The TRFs on the EURO STOXX® Banks Index and EURO STOXX® Select Dividend 30 Index will be listed on Mar. 29. TRFs have seen strong demand from banks selling structured products and other market participants, as a way to efficiently gain exposure to price-plus-dividend returns of shares and indices.

On March 29, Eurex will introduce total-return futures (TRFs) on the EURO STOXX® Banks Index and EURO STOXX® Select Dividend 30 Index, expanding the offering of a product type that has seen strong demand.

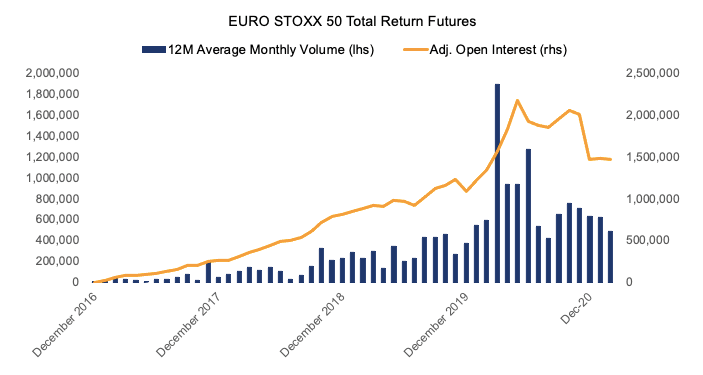

The new TRFs follow in the footsteps of successful trading in EURO STOXX® 50 Index TRFs, which attracted record interest last year amid market volatility.

A TRF holder receives the price performance of the underlying index or security plus 100% of its dividends. TRFs are a more efficient hedging instrument for banks selling structured products, relative to owning price futures or an entire basket of underlying equities, Eurex said in a press release.

Having a TRF that’s traded on a regulated exchange and centrally cleared is also an advantageous alternative to over-the-counter derivatives at a time when the latter have been subject to increasingly demanding regulation, Eurex also said.

Underlying indices in focus

The EURO STOXX® Banks Index tracks companies from the Eurozone’s Banks supersector and currently has 22 components. The EURO STOXX® Select Dividend 30 Index has 30 high-yielding components from the Eurozone, stemming from various industries.

Cost-efficient access to total returns

The total-return products have less pricing sensitivity to dividends than do price-return futures, and was a reason why many traders turned to them last year amid rising volatility and uncertainty over dividend payments. Total return futures on the EURO STOXX® 50 Index posted record demand as investors sought to hedge income returns amid widespread cuts in company payouts (Exhibit 1).

A TRF holder also hedges the implied equity repo rate. This rate is the profit earned from selling a futures contract and then buying the underlying shares and lending these out to the market for extra income.

Exhibit 1 – Monthly traded volume and open interest in EURO STOXX® 50 Total Return Futures

Source: Eurex. Data from December 2016 through February 2021.

Eurex also offers TRFs on single stocks, baskets of shares and collateral indices. For more on the functioning of STOXX®-linked TRFs, please visit a dedicated section on Eurex’s website.

.jpg)