- The total volume of trading in all derivatives was 15.6 million instruments in 2011, an increase of 5.7% year on year.

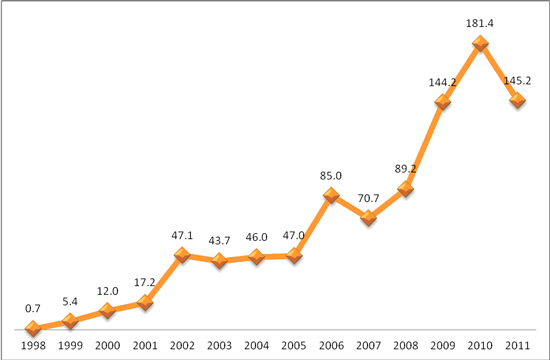

- The number of open interest was 145.2 thousand instruments at the end of the year.

WIG20 futures

- The volume of trading in WIG20 futures was 13.6 million contracts in 2011, an increase of 1.2% year on year;

- The monthly volume of trading in WIG20 futures was historically the highest in August 2011 at 1.7 million contracts;

- The number of open interest in WIG20 futures was 104.9 thousand contracts at the end of 2011; the month-end number of open interest in WIG20 futures was the highest at the end of May 2011 at 123.9 thousand contracts..

WIG20 options

- The volume of trading in WIG20 index options was 897.8 thousand options in 2011, an increase of 33% year on year;

- The monthly volume of trading in WIG20 index options was the highest in WSE history in August 2011 at 135.3 thousand options. The daily volume of trading in WIG20 options was historically the highest on 4 August at 19,372 options;

- The number of open interest in options was 17.5 thousand options at the end of the year. The month-end number of open interest was historically the highest at the end of May 2011 at 144.9 thousand options.

Single stock futures

- The volume of trading in single stock futures was 737.7 thousand contracts in 2011, an increase of 96.5% year on year;

- The monthly volume of trading in single stock futures was the highest in WSE history in August 2011 at 79.7 thousand contracts. The daily volume of trading in WIG20 options was historically the highest on 4 August at 6,261 contracts;

- The number of open interest in single stock futures was 6.5 thousand contracts at the end of 2011. The month-end number of open interest was historically the highest at the end of July 2011 at 14.4 thousand contracts.

- The most traded single stock futures as measured by the highest monthly trading volume:

|

No. |

Underlying |

Volume of trading (#) in 2011 |

% share in the volume of trading in all single stock futures in 2011

|

|

1. |

KGHM SA |

319,805 |

43.4 |

|

2. |

PKO BP SA |

149,746 |

20.3 |

|

3. |

PKN ORLEN SA |

141,984 |

19.3 |

|

4. |

TP SA |

30,011 |

1.1 |

|

5. |

PGE SA |

22,557 |

3.1 |

Currency futures

- The volume of trading in currency futures was the highest in the history of this instrument on the WSE.

- The most traded currency futures in 2011 were USD/PLN futures: the volume of trading in USD/PLN futures was 104.5 thousand contracts. The second most traded currency futures were CHF/PLN futures with a trading volume of 73.2 thousand contracts;

- In total, currency futures generated a trading volume of 199.5 thousand contracts in 2011 (an increase of 68% year on year);

- The number of open interest in currency futures was 3,276 contracts at the end of December, an increase of 68% year on year;

- The number of open interest was record-high in July 2011 at 6,299 currency futures.

For more statistics, see Table 2 and Figures 1 and 2 below.

Highlights of 2011

- The Exchange introduced to trading 8 new single stock futures on the shares of the following companies:

1) CD PROJEKT RED SA,

2) GLOBE TRADE CENTRE SA,

3) GRUPA LOTOS SA.

4) JASTRZĘBSKA SPÓŁKA WĘGLOWA SA,

5) KERNEL HOLDING SA,

6) LUBELSKI WĘGIEL BOGDANKA SA,

7) PETROLINVEST SA,

8) TVN SA.

As a result, the WSE offered 18 single stock futures at the end of 2011 (16 futures on shares of companies participating in the WIG20 index and 2 companies participating in the mWIG40 index).

