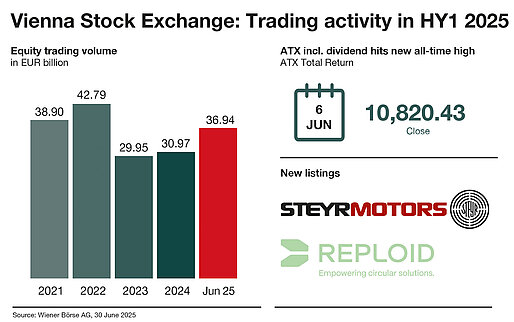

Dynamic trading activity characterised the first half of the year on the Vienna Stock Exchange. The ATX, including dividends, continued to climb from its previous record level. Following Steyr Motors AG in the spring, REPLOID Group AG was the second listing in the direct market plus for small and medium-sized enterprise (SMEs) this year on 3 July. The Vienna Stock Exchange saw further growth in debt listings, as well as in international equities and ETFs.

"So far this year, we have seen uncertainty and a lot of movement on the global markets. At the same time, European investment programmes have also boosted the domestic stock market. This has resulted in noticeably higher equity turnover compared to the previous year. The continued growth in the segment direct market plus underpins the need for uncomplicated and practical access to the capital market for companies," says Christoph Boschan, CEO of Wiener Börse AG.

Equity and ETF turnover increased significantly – strong internationality

Turnover from equity trading rose to EUR 36.94 billion at the end of the first half of the year (+19.28% vs H1 2024: EUR 30.97 billion). A study by S&P Market Intelligence on the institutional free float in the prime market underlines the importance of Austrian stocks for international investors. 92.3% of the freely tradable shares in the portfolios of large investors – i.e. those holding at least four per cent of the free float – are held by international asset managers. The majority originates from the USA, accounting for 34%.

Extensive expansion of ETFs and international securities

Trading in international securities and ETFs (Exchange Traded Funds) on the Vienna Stock Exchange has also increased significantly. As of today, 50 additional ETFs can be traded on the Vienna Stock Exchange at domestic fees. As a result, the ETF offering on the Vienna Stock Exchange has more than doubled this year to over 280 index funds. The attractiveness of ETF investments is also reflected in trading turnover, which reached an all-time high of over EUR 400 million in the first half of the year. In addition, the international global market segment was expanded several times within the last months: 68 securities from around the world have been included in trading since the beginning of the year, most recently the Swiss SMI index blue chips. Around 900 securities from 28 countries can now be traded in euros, at domestic fees and during Vienna trading hours.

ATX including dividends at record level

The ATX Total Return – a performance index like the German DAX – is one of the top international performers with its year-to-date growth. On 6 June, the national index reached a new all-time high of 10,820.43 points. By 30 June, the Austrian leading index, including dividends, has risen by 26.38% (ATX without dividends: 20.95%), putting it ahead of the DAX (20.09%), Euro Stoxx 50 (8.32%) and MSCI World (8.59%). The market capitalisation of all domestic companies listed in Vienna amounted to around EUR 153 billion at this time.

"The European stock market is on the upswing and Austrian companies are part of this dynamic. They stand out with solid dividends, moderate valuations and strong positioning in the growth region of Central and Eastern Europe," says Boschan.

Debt listings almost at the overall level of 2024

The number of debt listings continues to grow rapidly. At the end of June, 12,144 new listings were recorded, almost as many as in the entire previous year (2024: 13,443). The new listings came from over 30 countries, spread across around 360 issuers. This corresponds to around 24% more issuers than in the same period of the previous year. In total, the Vienna Stock Exchange currently services around 1,200 issuers from 44 countries.

| Vienna Stock Exchange: First half-year facts and figures | |||

|---|---|---|---|

| Equity turnover | Top performer ATX Prime | Most traded shares | Strongest trading days |

| 2025: EUR 36.94 bn |

STRABAG SE +104.30% |

Erste Group Bank AG EUR 8.98 bn |

21 March EUR 1,077.83 mn |

| 2024: EUR 30.97 bn |

FREQUENTIS AG +83.45% |

OMV AG EUR 5.80 bn |

28 February |

| 2023: EUR 29.95 bn |

Palfinger AG +81.91% |

BAWAG Group AG EUR 3.40 bn |

20 June EUR 850.70 mn |