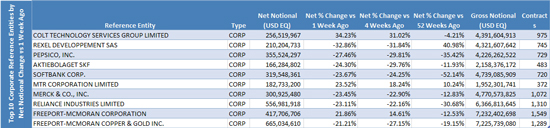

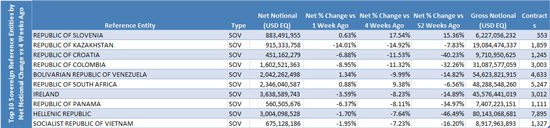

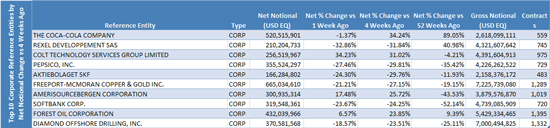

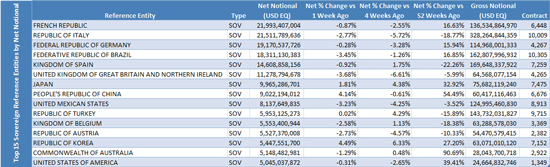

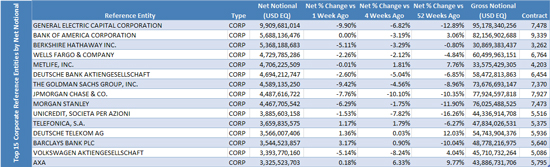

The Depository Trust & Clearing Corporation (DTCC) is publishing a weekly email containing simple, easy-to-read tables listing credit default swaps (CDS) contracts on the top 15 sovereign and corporate reference entities by net notional amount as well as the Top 10 volume movers, both corporate and sovereign, by percentage change based on the net notional amount registered in its Trade Information Warehouse for the week ending March 16, 2012, along with historical data.

DTCC’s Trade Information Warehouse contains approximately 99% of all CDS trades executed globally. This information is publicly available on DTCC’s website, www.dtcc.com, where you can also view the total size of the global CDS market and other data. DTCC makes this information available to the public as part of its ongoing efforts to bring greater transparency to the CDS market.

The gross notional amount represents the value of all active CDS contracts, including offsetting contracts. The net notional amount is a better indication of risk since it eliminates offsetting CDS contracts and represents the maximum amount that would have to be paid in the event of a default by the indicated entity, assuming netting across trade counterparties’ families.* The Top 10 volume movers show the sovereign and corporate reference entities with the largest notional movement for the week ending March 16, 2012 compared to one week ago (tables #3 & 4) and four weeks ago (tables #5 & 6), using data from the Top 1000 reference entities on www.dtcc.com.

*A counterparty family will typically include all of the accounts of a particular asset manager or corporate affiliates rolled up to the holding company level.

.jpg)