futures was 3.6 thousand contracts, an increase of 44.6% year on year.

Table 2

Volume of trading (including block trades):

· in February 2012;

· in January-February 2012;

· in the last 12 months (March 2011 – February 2012);

· number of open interest (NOI) at the end of February 2012.

|

No. |

INSTRUMENT |

|

NOI |

||||||||||

|

VOLUME OF TRADING |

(#) |

||||||||||||

|

(#) |

|

||||||||||||

|

FEBRUARY |

JANUARY-FEBRUARY |

LAST 12 MONTHS |

2011 |

CHANGE |

end of FEBRUARY |

||||||||

|

2012 |

2011 |

CHANGE |

2012 |

2011 |

CHANGE |

(MAR'11 - FEB'12) |

(%) |

2012 |

2011 |

CHANGE |

|||

|

(%) |

(%) |

|

(%) |

||||||||||

|

1 |

WIG20 FUTURES |

686 417 |

904 991 |

-24.15% |

1 453 909 |

2 075 905 |

-29.96% |

13 020 286 |

13 642 282 |

-4.56% |

132 138 |

98 409 |

34.27% |

|

2 |

mWIG40 FUTURES |

1 312 |

2 034 |

-35.50% |

2 608 |

4 738 |

-44.96% |

27 309 |

29 439 |

-7.24% |

502 |

815 |

-38.40% |

|

3 |

SINGLE STOCK FUTURES |

43 217 |

47 758 |

-9.51% |

96 009 |

104 114 |

-7.78% |

729 637 |

737 742 |

-1.10% |

12 377 |

9 354 |

32.32% |

|

4 |

CURRENCY FUTURES |

21 562 |

8 292 |

160.03% |

40 303 |

17 019 |

136.81% |

222 774 |

199 490 |

11.67% |

3 609 |

2 496 |

44.59% |

|

5 |

WIG20 OPTIONS |

43 124 |

64 073 |

-32.70% |

78 512 |

150 793 |

-47.93% |

825 520 |

897 801 |

-8.05% |

45 676 |

108 198 |

-57.78% |

|

6 |

WIG20 INDEX PARTICIPATION UNITS |

829 |

2 616 |

-68.31% |

3 289 |

3 381 |

-2.72% |

49 948 |

50 040 |

-0.18% |

13 359 |

13 073 |

2.19% |

|

|

TOTAL |

796 461 |

1 029 764 |

-22.66% |

1 674 630 |

2 355 950 |

-28.92% |

14 875 474 |

15 556 794 |

-4.38% |

207 661 |

232 345 |

-10.62% |

Source: WSE

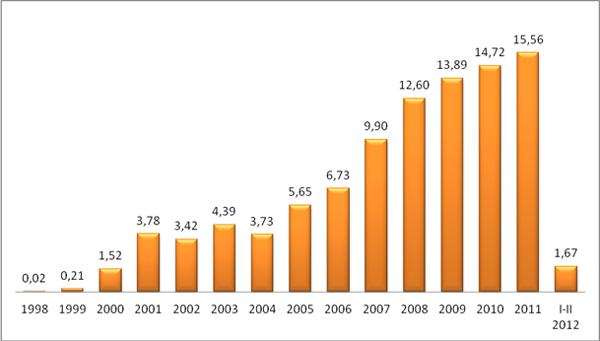

Figure 1

Annual volume of trading (including block trades) in all derivative instruments listed on the WSE in 1998 – February 2012 (million instruments).

Source: WSE

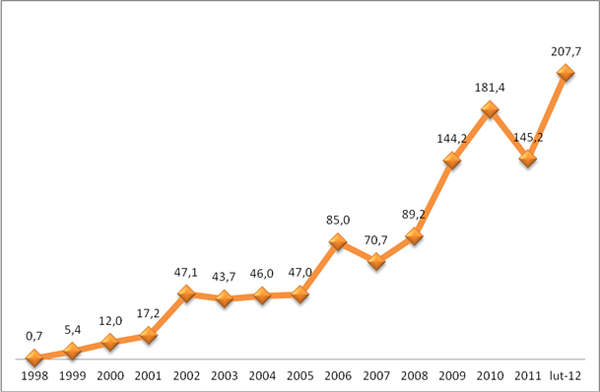

Figure 2

Total number of open interest in all derivative instruments at year-end and at the end of February 2012 (thousand instruments).

Source: WSE