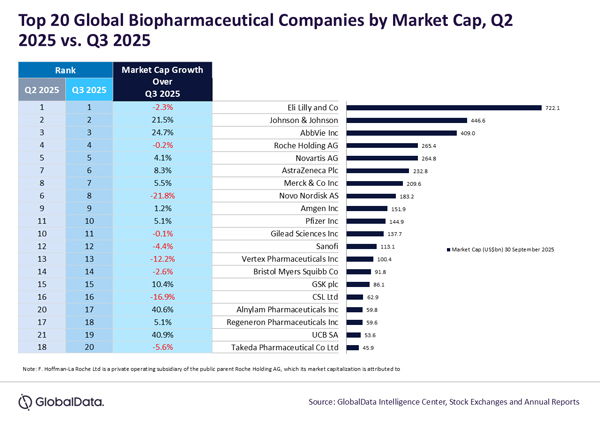

The top 20 global biopharmaceutical companies experienced mixed individual market capitalization performances in Q3 2025, with those experiencing robust pipeline progress reaping success. This resulted in a 4% quarter-on-quarter (QoQ) increase in their combined market capitalization from $3.7 trillion on 30 June 2025 to $3.8 trillion on 30 September 2025, reveals GlobalData, a leading data analytics and research company.

More than half (11) of the top 20 companies reported growth in their market capitalization, with UCB (40.9%), Alnylam Pharmaceuticals (40.6%), AbbVie (24.7%) and Johnson & Johnson (21.5%) registering over 20% market capitalization growth, as per GlobalData’s Pharmaceutical Intelligence Center Companies Database.

UCB, a Belgian biopharmaceutical company, reported the largest market capitalization growth of 40.9% to $59.8 billion in Q3 2025, positioning the company as a new entrant in the top 20 players.

Alison Labya, MSc, Senior Business Fundamentals Pharma Analyst at GlobalData, comments: “UCB’s growth was driven by its competitor drug sonelokimab by Moonlake Immunotherapeutics failing to meet VELA-2 trial results and therefore strengthening UCB’s drug, Bimzelx, market position for the treatment of hidradenitis suppurativa (HS).

Alnylam Pharmaceuticals recorded a market capitalization growth of 40.6% in Q3 2025, owing to the strong performance of its RNA interference (RNAi) therapeutic Amvuttra for transthyretin amyloidosis cardiomyopathy (ATTR-CM) and hereditary transthyretin amyloidosis with polyneuropathy (hATTR‑PN), with 59% quarter-over-quarter (QoQ) increase in global sales to $492 million in Q2 2025. The EU approval of Amvuttra for ATTR-CM received in June 2025 further fueled the company’s growth.

AbbVie reported a 24.7% increase in market capitalization in Q3 2025, driven by the completion of its $2.1 billion acquisition of Capstan Therapeutics in August 2025, including its lead phase I CAR T therapy CPTX2309 for autoimmune disorders and proprietary RNA delivery platform.

Johnson & Johnson saw a 21.5% market capitalization growth, attributed to its 5.8% sales growth reported in Q2 earnings and robust pipeline progress, including the FDA approval in September 2025 of its monoclonal antibody Tremfya (guselkumab) for pediatric patients with plaque psoriasis and active psoriatic arthritis.

Labya continues: “The recent FDA approval of Tremfya builds upon its current approvals in adult plaque psoriasis, psoriatic arthritis, ulcerative colitis and Crohn’s disease. Tremfya is forecasted to achieve drug analyst consensus global forecast sales of $9.2 billion by 2031, according to GlobalData’s Sales and Forecast database.”

A total of nine biopharmaceutical companies experienced a market capitalization decline in Q3 2025, with Novo Nordisk (-21.8%), CSL (-16.9%), and Vertex Pharmaceuticals (-12.2%) registering more than 10% market capitalization decline.

Novo Nordisk moved down by two places with a 21.8% market capitalization decline after the company lowered its sales and operating profit forecasts, citing reduced US demand for its obesity and diabetes drugs Wegovy and Ozempic amid increasing competition from Eli Lilly’s Mounjaro and Zepbound and compounded GLP-1 agonists. CSL’s market capitalization fell by 16.9% due to diminishing demand for its flu vaccines.

Vertex reported a 12.2% decline in market capitalization in Q3 after its oral NaV1.8 pain signal inhibitor, VX‑993, failed to meet its primary endpoint in the Phase II study for acute pain following bunion surgery.

Labya concludes: “The biopharmaceutical industry faces headwinds from Trump’s ongoing tariffs and executive order on a ‘Most Favored Nation’ pricing model, which aims to align US drug prices with those in other developed countries. However, industry leaders continue to drive innovation by advancing their R&D programs, with companies such as AbbVie entering billion-dollar strategic acquisitions.”