Geopolitical and trade policy turmoil has caused considerable volatility on international stock markets. On the Vienna Stock Exchange, this resulted in a trading volume of EUR 52.95 billion, with the Austrian leading index ATX hovering near its all-time high. At the beginning of July, REPLOID Group AG became the second company after Steyr Motors AG to be listed in the SME segment direct market plus in 2025. The growth trend in debt listings has led to another record year: after just three quarters, 21,719 new bonds were listed – around 62% more than in the entire previous record year.

"Austrian stocks remained in demand as part of the brisk market activity. With continued growth in the global market and ETF sector, as well as business development in the debt listing space, we are consistently expanding our offering beyond our core business in Austrian equity trading. In doing so, we are creating added value for investors and issuers alike," says Christoph Boschan, CEO of Wiener Börse AG.

Volatile market conditions lead to high equity turnover

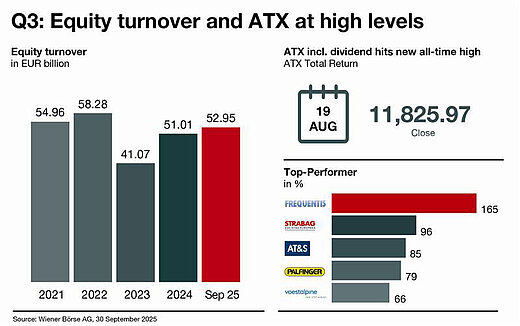

After an exceptionally strong spring in terms of turnover, which was particularly influenced by US tariff policy, the summer months were somewhat quieter. Still, August was the second-strongest month in the past decade – surpassed only by August of the previous year. September turnover was also on a par with peak years such as 2021 or 2022. Geopolitical news therefore continues to cause noticeable movement on the markets. Turnover from equity investments amounted to EUR 52.95 billion at the end of the third quarter (+3.8% vs Q1-Q3 2024: EUR 51.01 billion).

ATX including dividends at new all-time high and with new composition

The ATX Total Return, like the German DAX, a performance index including dividends, tops international rankings with its year-to-date gains. On 19 August, the national index reached its all-time high of 11,825.97 points. By 30 September, the Austrian benchmark, including dividends, had risen by 32.45% (ATX without dividends: 26.56%), putting it ahead of the DAX (19.95%), MSCI World (16.15%) and Euro Stoxx 50 (12.95%). Since 22 September, the ATX has also been calculated with a new composition: as part of the semi-annual review, STRABAG SE and PORR AG were newly included, replacing Telekom Austria AG and Mayr-Melnhof Karton AG. As of 30 September, the market capitalisation of all domestic companies listed in Vienna amounted to EUR 160 billion.

"Austrian stocks are in high demand this year, and this trend is far from short-term. Since the start of calculation, the ATX Total Return has delivered an annualised average performance of around 7%, earning its place in the global league. Attractive dividend yields, a strong position in the growth region of Central and Eastern Europe and moderate valuations make Austrian equities a key component of globally balanced portfolios," says Boschan.

ETF offering more than doubled since the beginning of the year

Turnover in the international segments of global market and exchange traded funds also developed very positively this year. Both the number of international equities tradable in Vienna at domestic fees and the number of index funds have been expanded several times over the course of the year. Most recently, 50 new ETFs were added to trading on the Vienna Stock Exchange, more than doubling the offering since the start of the year from 137 to 336 funds. The global market grew by around 60 securities this year, with the latest addition being the Swedish payment service provider Klarna. Shares in the medical technology company Ottobock are also set to be offered on the Vienna Stock Exchange, alongside the planned IPO on Deutsche Börse. The international segment currently comprises around 900 securities from 28 countries.

Another record year for debt listings

The Vienna Stock Exchange has continued its strong growth in debt listings. By the end of the third quarter, 21,719 primary listings were admitted to trading, clearly surpassing the previous record year of 2024 (13,443) several months before the end of 2025. This is the result of the Vienna Stock Exchange's growing global reach, as underscored by listings from China's Alibaba Group and the first Mexican issue by Cobre del Mayo. A total of 1,297 debt issuers from 48 countries are currently served.

| Vienna Stock Exchange: Q1-Q3 facts and figures | |||

|---|---|---|---|

| Equity turnover Q1-Q3 comparison | Top performers prime market 2025 | Most traded shares 2025 | Strongest trading days 2025 |

| 2025: EUR 52.95 billion |

FREQUENTIS AG +165.47% |

Erste Group Bank AG EUR 12.63 billion |

21 March EUR 1,077.83 million |

| 2024: EUR 51.01 billion |

STRABAG SE +96.46% |

OMV AG EUR 7.74 billion |

19 September EUR 1,022.01 million |

| 2023: EUR 41.07 billion |

AT&S Austria Tech.& Systemtech. AG +84.97% |

BAWAG Group AG EUR 5.38 billion |

28 February EUR 896.96 million |