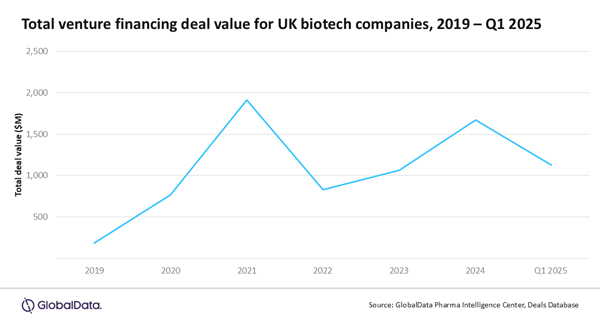

UK biopharmaceutical companies experienced a quarter-on-quarter (QoQ) surge in venture financing, reaching $1.1 billion in the first quarter (Q1) of 2025—twice the amount raised in the fourth quarter (Q4) of 2024 and exceeding all quarterly totals from 2021. This surge highlights investor appetite for breakthrough innovation, but growing dependence on US capital and policy-driven cost pressures signal an urgent need to strengthen domestic investment for sustainable growth, says GlobalData, a leading data and analytics company.

While global biopharmaceutical venture financing witnessed a downturn over 2022 and 2023, the UK demonstrated resilience with sustained year-over-year growth, doubling from $827 million in 2022 to $1.7 billion in 2024, according to GlobalData’s Pharmaceutical Intelligence Center Deals Database.

In 2021, British Patient Capital launched the “Life Sciences Investment Programme (LSIP)” – a GBP200 million initiative that aimed to attract GBP400 million additional venture financing for UK life sciences. Under the new Mansion House Accord announced by the UK government in May 2025, leading pension providers have committed to invest 5% of their funds towards private UK-based companies, potentially unlocking $25 billion of domestic funding for UK businesses by 2030.

Alison Labya, Business Fundamentals Pharma Analyst at GlobalData, comments: “The growth in venture financing for UK biopharmaceutical companies in Q1 2025 was primarily driven by two mega-rounds – Isomorphic Labs with $600 million and Verdiva Bio with $411 million. This suggests increased investor selectivity where available capital is being concentrated into a smaller number of companies with high commercial potential.”

Furthermore, US investors were involved in almost totality for the $1.1 billion of the total venture financing deal value raised in Q1 2025 by UK biopharmaceutical companies, compared to UK investors’ involvement of only $112.7 million. A dependency on US capital could prompt companies to relocate to the US and limit the reinvestment of returns into the UK biopharmaceutical sector, weakening its long-term growth.

Labya concludes: “UK biopharmaceutical companies continue to attract investor interest; however, sustained venture financing and initiatives to boost domestic investment will be crucial for translating UK-based innovation into commercial success.

“Investor appetite could be impacted by the rise in rebate rates from 15.5% to 32.2% for H2 2025 under the Statutory Scheme announced in March 2025, along with an increase to 22.9% under the 2024-2028 Voluntary Scheme for Branded Medicines Pricing, Access and Growth (VPAG). An anticipated increase in costs associated with these drug pricing policy changes could deter companies from developing drugs in the UK, which may slow UK-based innovation and reduce patient access to medicines.”

Note: Includes announced and completed venture capital deals involving companies headquartered in the UK with at least one innovator drug where marketed, pre-registration, Phase III, Phase II, Phase I, preclinical, and discovery stages are considered. Includes deals where a deal value was publicly disclosed.

For further insights into the latest Deal Trends in the Pharma Sector, please see our Venture Capital Investment Trends in Pharma – Q1 2025 and M&A Trends in Pharma – Q1 2025 reports.