SWIFT, the financial messaging provider for more than 10,000 financial institutions and corporations in 212 countries and territories, today forecasts continued momentum in the growth of the UK and US economies.

Based on an average of 2 million SWIFT payments messages per day, the SWIFT Index produces quarterly GDP growth nowcasts and forecasts for the UK, EU27, Germany, US and OECD economies and is available on a monthly basis for download at swift.com.

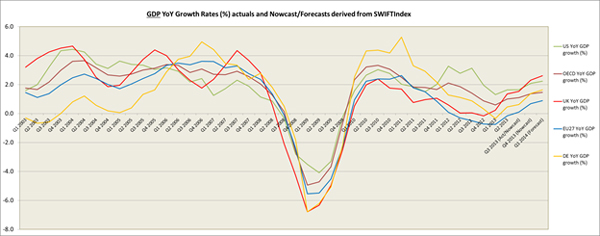

One year on from its inception, the SWIFT Index continues to forecast improvement in the UK economy, with an anticipated year-on-year GDP growth rate of 2.6% by Q1 2014.

Despite a shaky October with the US economy at risk of a default, the SWIFT Index predicts further economic expansion for the US in the new year with a 2.2% year-on-year GDP growth rate expected by Q1 2014.

The following graph shows year-on-year GDP growth based on the SWIFT Index, clearly indicating improving growth for the UK, EU27 Germany, US and OECD aggregates.

The SWIFT Index continues to be optimistic for EU27 growth, forecasting a steady climb out of recession in Q1 2014 with a year-on-year GDP growth rate of 0.9% anticipated - higher than current expectations for Q4 2013.

Similarly, the German economy should continue its steady recovery from 0.6% in Q3 2013 to 1.6% year-on-year growth by Q1 2014.

Underpinning the combined regional growth, the OECD region continues to grow at a strong year-on-year GDP growth rate, reaching 1.5% by Q1 2014.

“Since launching the SWIFT Index in October 2012, we have seen a great deal of success, particularly in forecasts for UK and US economic recovery, post financial crisis. This proves to us that our methodology, which uses an algorithm based on SWIFT payments volumes and OECD data, is accurate and is an early barometer for GDP growth”, said Andre Boico, Head of Pricing & Analytics, SWIFT. “As we move into the New Year, the future is bright for the UK and US economies, with the global economy not far behind.”

Background:

Below, you can find a summary table of the GDP estimates derived from the SWIFT Index and the forecast trend compared to the last actual figure (Q3-2013).

|

egion/ Country |

Q3-2013 vs. Q3-2012 (Year-on-Year %) |

Q4-2013 vs. Q4-2012 (Year-on-Year %) |

Q1-2014 vs. Q1-2013 (Year-on-Year %) |

Forecast Q1-2014 Trend |

|

|

GDP Actual (1) (published by OECD) |

GDP Nowcast |

GDP Forecast |

Direction(2) |

Rate of change(3) |

|

|

OECD |

1.1% |

1.4% |

1.5% |

Growing |

Faster |

|

EU27 |

0.1% |

0.7% |

0.9% |

Growing |

Faster |

|

US |

1.6% |

2.1% |

2.2% |

Growing |

Faster |

|

UK |

1.5% |

2.3% |

2.6% |

Growing |

Faster |

|

Germany |

0.6% |

1.4% |

1.6% |

Growing |

Faster |

Dictionary of terms:

- Published by OECD & downloaded on 12 November 2013. When no actual is available, SWIFT will use its previous nowcasted GDP growth rate.

- Direction: sign of the GDP forecast figure. Positive growth rate (>0%) is equivalent to ‘Growing’. Negative growth rate (<0%) is equivalent to ‘Contracting’. Flat is used when GDP shows no change at 0%.

- Rate of change: we compare the GDP growth rate forecast to the last known actual. If the forecasted GDP growth rate is higher than the last actual, then the “rate of change” can be ‘Faster’,’ Slightly Faster’ or ‘From Contracting’ (if there is a change in sign from negative growth to positive growth). If the forecasted GDP growth rate is lower than the last actual, then the “rate of change” can be ‘Slower’, ’Slightly Slower’ or ‘From Growing’ (if there is a change in sign from positive growth to negative growth).