- Three new market makers began operation on the WIG20 options market. In total, 5 market makers support liquidity, including 3 domestic companies and 2 foreign companies. The increase of the number of market makers has significantly improved liquidity of this market segment.

- In Resolution No. 1315/2011 dated 20 October 2011, the Exchange Management Board amended the standard specification of single stock futures by changing the calculation formula of the final settlement price. According to the new rules, the price is determined as the price of the last transaction in shares which are the underlying instrument concluded at the trading session on the expiry date of the given futures. The Resolution entered into force on 19 December 2011.

- In Resolution No. 1272/2011 dated 7 October 2011, the Exchange Management Board amended the rules of concluding block trades in derivatives. The changes include:

- Time limit of concluding a block trade extended from 17:45 to 17:50 (for all futures and options);

- Minimum volume of a block trade in single stock futures reduced from 500 to 200 contracts. As a result, the parameter is the same (200) for all derivatives;

- Change of the maximum volume of a block trade for all futures and options.

- In Resolution No. 643/2011 dated 20 May 2011, the Exchange Management Board amended the standard specification of WIG20 index participation units by changing the calculation algorithm of the settlement price as well as the exercise dates of index participation units. As a result, index participation units can be exercised 4 times per year and the calculation algorithm of the settlement price is consistent with the calculation algorithm of the final settlement price for index futures and options. The Resolution entered into force on 21 November 2011.

- The Exchange launched an internet service dedicated to the derivatives market. The service is available at www.pochodne.gpw.pl. Among its core parts are extensive educational materials. Many of them are translations of materials of The Options Industry Council (OIC), an organisation established in 1992 in the USA with a mission of educating investors and financial advisors in the use, advantages and risks involved in investment in exchange-traded options. The materials have been translated under a contract between the WSE and OIC.

- A television channel in co-operation with the Exchange organised a series of educational programmes on exchange-traded options entitled “Invest in Options with the Exchange”. Fifteen episodes of the programme have been produced, which present the structure of options, the rules of their trading and the most popular investment strategies for options.

Table 2

Volume of trading (including block trades):

- in December 2011 and in all of 2011;

- number of open interest (NOI) at the end of December 2011

|

LP |

INSTRUMENT |

VOLUME OF TRADING (#) |

NOI (#) |

|||||||

|

DECEMBER |

JANUARY-DECEMBER |

end of DECEMBER |

||||||||

|

2011 |

2010 |

CHANGE |

2011 |

2010 |

CHANGE |

2011 |

2010 |

CHANGE |

||

|

(%) |

(%) |

(%) |

||||||||

|

1 |

WIG20 FUTURES |

1 050 448 |

991 552 |

5.94% |

13 642 282 |

13 481 633 |

1.19% |

104 924 |

114 019 |

-7.98% |

|

2 |

mWIG40 FUTURES |

1 766 |

3 636 |

-51.43% |

29 439 |

32 998 |

-10.79% |

530 |

801 |

-33.83% |

|

3 |

SINGLE STOCK FUTURES |

50 866 |

39 345 |

29.28% |

737 742 |

375 496 |

96.47% |

6 545 |

7 735 |

-15.38% |

|

4 |

CURRENCY FUTURES |

16 600 |

9 619 |

72.58% |

199 490 |

119 075 |

67.53% |

3 276 |

1 949 |

68.09% |

|

5 |

WIG20 OPTIONS |

35 834 |

66 785 |

-46.34% |

897 801 |

675 112 |

32.99% |

17 517 |

43 583 |

-59.81% |

|

6 |

WIG20 INDEX PARTICIPATION UNITS |

2 649 |

2 515 |

5.33% |

50 040 |

36 240 |

38.08% |

12 385 |

13 281 |

-6.75% |

|

|

TOTAL |

1 158 163 |

1 113 452 |

4.02% |

15 556 794 |

14 720 554 |

5.68% |

145 177 |

181 368 |

-19.95% |

Source: WSE

Figure 2

Total number of open interest in all derivative instruments at year-end (thousand instruments).

Source: WSE