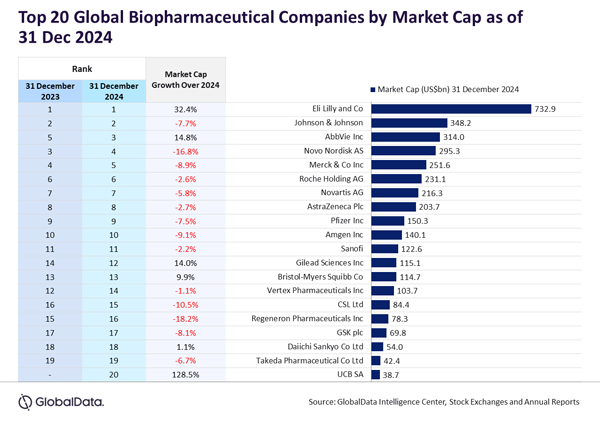

The biopharmaceutical industry in 2024 experienced a mixed performance, with the aggregate market capitalization of the top 20 biopharmaceutical firms’ year-on-year increasing by 1.7% from $3.6 trillion to $3.7 trillion as on 31 December 2024, despite challenges from shifting policies and regulatory concerns. Key players like Lilly, AbbVie, and Gilead Sciences saw significant growth, while companies like Novo Nordisk and CSL faced setbacks. The industry’s outlook remains uncertain as it navigates complex economic and political dynamics, reveals GlobalData, a leading data and analytics company.

Ophelia Chan, Business Fundamentals Senior Analyst at GlobalData, comments: “The biopharmaceutical industry faced a dynamic landscape in 2024, shaped by the US Federal Reserve interest rate cuts, Medicare policy concerns under Donald Trump’s second presidential term, and the uncertainty fueled by Robert F. Kennedy Jr.’s anti-vaccine stance.”

An analysis of GlobalData’s Deals Database reveals that over two-thirds of the top 20 biopharmaceutical companies reported a decline in market capitalization. However, three companies achieved growth greater than 10%: Lilly (32.4%), AbbVie (14.8%) and Gilead Sciences (14.0%).

Lilly retained its top position with a 32.4% growth in market capitalization to $733 billion in 2024, driven by strong demand for its weight-loss drugs, Mounjaro and Zepbound (tirzepatide). The recent results from the SURMOUNT-5 phase 3b trial revealed Zepbound (tirzepatide) provided a 47% greater relative weight loss compared to rival Novo Nordisk’s Wegovy (semaglutide).

AbbVie reported market capitalization growth of 14.8% in 2024, fueled by acquisitions of ImmunoGen and Cerevel Therapeutics worth $19 billion in total, which further strengthened AbbVie's oncology and neuroscience portfolios.

Gilead Sciences achieved a 14% increase in market capitalization, driven by the advancement of late-stage drug candidates to new drug application submissions, including lenacapavir, an injectable HIV-1 capsid inhibitor for HIV prevention. The company also benefited from the accelerated approval of Livdelzi (seladelphar) for primary biliary cholangitis.

UCB was a new entrant among the top 20 biopharmaceutical companies, doubling its market capitalization from $16.9 billion in 2023 to $38.7 billion in 2024. This growth was driven by the success of its blockbuster drug, Bimzelx (bimekizumab). Following its initial FDA approval for plaque psoriasis in October 2023, UCB secured approvals for three additional indications: psoriatic arthritis, non-radiographic axial spondyloarthritis, and ankylosing spondylitis, further expanding the drug’s potential across multiple inflammatory diseases.

However, Novo Nordisk saw a 16.8% decline in market capitalization in 2024, following the Phase III REDEFINE 1 trial results for its next-generation weight-loss drug, CagriSema (cagrilintide + semaglutide), which fell short of expectations. The outcome raised concerns about the company’s competitive position in the growing obesity and diabetes drug market.

CSL also witnessed a 10.5% decline in market capitalization in 2024, following its acquisition of Vifor Pharma in August 2022, aimed at diversifying its portfolio of vaccines and blood plasma products. However, CSL has since reported that Vifor’s portfolio is facing commercial and regulatory challenges, including reimbursement bundle issues for its pruritus drug, Korsuva (difelikefalin).

Chan concludes: “The biopharmaceutical industry’s mixed performance in 2024 underscores rising uncertainty driven by shifting policies and regulatory challenges. With Trump’s second term raising concerns around drug pricing, inflation trends, and FDA approvals, the industry faces an unclear outlook heading into 2025.”