- The 100 companies comprising the UK’s FTSE 100 Index recorded an aggregate goodwill impairment of €6.8 billion (bn) in 2020, a fall of almost 60% compared to the previous year. Nevertheless, this is the second highest aggregate impairment since the Brexit vote in 2016, while the number of impairments is the biggest since 2015.

- UK government intervention is key to supporting UK businesses against the backdrop of the worst global recession since World War II.

- Total goodwill impairment recorded by European-listed companies in the STOXX®Europe 600 rose by almost half to €54.1 bn in 2020, the highest level since 2012.

Duff & Phelps, A Kroll Business, the world’s premier provider of services and digital products related to valuation, governance, risk and transparency today released its latest European Goodwill Impairment Study. The study reveals that UK companies in the FTSE 100 recorded the first decrease in goodwill impairment since 2017 despite the COVID-19 pandemic, but the number of impairments surpassed 2016 levels. Meanwhile, European companies in the STOXX® Europe 600 saw aggregate impairment increase by 49% in 2020.

In 2020, the 100 companies comprising the FTSE 100 Index recorded an aggregate goodwill impairment of €6.8 billion (bn), a 58% decrease from 2019 (€16 bn), but the number of impairments increased by 9%. In addition, the 138 UK companies within the STOXX® Europe 600 also saw a decrease in their aggregate impairment amount to €11.8bn, a 39% fall from 2019 (€19.3 bn), while the number of impairments rose by 23%. In both cases, however, the aggregate impairment was still the second highest level since the Brexit vote in 2016, which reveals UK companies are still struggling to navigate the post-Brexit environment.

In comparison, the total goodwill impairment recorded by European-listed companies in the STOXX® Europe 600 increased for a third consecutive year. Goodwill impairment rose 49% to €54.1 bn in 2020, reflecting the adverse effects of COVID-19 on the global economy; the pandemic had a particularly negative impact on Eurozone countries like Spain. This was the highest level of aggregate goodwill impairment for the STOXX® Europe 600 since 2012, at the height of the Euro sovereign debt crisis.

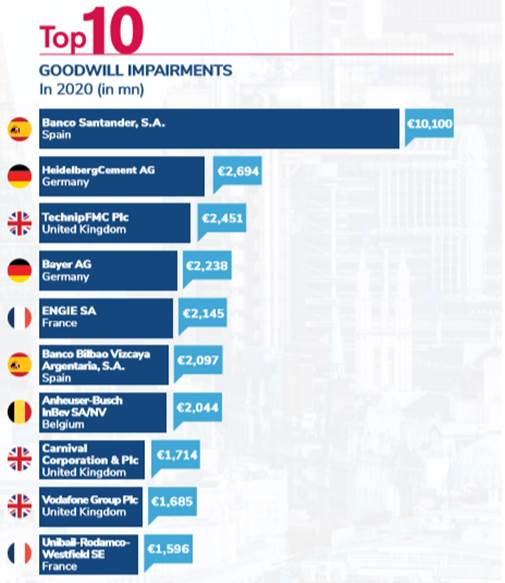

In 2020, the top 10 goodwill impairments accounted for just over half of the aggregate STOXX® Europe 600 goodwill impairment of €54.1 bn. UK companies contributed to 20% of the top 10 goodwill impairments and still reached the second highest aggregate impairment for the year, representing 22% of the total amount recorded by STOXX® 600 constituents.

Michael Weaver, Managing Director and International Valuation Advisory Services Leader at Duff & Phelps, commented:

“The UK emerged as the only major country in the STOXX® Europe 600 to report a fall in goodwill impairment; the drop of almost 40% can be partly attributed to the unprecedented levels of government support, which propped up businesses through the pandemic. Government initiatives launched in 2020, such as the various furlough packages and lending programmes like the Bounce Back Loan Scheme (BBLS), the Coronavirus Business Interruption Loan Scheme (CBILS) and the Coronavirus Large Business Interruption Loan Scheme (CLBILS), helped many UK companies weather the pandemic.

