The US investment management industry this year is riding a continuing wave of strong equity market performance, but the buy side know they can’t be complacent with the tightening vice of MiFID II regulation in Europe and the rising flow of assets into passive vehicles, buy-side traders tell TABB Group in the 14th annual benchmark International US Equity Trading study, “US

Institutional Equity Trading 2018: Adapting to the New Reality.”

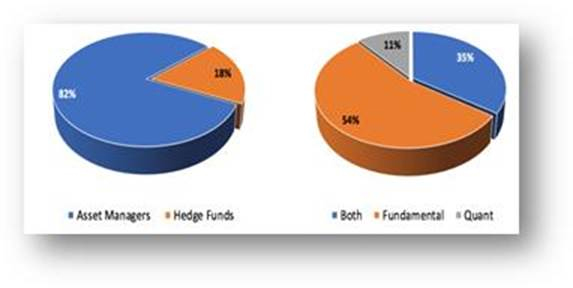

Based on in-depth interviews with 100 buy-side head traders during the first and second quarters of 2018 – including 82% traditional asset managers, 18% hedge funds with 54% using a fundamental investment style, 11% quantitative and 35% both, and AUM from $50bn to $500bn – TABB’s comprehensive study this year covers the looming influence of MiFID II on US investment managers; reallocation of assets to passive/ETF index-based products, buy-side’s relationship with the sell side; and the buy-side’s top technology initiatives to adapt and overcome these challenges.

Specific issues covered include:

- Top buy-side trends in 2018

- Impact of MiFID II in 2018 and 2019

- Research usage and expectations

- Broker vote process and tools

- CSA usage and expectations

- Funds’ reactions to growth of passive investments

- Changing fee structures

- Active-to-passive debate issues

- 2018 trading-desk initiatives by firm size

- Use of AI and machine learning in achieving best ex

- OMS adoption, 2017-2018

- TCA platforms

- Broker coverage model preferred

- Algo broker usage

- Execution-channel market share

- Algo wheels

- Cryptocurrency trading

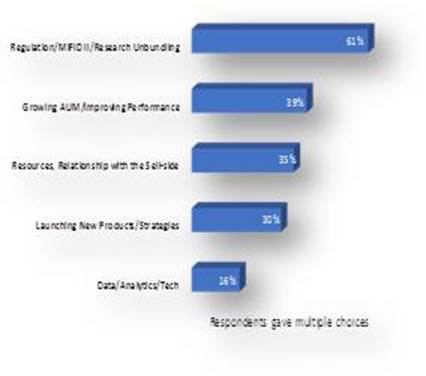

According to TABB senior analyst Dayle Scher, a 30-year buy-side industry veteran who wrote the study, “After lengthy one-to-one interviews, key issues emerged, such as US money managers expect MiFID II to not only influence their business in 2018 but even more over the next year or two, particularly in the areas of commissions, execution costs and research budgets.

As Scher explains, with commission rates down across the board, more than half of all firms expect their research budgets to decline, having already dropped to $8.6 billion in 2017 from a 2007 high of $15.3 billion. With low volatility and heavy competition pushing funds to negotiate harder with their brokers, migrating when necessary to bigger brokers, pressure on returns/costs, greater unbundling focus and best execution have pushed these buy-side firms toward upping their algo usage, begun in 2017.” As a result, 25% of the firms she spoke with now expect their use of capital to rise due to MIFID II, with a greater impact on more than 40% of medium-sized firm. “There’s a pronounced push for more capital.”

The move away from high-touch sales desks by asset managers, particularly hedge funds, has persisted as firms need to lower costs through electronic trading. By taking more trading in house and automating through algorithms, they want to cut overall costs without reducing execution quality or volumes, and to source liquidity without impacting the stock price. “The adoption of algo wheels,” Scher says, “has enabled this swing to low-touch trading as algo selection and performance monitoring becomes increasingly automated.”

Other pertinent issues:

- Asset managers cut 31% of their research providers in 2017, hedge funds, 40%; both plan to cut further in 2018.

- 43% are proactively addressing flow of capital into ETFs and passive funds.

- Less than one quarter believe passive investing will win out over active in the long term.

- Only 27% expect to benefit from MiFID II with medium and small investment managers feeling the most pain.

- Two thirds are already updating technology, automating manual trading and post-trade workflows.

- Nearly 40% of tier 1 investment managers use AI and machine learning to achieve best execution.

- 97% have little interest in crypto currencies.

As investment management fees continue to drop this year and research and compliance costs go up, says Scher, the buy side needs to adapt – or suffer the consequences. “Automation and integration of any remaining manual-trading processes are critical; the need to reduce cost margins, remain competitive and outperform benchmarks and peers hasn’t abated. Firms that do will prevail as will investors, who will benefit from increased transparency and lower fees.”

The 39-page study with 32 charts is available for download by TABB equities clients and pre-qualified media athttps://research.tabbgroup.com/search/grid. To buy the report, go to the Executive Summary at tabbgroup.com or write toinfo@tabbgroup.com.

Aligned with the release of this annual comprehensive benchmark study, TABB Group is previewing its research in a webinar series. Click here for more information and to register.