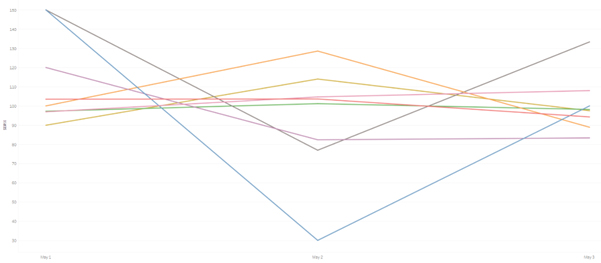

Spectrum Markets’ SERIX retail investor sentiment data for the early part of this week shows a mixed response from investors to the news on Monday night that First Republic had been bailed out by JP Morgan. The SERIX value indicates retail investor sentiment, with a number above 100 marking bullish sentiment, and a number below 100 indicating bearish sentiment. (See here for full methodology).

Sentiment towards the three main US indices, S&P 500, NASDAQ 100 and DOW, saw a market uptick on Tuesday perhaps reflecting retail investors’ hope that the bailout would draw a line under recent turmoil in the banking sector. Though by Wednesday, pessimism had returned, with S&P 500 and NASDAQ 100 dropping back down to a bearish 97 and 98 respectively.

By contrast, sentiment towards the DOW, which is less exposed to financial companies, strengthened further to reach 108 on Wednesday.

The picture for European indices was a little different, with sentiment towards the EUROSTOXX 50 plummeting to 30, likely driven by fears of contagion to European banks which are well represented in the index. Spain’s IBEX saw a similar, but less acute, drop on Tuesday, though both indices recovered on Wednesday. Germany’s DAX 40 and Italy’s FTSE MIB started the week well, but saw sentiment drop off on Wednesday.

“It’s been a bumpy ride for markets this week, and we continue to see retail investors responding rapidly to breaking news all over the world. The divergent SERIX data suggests that one big question on investors’ minds is whether First Republic’s bailout represents the end of a troubling time for American banks or the start of a challenging chapter for their European counterparts. And alongside this, all eyes will be on the central bank announcements coming out this week and next for a hint of what’s to come,” says Michael Hall, Head of Distribution at Spectrum Markets.

|

Calculating SERIX data The Spectrum European Retail Investor Index (SERIX), uses the exchange’s pan-European trading data to shed light on investor sentiment towards current development in financial markets. The index is calculated on a monthly basis by analysing retail investor trades placed and subtracting the proportion of bearish trades from the proportion of bullish trades, to give a single figure (rebased at 100) that indicates the strength and direction of sentiment: SERIX = (% bullish trades - % bearish trades) + 100 Trades where long instruments are bought and trades where short instruments are sold are both considered bullish trades, while trades where long instruments are sold and trades where short instruments are bought are considered bearish trades. Trades that are matched by retail clients are disregarded. (For a detailed methodology and examples, please visit this link). |