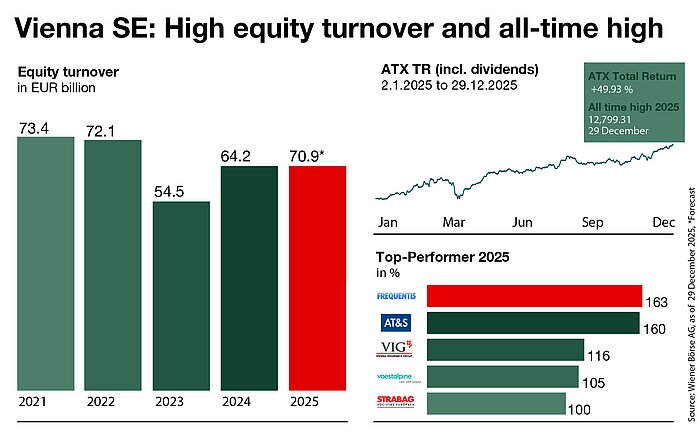

The Vienna Stock Exchange recorded a dynamic trading year in 2025, marked by geopolitical tensions, trade conflicts and the prospect of an end to the war in Ukraine. Equity turnover will amount to around EUR 71 billion at the end of the year, making 2025 the third strongest trading year since 2012, after 2021 and 2022. The last trading day of 2025 is today and will end with an early closing auction at 2:15 p.m. The 2025 stock market year had 253 trading days, and next year there will also be 253 trading days in Vienna. The trading calendar is available online.

Austrian national index broke through three "thousand" marks in one year

The ATX including dividends (total return) is at an all-time high and exceeded the ten-, eleven- and twelve-thousand-point marks for the first time. By the close of trading on 29 December, the ATX Total Return had gained 49.93% since the beginning of the year, reaching an all-time high of 12,799.31 points (ATX price index: 43.27%, 5,247.96 points). Austria's benchmark index is thus among the top performers internationally. During the same period, the German benchmark index DAX – which, like the ATX Total Return, also includes dividends – gained 22.38%, the MSCI World 20.64% and the Euro Stoxx 17.58%. The market capitalisation of domestic companies listed in Vienna amounted to around EUR 177 billion as of 22 December.

Entry-level segment with three new issuers, debt listings continue to grow rapidly

With Steyr Motors AG, REPLOID Group AG and Gallmetzer HealthCare S.p.A. three companies were added to the SME segment direct market plus. In the debt segment, the Vienna Stock Exchange recorded 31,490 primary listings by 29 December, more than twice as many as in the previous record year of 2024 (13,443). The Vienna Stock Exchange has further increased its global reach this year, including new issuers from Central and East Asia, Türkiye, Australia, Mexico and North Africa. While listings from 191 issuers from 17 countries were added in 2020, there were 682 new issuers from 43 nations in 2025. A total of 1,369 active debt issuers from 50 countries are currently serviced. Around 90 per cent of the debt listings are of international origin. Equity turnover in the international segment global market, which was expanded by around 100 securities in 2025 and currently comprises over 900 securities from 28 countries, also remains at a robust level. The ETF offering has also been massively expanded, more than doubling to 336 securities, which is reflected in record turnover levels.

“Austria’s stock market has demonstrated remarkable growth, with Austrian-listed companies performing strongly on the international stage. Wiener Börse remains a key European player, offering a robust and transparent market infrastructure. However, to fully capitalise on this potential, it is crucial that political action aligns with market development. While European countries such as Germany and Poland are actively introducing measures to better leverage capital markets for broader economic benefits, Austria has been notably passive,” says Vienna Stock Exchange CEO Christoph Boschan, referring to pension reforms in various EU countries.

Boschan: Incentives for private pension provision are needed

Germany, for example, is currently realigning the third pillar of its pension system with subsidised pension savings accounts. Poland will also launch tax-privileged personal investment accounts ("OKI") in 2026, following the model of Sweden's "Investeringssparkonto" (ISK), in which around 40% of the population participate and the total savings amount to around one third of GDP. "The proposed general pension fund contract in the second pillar of retirement provision is a small step in the right direction if implemented properly. However, it must not serve as a mere fig leaf to cover up the lack of more comprehensive measures. A return to the holding period for securities or a tax-privileged investment account, as seen in many other countries already, would be a more decisive move for strengthening private pension provision," Boschan asserts.

| Vienna Stock Exchange 2025: facts and figures | |||

|---|---|---|---|

| Equity turnover comparison | Top performers prime market 2025** | Most traded shares 2025*** | Strongest trading days 2025 |

| 2025: EUR 70.9 billion* |

FREQUENTIS AG +163.20% |

Erste Group Bank AG EUR 16.26 billion |

24 November EUR 1.21 billion |

| 2024: EUR 64.18 billion |

AT&S Austria Tech. & Systemtech +159.70% |

OMV AG EUR 9.47 billion |

21 March EUR 1.08 billion |

| 2023: EUR 54.48 billion |

VIENNA INSURANCE GROUP AG +115.82% |

BAWAG Group AG EUR 6.94 billion |

19 September EUR 1.02 billion |

*forecast as of 22 December 2025

**as of close of trading on 29 December 2025

***as of close of trading on 22 December 2025