What is the Bitcoin Halving?

Bitcoin is a revolutionary kind of asset. Entirely digital, and with no central authority in charge, it relies on consensus between everyone on the network to keep it running. Every 4 years, the Bitcoin network undergoes a momentous event known as the “halving.” When the pseudonymous creator of Bitcoin, Satoshi Nakomoto, constructed the Bitcoin network and protocol, he or she (or they) programmed it to include an ever-decreasing rate of new Bitcoins being supplied, with the total amount capped at 21 million bitcoins.

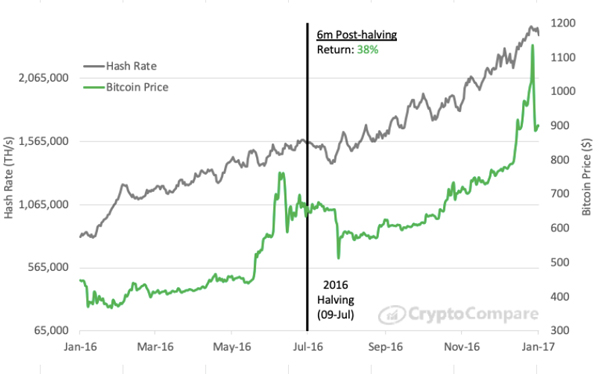

Bitcoin relies on “miners” to maintain and secure the network, who process blocks and add them to the shared record of all transactions (the “distributed ledger”) which form the blockchain. As a reward for this energy-intensive task, miners are compensated with bitcoins. Every 4 years, this reward for adding a new block is cut in half. The last time this happened, in July 2016, the Bitcoin block reward was slashed from 25 to 12.5 bitcoins, and the same is due to happen this May (estimated to be on May 12), with miners set to receive only 6.25 bitcoins from then onwards.

Previous halvings have heralded significant surges in the Bitcoin price around the halving event and in the months and year following, and many expect - if demand remains constant - a similar result following a decrease in the rate of supply.

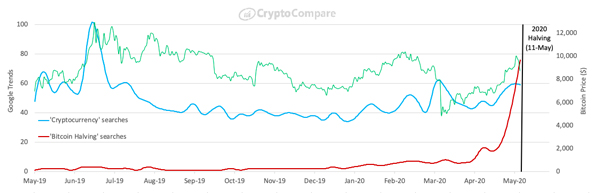

Google searches for “Bitcoin Halving” surpass searches for “Cryptocurrency”

As we have approached the Bitcoin Halving, searches for the term have skyrocketed, hitting levels which make the previous halving - which took place in July 2016 - look tiny in comparison.

Furthermore, the volume of searches for “Bitcoin Halving” has now surpassed those for “cryptocurrency,” as shown in the chart below. Once a far more popular search term, which reached enormous heights around the ICO-inspired boom of 2017, this shift in popularity may also be indicative of a market trend back towards Bitcoin dominance in the 2020s.

Bitcoin’s average block size is at an all-time high

Bitcoin’s average block size has hit a new high. What does this mean?

The blocks in Bitcoin’s blockchain are essential links in the chain that record some or all of the most recent Bitcoin transactions that haven’t yet entered prior blocks.

Bitcoin’s blocks are limited to 1 MB worth of data, meaning that they can store transaction information up to 1 MB before being full. They are processed every 10 minutes, so if enough transactions are made, the network creates a backlog of transactions that will be processed when block space is available.

This limit has been raised thanks to several technical innovations, including Segregated Witness (SegWit). SegWit essentially segregates the digital signature - which comprises 65% of the space in a block - from the transaction data, to allow block size limits to reach 4 MB.

Our data, powered by IntoTheBlock, shows that the average block size on the Bitcoin network has reached a new all-time high of 1.34 MB ahead of the halving.

This means activity on the network is seeing substantial growth, and that the network is making use of the technology that is seen by many as essential to Bitcoin’s ability to scale.

Such growth ahead of the halving bodes well for the network as it enters its next phase in a robust state of health.

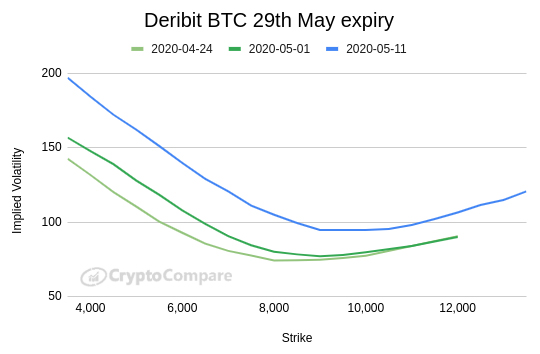

Options market expects volatile moves in the weeks to come

The Bitcoin options market offers some insights as to how the most sophisticated market participants are approaching this historic event.

Broadly speaking the options market is telling us two things:

First, that the options market has increasingly expected volatility. If we look at options contracts on Deribit, we can see the differences between the implied volatility skews over the last few weeks.

After the spike in volatility following the March 13th crypto market crash, the steady recovery led implied volatility to calm down. The market rally at the end of April however, has led the options market to expect more volatility, regardless of direction.

The roller coaster ride for Bitcoin over the weekend up to $10,000, before a sudden $2,000 drop has seen the implied volatility advance even further.

Second, the market, while always cautious, had begun to tilt in the bullish direction, but has since moved back to where it was before the Bitcoin rally.

At the end of April, May expiries' 25-delta call over put (a measure which aims to capture call or put skew) reached around 0% - which indicated that the trend was turning bullish. The last week however, has seen this number gradually move back towards negative territory, and the drop over the weekend has placed it solidly in the negative zone.

All in all the options market remains cautious, and expects some sizable volatility to come after the halving.

Where does Bitcoin go from here?

Previous halvings in 2012 and 2016 saw enormous surges in price in the six months and year following the event, with 2017 proving to be a landmark year in the history of the nascent asset class.

The market in 2020 is significantly different from 2016. With a broader, more sophisticated array of market participants, larger exchanges and a more developed derivatives market, changes to supply and demand are less felt in such a market, and many feel that other forces - including the impacts of Covid-19 on all financial markets - may be stronger determinants of the direction of Bitcoin’s price.

For now, the options market remains cautious, but clearly expects substantial volatility in the months to come.

What remains clear is that this halving has many more eyes on it than in previous cycles. Search data indicates unprecedented interest in the event and Bitcoin’s blockchain data shows it to be in good health. With the halving taking place at such a significant juncture in financial history, Bitcoin has never been better placed to shine.