Short-term options represent one of the most successful products launched by options exchanges in recent years, with demand from retail and institutional investors driving growth, says TABB Group in new research published today, “Accelerated Expirations: The Growing Relevance of Short-term Options.”

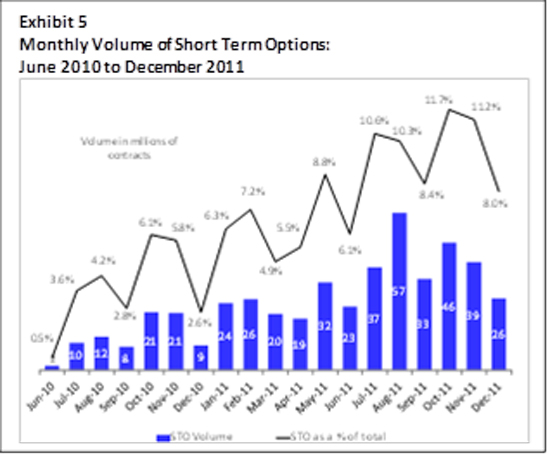

According to TABB, short-term options (STOs) were a significant factor behind record options volume in 2011 with STOs accounting for 8.3% of the total 4.6 billion contracts traded for the year. Short-term options accounted for a peak 11.7% of total volume in October 2011, when volume reached 45.7 million contracts. Comparatively, one year earlier in October 2010, STOs trading volume totaled 20.8 million contracts.

“Short-term options have seen their popularity rise among retail and institutional investors, as spiking market volatility caused rising demand for efficient ways to manage risk exposures,” says Andy Nybo, a TABB principal, head of derivatives and the report’s author. “Investors tell TABB they’re using STOs as a part of strategies to hedge risk over narrower time periods, as a less expensive way to take directional views and, increasingly, as part of statistical arbitrage strategies leveraging market volatility.”

The appeal of STOs in volatile markets was clearly evident in 2011, as surging volatility surrounding the US downgrade contributed to record trading in STOs. As options trading reached a record 550 million contracts in August, STOs volume accounted for 10.3% of the total, with trading on August 4 and August 5 accounting for 13.6% and 13.0% of total activity, respectively, according to TABB Group estimates.

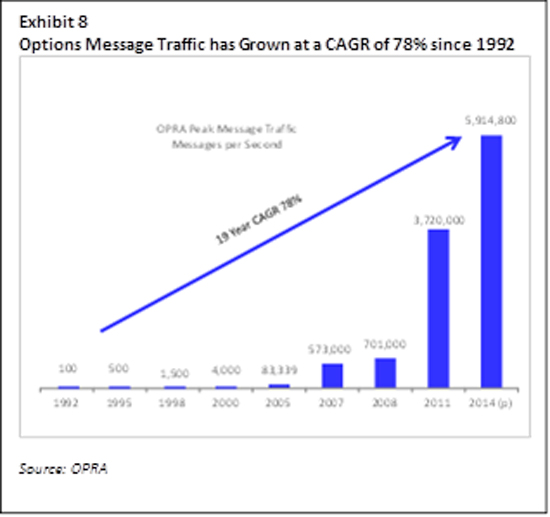

The rising popularity of short-term options isn’t without challenges, Nybo explains. Increased STO quote-and trade-messaging traffic is taxing existing technology infrastructures, placing onerous burdens on market-making firms, forcing them to add servers to capture and analyze market activity, add bandwidth to support higher messaging traffic and higher quote–to-trade ratios, and in some cases increase their co-location capabilities to support higher-velocity trading activity.

The short-term nature of STOs coupled with the high levels of trading interest and liquidity has created a trading environment where minimizing latency is a critical key to success,” says Nybo. “Market makers either love or hate the product, with the delineating factor being the degree of sophistication of their existing technology infrastructures. The burden of quoting the shorter term expirations is considerable, with message rates many times greater for these shorter expiry options,” he added.

“However, as more names are added to the list, investor interest and volume will rise,” Nybo says. “This raises the question: do investors really need to trade options with a short-term expiring next week in a small-cap name trading less than 50,000 shares a day? The answer is no, unless there’s a market-moving corporate event in the offing. Still, the success of STOs does give rise to shorter-term options – as short as minutes – but for now, many exchanges, market makers and brokers have drawn a line in the sand, at least for now, and aren’t planning to list daily options anytime soon.”

The 18-page report with eight exhibits is available to TABB Research Alliance Derivatives clients and pre-qualified media at https://www.tabbgroup.com/Login.aspx. For an executive summary or to purchase the report, visit http://www.tabbgroup.com or write to info@tabbgroup.com.

Other recent options research includes: US Options Trading 2011: Finding the Other Side of the Trade; Feeding the Options Beast: Big Data in the US Options Space; EU Equity Options Market Structure: Opening The Door To High Frequency Flow; and TABB Group’s Options LiquidityMatrix.