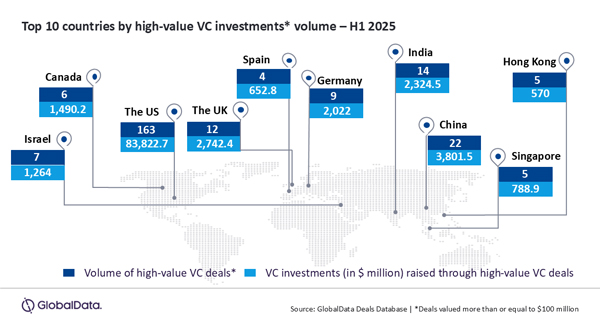

In a striking display of financial prowess, the US has once again emerged as the unrivaled leader in high-value venture capital (VC) investments* during the first half (H1) of 2025. The US accounted for a staggering 163 high-value VC deals, amassing a total investment value of more than $80 billion. This represents a significant portion of the global total of $102.8 billion worth high-value VC deals, underscoring the country's dominant position in the VC funding landscape, according to GlobalData, a leading data and analytics company.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “The US continues to be the epicenter of innovation and entrepreneurship. The sheer volume of deals and the capital involved highlight the robust ecosystem that supports startups and emerging companies across various sectors.”

An analysis of GlobalData’s Deals Database revealed that the US attracted around 60% of the total number of high-value VC deals announced globally during H1 2025. Meanwhile, its share of the global total of high-value VC investments value stood at more than 80%.

Bose adds: “While the US continues to dominate high-value VC investments, it is essential to recognize the potential of markets like China, India, and the UK. As global economic conditions shift, more opportunities are expected to arise in regions that are currently relatively underrepresented in high-value investments.”

China, while trailing significantly behind the US, secured the second position with 22 high-value VC deals valued at $3.8 billion. India and the UK follow closely, with 14 high-value VC deals worth $2.3 billion and 12 deals worth $2.7 billion, respectively.

These four (the US, China, India and the UK) were the only markets with double or triple-digit high-value VC deal volume during H1 2025. They collectively accounted for around 80% share of the total number of high-value VC investments announced globally in H1 2025 and 90% share in terms of value.

In terms of high-value VC deal volume during H1 2025, the UK is followed by Germany, Israel, Canada, Singapore, Hong Kong and Spain. The top 10 countries collectively attracted more than 90% of the total number of high-value VC investments announced globally in H1 2025. In terms of value, the combined share of these markets stood at around 97%.

*Valued more than or equal to $100 million