“However, Britain still saw sizable goodwill impairment events, with three UK companies landing in the top 10 impairment list for 2020, while UK companies recorded the second largest aggregate impairment amount in the STOXX® Europe 600, behind Spain. Moreover, the UK 2020 total goodwill impairment was still the second highest level since the Brexit vote in 2016.

“For Europe in general, the effect of COVID-19 on economic and business conditions was damaging, with total goodwill impairment reaching its highest levels in eight years. Despite this, intervention by governments and central banks, through unprecedented levels of fiscal and monetary support, likely averted more severe impacts.”

2021 to date for STOXX® Europe 600 Companies

While several companies in the STOXX® Europe 600 will take a few more months to release full calendar-year 2021 results, as of early October 2021, the top 10 goodwill impairment events recognised for 2021 reached a combined €5.1 bn, a sharp decrease from the top 10 amount disclosed for 2020. The data suggests that business recovery from the pandemic is underway, but continued supply chain disruption and inflationary pressures are contributing towards uncertainty in this outlook.

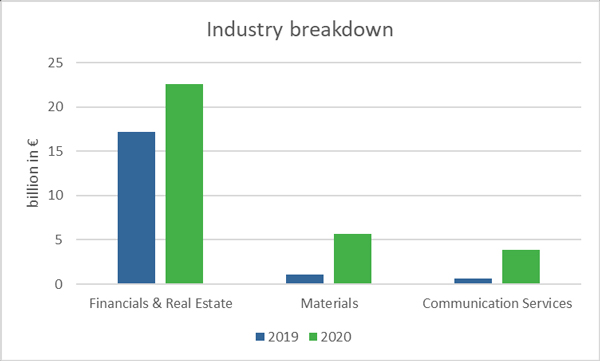

STOXX® Europe 600 Industry breakdown

The top three industries in the STOXX® Europe 600 with the most significant increase in goodwill impairment amounts in 2020 were Financials & Real Estate (from €17.2 bn in 2019 to €22.6 bn in 2020), Materials (from €1.1 bn in 2019 to €5.7 bn in 2020), and Communication Services (from €0.6 bn in 2019 to €3.9 bn in 2020). The Financials & Real Estate industry topped the list for the third consecutive year, registering its highest goodwill impairment level since 2011. Already challenged by a low interest environment, monetary policies implemented by central banks to counter the effects of COVID-19 drove interest rates even lower, leading to further pressure on financial institutions’ profitability.

Eurozone M&A deal volumes decreased slightly by 8% in 2020, but total deal value more than doubled (118%) compared to 2019 levels. However, almost 80% of the deal value was linked to transactions announced before March 2020, prior to COVID-19 being declared a pandemic. This same theme was reflected in UK’s M&A activity, with an overall decline in deal volume for the year, down by 15%, and an increase in deal value by 34%. Notably, two-thirds of the deal value was also related to transactions announced prior to March 2020.

Weaver concluded:

“Looking ahead, the data shows that aggregate goodwill impairments for 2021 will likely not exceed 2020 levels as the impacts of COVID-19 begin to lessen and businesses carve a path to recovery.

“We’re not out of the woods yet, and businesses must not underestimate the lingering effects of the pandemic and their potential to derail readjustment. As the UK emerges from the crisis, we face a new year of supply chain problems, climbing inflation, the ongoing energy crises and mandatory increases to taxation, minimum wage and national insurance contributions.

“UK companies must remain mindful of these factors when performing their upcoming goodwill impairment tests. The path and speed of economic recovery from the COVID-19 crisis and its impact on long-term growth prospects will be among the crucial factors for European companies to consider when identifying potential goodwill impairments over the next couple of years. Goodwill impairment testing and disclosures will remain critical information for users of financial statements.”

.jpg)