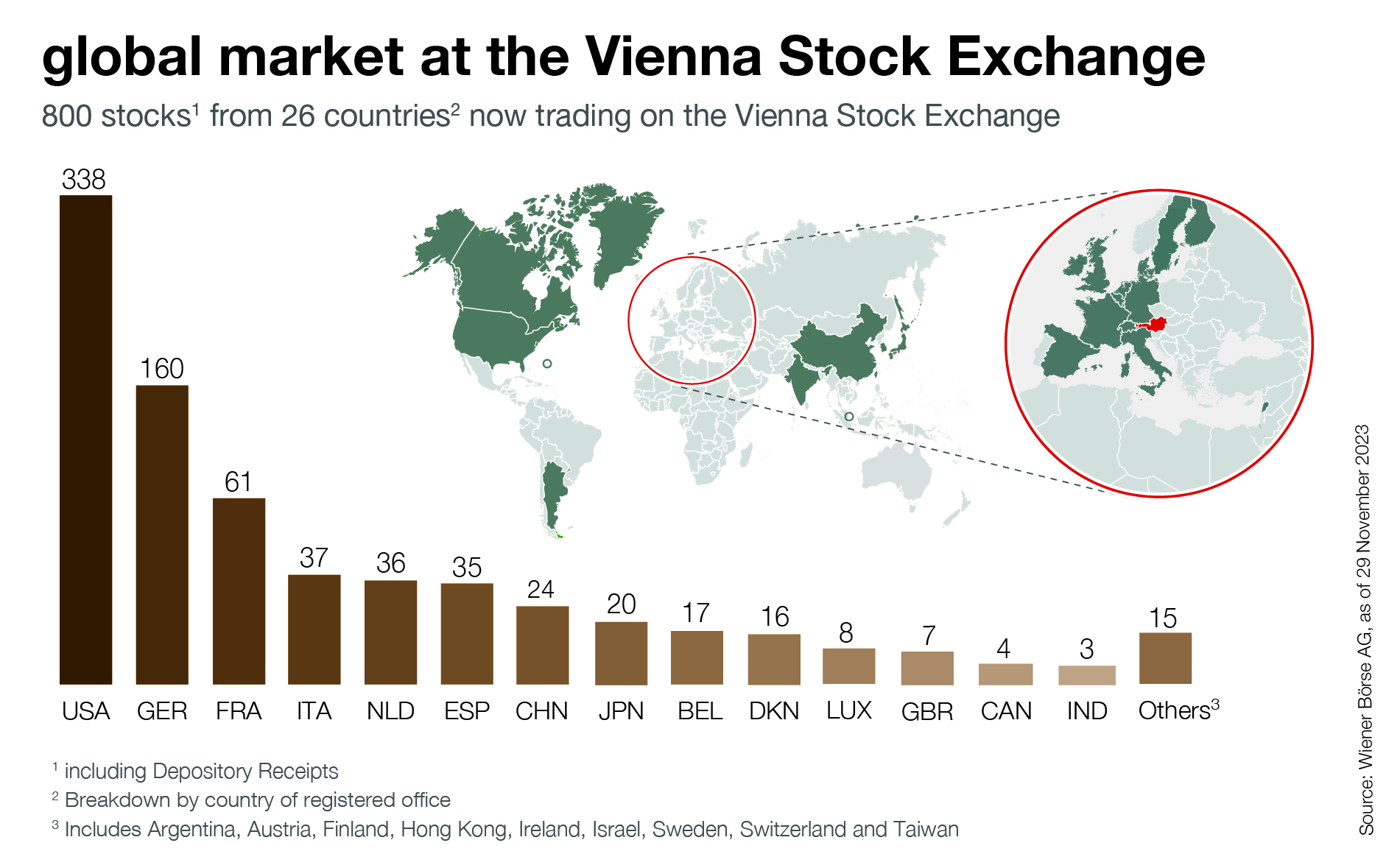

As of today, Austrian fans of US equities will find an expanded offering in the global market of the Vienna Stock Exchange. In addition to the already listed 250 US securities, a further almost 30 are being added today. These include popular stocks such as the financial services provider "Bank of New York Mellon", "Fidelity National Information Service" processing of financial transactions, the global hotel chain "Hilton Worldwide Holdings", the rating agency "Moody's" and one of the largest US retailers "Target". Over 680 securities from 26 countries can be traded in the global market. The segment is very well received by domestic investors. Turnover on 23 October was EUR 1.59 billion, up almost 50% on the same period last year.

"A broad investment horizon is important, both in terms of time and sectors. 'Buy local – invest global'. Our global market segment offers access to popular blue chips via the national exchange applying a domestic fee schedule. We will maintain this course and continuously broaden our offering," says Christoph Boschan, CEO of the Vienna Stock Exchange.

In the global market segment, three market makers (Baader Bank, Lang & Schwarz and Raiffeisen Centrobank) provide additional liquidity. With attractive prices, they create the opportunity for continuous trading between 9:00 and 17:30 hours. Narrow spreads with high volumes enable private investors to execute immediately and at lower fees than abroad.

Download info graphic (jpg-file 255 KB)

All new listings at a glance (pdf-file 35 KB)

Details about the global market

Price information