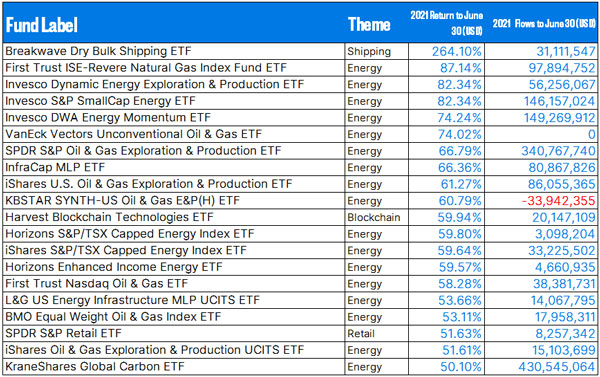

Data from Trackinsight, the first global ETF analysis platform, reveals that energy and energy infrastructure was the highest-performing segment of the ETF markets in the first half of 2021.

17 of the 20 top performing ETFs (excluding leveraged ETFs) globally tracked the energy theme, returning between 50% to 87% to investors in just 6 months. The top 20 best-performing funds have added $1.1 Billion in new assets since the start of the year with two funds, the SPDR S&P Oil & Gas Exploration & Production ETF and the KraneShares Global Carbon ETF contributing a combined $770 Billion towards the total.

Despite much hype and strong inflows in 2021, clean energy and ESG-screened energy funds do not feature in the top 20 performers of 2021, which consists largely of traditional fossil-fuel derived energy funds.

Energy prices have rising steadily, with everything from electricity to natural gas rising hitting recent record highs due to supply constraints and a breakdown of talks at OPEC to agree on oil production levels. Some analysts have predicted that oil could exceed $100 per barrel this year.

The world’s best performing ETF of 2021 continues to be the Breakwave Dry Bulk Shipping ETF, which has returned over 11% in June and an astonishing 264% year-to-date. This ETF tracks the price of shipping goods and materials – a cost that has risen dramatically this year given restrictions on port capacity, accelerating consumer demand and low availability of shipping containers.

Anaëlle Ubaldino, Head of ETF Research and Investment Advisory at Trackinsight commented:

"The diversity and coverage of the ETF markets makes them an excellent lens through which investors can easily identify and participate in the main economic trends. We have seen new themes emerge on almost a monthly basis, but energy, especially traditional fossil-fuel based energy, has been consistently strong throughout the year so far. With energy prices surging, this theme may well have further to run."

Trackinsight is recognized as the leading source of independent and reliable information on over 7,000 Exchange Traded Funds listed globally. In 2021, Trackinsight launched its ESG Observatory to provide data, research and transparency on the global market for ESG ETFs.

All data referenced in this release is in USD and sourced from Trackinsight as of 30/06/2021. ESG data from Trackinsight ESG Observatory as of 30/06/2021.

For more daily update and research on over 7,000 ETFs, visit www.trackinsight.com.