- Flows into ESG and Active ETFs hit a 5-month low

- Bitcoin ETFs see new asset high of $6.7 Billion

- Gold ETFs see second consecutive month of redemptions, losing $6.4Billion

- Cannabis ETFs continue their winning streak

March data from TrackInsight, the world’s first global Exchange-Traded Funds analysis platform, shows that while the ETF industry continues to hit new AuM records, investors are slowing down the pace of ESG investments.

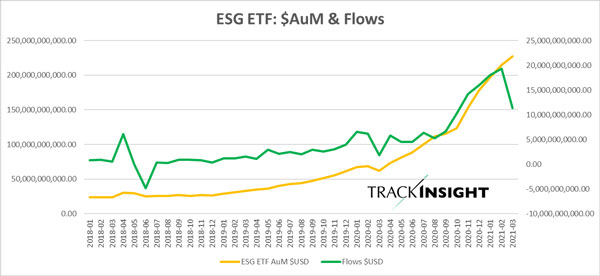

Over March, ESG ETFs attracted $11.3 Billion in new assets, a significant slowdown compared to the $19 Billion of flows recorded in February and the $18 Billion of flows recorded in January. 15 new ESG ETFs were launched in March, bringing the total to 629 funds managing a collective $227 Billion of assets.

Chart: ESG ETF Flows & AuM: Jan 2019 - Mar 2021

Bitcoin ETFs witnessed another huge month for flows with investors adding $493 Million of assets over March. This is the second highest month on record for Bitcoin ETF flows, beaten only by the $778 Million of flows seen in February 2021. There are now 15 ETFs tracking Bitcoin – up from just 8 at the start of the year.

The 96 Gold ETFs listed around the world have seen assets drop significantly from their December highs, falling from $208 Billion in assets to just $175 Billion. Over March, investors pulled $6.4 Billion from the sector – the second consecutive month of negative flows.

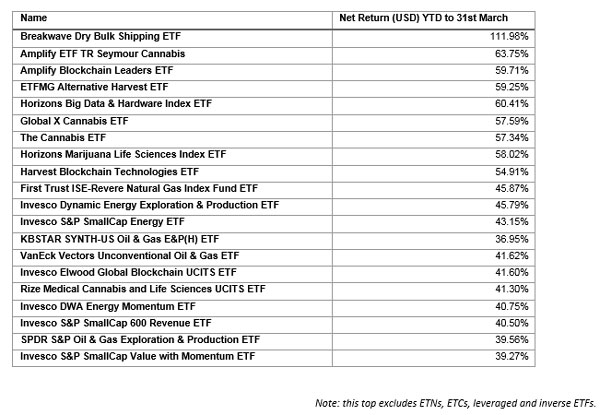

Thematic ETFs continue to dominate the top performers of the year with Cannabis-related ETFs taking 4 of the top 10 spots. ETFs tracking the energy, oil and gas segments have also been strong performers this year, returning upwards of 40%.

Table: Top performing ETFs 2021 (to March)

Anaelle Ubaldino, Head of ETF Research and Investment Advisory at TrackInsight said: “As ETFs become more mainstream around the globe, looking at ETF flows can provide an incredible window into the minds of investors. Our March stats show that the appetite for ETFs remains strong. It was a slow month for ESG ETFs, but the industry remains on track to reach $10 Trillion of AuM this year. Investors are switching away from Gold and into Bitcoin ETFs, which grew by 35% over March to reach $6.7 Billion of AuM. If and when a Bitcoin ETF finally launches in the US, we expect it to unleash a tidal wave of retail money that would dwarf these figures and put cryptocurrencies on a course to be a significant force for ETF market growth.”

TrackInsight operates a unique global platform dedicated to ETF search, analysis and selection aimed at professional investors and is recognized as the leading source of independent and reliable information on over 6,800 Exchange Traded Funds listed globally. In 2021, TrackInsight launched ESG Observatory to provide data, research and transparency on the global market for ESG ETFs.

All data referenced in this release is in USD and sourced from TrackInsight as of 31/03/2021. ESG data from TrackInsight ESG Observatory as of 31/03/2021.

Visit TrackInsight.com for daily ETF data and insights.