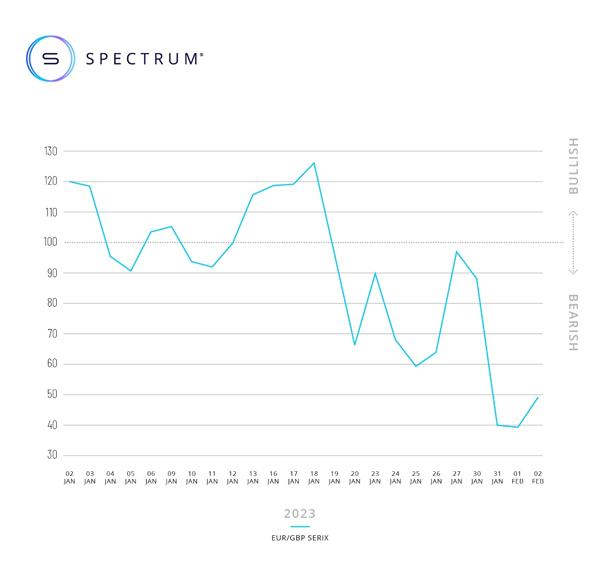

Spectrum Markets (“Spectrum”), the pan-European trading venue for securitised derivatives, saw a sharp increase in bearish sentiment among retail investors towards the Euro compared to the British Pound, ahead of last week’s interest rate announcements from the Bank of England and European Central Bank.

The SERIX value indicates retail investor sentiment, with a number above 100 marking bullish sentiment, and a number below 100 indicating bearish sentiment. (See below for more information on the methodology).

Spectrum’s SERIX sentiment indicator for derivatives linked to EUR/GBP dropped to 40 for January 31st and 39 for February 1st, as investors positioned themselves ahead of the announcements on February 2nd. The volume of securitised derivatives traded on this currency pair was also roughly double the January average during these two days, reflecting strong interest in the impact of the anticipated rate rises on markets.

“It’s no big surprise that two such closely-watched announcements attracted a lot of trading activity on Spectrum, as our retail investors tend to be very responsive to major macro events like these,” commented Michael Hall, Head of Distribution at Spectrum Markets. “While the eventual rate rises themselves were pretty widely anticipated by markets, there was a significant amount of volatility in the lead up to this which created opportunities for investors to act on short-term price movements, while the Euro gained strength overall,” he adds.

Calculating SERIX data

The Spectrum European Retail Investor Index (SERIX) uses the exchange’s pan-European trading data to shed light on investor sentiment towards current development in financial markets.

The index is calculated by analysing retail investor trades placed and subtracting the proportion of bearish trades from the proportion of bullish trades, to give a single figure (rebased at 100) that indicates the strength and direction of sentiment:

SERIX = (% bullish trades - % bearish trades) + 100

Trades where long instruments are bought and trades where short instruments are sold are both considered bullish trades, while trades where long instruments are sold and trades where short instruments are bought are considered bearish trades. Trades that are matched by retail clients are disregarded. (For a detailed methodology and examples, please visit this link).