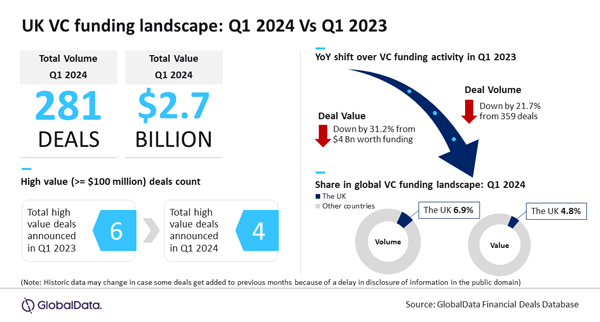

The UK experienced a year-on-year (YoY) decline in venture capital (VC) funding deal volume and value during the first quarter (Q1) of 2024 as investor sentiment remained weak. A total of 281 VC deals of worth $2.7 billion were announced during the quarter. This represents a 21.7% YoY decline in deals volume and 31.2% fall in funding value, respectively. Despite these challenges, March showed improvement in deal value amidst declining volume, observes GlobalData, a leading data and analytics company.

An analysis of GlobalData’s Deals Database also revealed that a total of 359 VC funding deals were announced in the UK during Q1 2023 while the disclosed funding value of these deals stood at $4 billion

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “The dent in investor sentiment can be understood from the fact that the average size of VC funding deals fell from $11.1 million in Q1 2023 to $9.7 million in Q1 2024. However, despite this decline, we can see some bright spots, particularly in March when there was an improvement in deal value despite month-on-month decline in deal volume.”

“Moreover, the UK, apart from being the top European market for VC funding activity, also continues to be a key global market. It ranked among the top markets globally both in terms of VC funding deal volume and value during Q1 2024.”

The UK accounted for 6.9% share of the total number of VC deals announced globally during Q1 2024. Meanwhile, its share of the corresponding funding value stood at 4.8% during the quarter.

Some of the notable VC funding deals announced in the UK during Q1 2024 include the $430 million raised by Monzo, $112 million raised by Exohood Labs, $110 million raised by Build A Rocket Boy, and $100 million raised by Oxford Quantum Circuits.

Note: Historic data may change in case some deals get added to previous months because of a delay in disclosure of information in the public domain