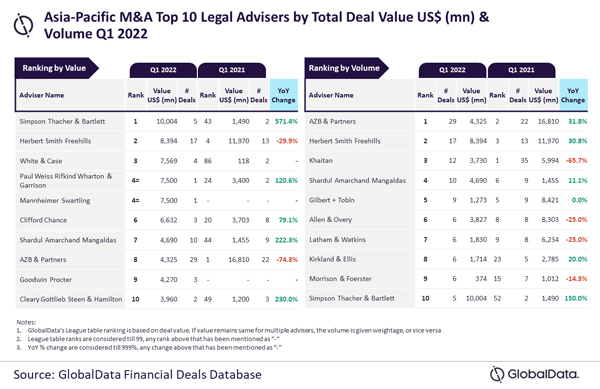

Simpson Thacher & Bartlett and AZB & Partners were the top mergers and acquisitions (M&A) legal advisers in the Asia-Pacific (APAC) region for Q1 2022 by value and volume, respectively. Simpson Thacher & Bartlett advised on five deals worth US$10bn, the highest among all the advisers. Meanwhile, AZB & Partners led in volume terms having advised on 29 deals worth US$4.3bn, according to GlobalData, a leading data and analytics company.

An analysis of GlobalData’s Financial Deals Database reveals that a total of 1,904 M&A deals were announced in the region during Q1 2022.

GlobalData’s report, ‘Global and Asia-Pacific M&A Report Legal Adviser League Tables Q1 2022’, reveals that the deal value for the region increased by 38% from US$126.8bn during Q1 2021 to US$175bn in during Q1 2022.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Simpson Thacher & Bartlett and AZB & Partners were clear winners by value and volume, respectively. While Simpson Thacher & Bartlett was the only adviser with total deal value crossing US$10bn mark, AZB & Partners was also the only adviser that managed to advise on more than 20 deals during Q1 2022.

“Simpson Thacher & Bartlett, apart from leading by value, also occupied the 10th position by volume. Similarly, AZB & Partners, apart from leading by volume, also occupied eighth position by value.”

Herbert Smith Freehills occupied the second position in terms of value with 17 deals worth US$8.4bn followed by White & Case with four deals worth US$7.6bn. Paul Weiss Rifkind Wharton & Garrison and Mannheimer Swartling jointly occupied the fourth position by value with each advising on one deal worth US$7.5bn.

Herbert Smith Freehills with 17 deals worth US$8.4bn occupied the second position in terms of volume followed by Khaitan with 12 deals worth US$3.7bn and Shardul Amarchand Mangaldas with 10 deals worth US$4.7bn. Gilbert + Tobin occupied the fifth position by volume with nine deals worth US$1.3bn.