- Retail investors were bullish on US indices in January amid heightened volatility

- Spectrum Markets records all-time-high daily number of trades ahead of January FOMC meeting

- 87.5 million securitised derivatives were traded on Spectrum Markets last month

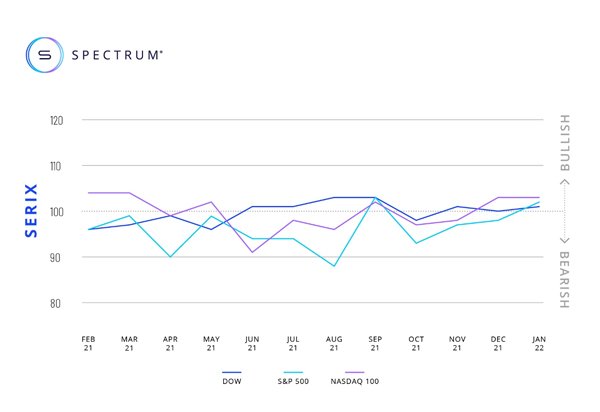

Spectrum Markets, the pan-European trading venue for securitised derivatives, has published its SERIX European retail investor sentiment data for January (see below for more information on methodology), which saw all the US indices move into bullish territory amid volatile trading around the Federal Reserve’s January meeting.

The US dollar hit a new high against other currencies towards the end of the month while January also saw marked trading volatility for US stocks, particularly in light of Federal Reserve’s efforts to overturn inflation and uncertainty over central bank action on interest rates.

With heightened levels of volatility being persistent, Spectrum Markets saw an all-time record trading day with over 22,000 trades, on January 24th, ahead of the FOMC meeting.

“The Fed is currently under pressure to raise rates to address high inflation, in line with other central banks. The market seems to be convinced Jerome Powell and his team are doing a good job on maintaining the fine balance between fighting inflation risks and the potential for an economic backlash at the same time. The Fed has indicated it will start raising interest rates step by step after March, avoiding a sense of extreme tightening, and the market seems to welcome this kind of cautious policy”, explains Michael Hall, Head of Distribution at Spectrum Markets.

During January, 87.5 million securitised derivatives were traded on Spectrum, with 38.4% of trades taking place outside of traditional hours (i.e. between 17:30 and 9:00 CET). 88.6% of the traded derivatives were on indices, 5% on currency pairs, 5.1% on commodities, and 1.3% on equities, with the top three traded underlying markets being DAX 40 (27.9%), S&P 500 (18%) and NASDAQ 100 (16.6%).

Looking at the SERIX data for the top three underlying markets, the NASDAQ 100 and DAX 40 were relatively unchanged at 103 and 100 respectively. Meanwhile the S&P 500 rose slightly, from 98 to 102, going into the bullish zone again.

Calculating SERIX data

The Spectrum European Retail Investor Index (SERIX), uses the exchange’s pan-European trading data to shed light on investor sentiment towards current development in financial markets.

The index is calculated on a monthly basis by analysing retail investor trades placed and subtracting the proportion of bearish trades from the proportion of bullish trades, to give a single figure (rebased at 100) that indicates the strength and direction of sentiment:

SERIX = (% bullish trades - % bearish trades) + 100

Trades where long instruments are bought and trades where short instruments are sold are both considered bullish trades, while trades where long instruments are sold and trades where short instruments are bought are considered bearish trades. Trades that are matched by retail clients are disregarded. (For a detailed methodology and examples, please visit this link).