Solactive AG today announced the availability of a unique sustainable bond index that aims to push innovation in the area of responsible investment. The Solactive Euro IG Sustainable Bond Index is designed for fixed- income investors seeking exposure to companies with strong sustainability profiles which value the risk-adjusted return chances inherent in responsible investment strategies. The Index is powered by ratings from Sustainalytics, a leading global provider of environmental, social and governance (ESG) research, ratings and analytics.

The concept of incorporating ESG factors into investment decisions is gaining increasing attention within the investment community. As of April, 2015, the United Nations-backed Principles for Responsible Investment had more than 1,300 signatory firms that manage almost $60 trillion in assets, representing a 31 percent increase over the same time period. However, so far, ESG criteria have foremost inspired the creation of new investment products on the equity side.

Relying on the high-quality Company ESG Ratings provided by Sustainalytics, Solactive has created a sustainable bond index to close this gap. Sustainalytics’ ESG Research covers more than 4500 companies globally and its Controversies Research highlights ESG risk across a worldwide universe of more than 10,000 companies.

Steffen Scheuble, CEO, Solactive AG says: “We are proud to be one of the first providers in the market that has incorporated ESG criteria into fixed-income indices and thus provides safety-oriented investors access to a broad sustainable bond benchmark in addition to the other SRI-themed indices, like the Solactive low carbon index family, which are already part of our innovative product offering.”

Michael Jantzi, CEO, Sustainalytics says: “We are delighted that Solactive chose Sustainalytics’ ESG Research and Ratings to develop this progressive Index, particularly since it expands the range of sustainable investment products and services. The backtesting results of the Index are encouraging as they show there is value in integrating ESG factors into corporate bond analysis. We applaud Solactive’s efforts to address investors’ needs for an appropriate benchmark for their ESG fixed income strategies.”

The Index follows a combination of two approaches: First, the Index targets the companies in the highest ESG ratings’ decile per industry of the underlying Solactive Euro IG Corporate Bond Index Benchmark. This “best-in-class” approach accounts for different businesses that vary with regard to their track record of compliance with ESG standards and exposure to ESG-related risks, ensuring a balanced index composition over industries. The criteria that are factored into ESG ratings may also differ on a sector basis, which helps to increase the informative value of the ESG scores.

Second, the Index excludes companies that do not meet a minimum level of ESG standards, i.e. have received an ESG score below 75. By including both the ESG score and the decile approach, only the top 10% of companies with the best ESG criteria related to management practices compared to their industry peers are taken into account. The components are weighted according to their market value, whereas the maximum weight per issuer is capped at 5%.

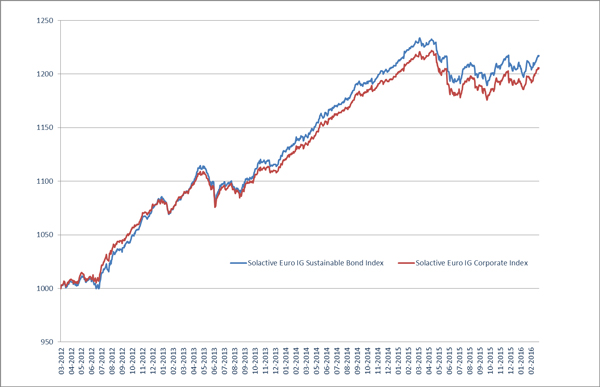

A backward-looking comparison of the Solactive Euro IG Sustainable Bond index and the Solactive Euro IG Corporate Bond Index reveals that the ESG screen for bonds does not lead to a significant performance difference, neither an out- nor an under- performance. In fact, the Solactive Sustainalytics Sustainable Bond index has a slightly superior risk-adjusted return and lower maximum drawdown. These results are in line with the overwhelming majority of past empirical findings pointing to an additional financial value of considering ESG criteria in investing, aside from the moral incentives to invest in SRI strategies.

| Solactive Euro IG Sustainable Bond Index | Solactive Euro IG Corporate Index | |

| Return | 21.74% | 20.58% |

| Return p.a. | 5.33% | 5.05% |

| Volatility p.a. | 2.16% | 2.10% |

| Return/Risk p.a. | 2.47 | 2.40 |

| # of Constituents | 1751 | 455 |