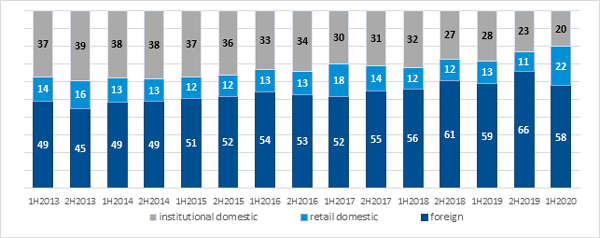

- Domestic individual investors generated 22 percent (+9 pps YoY), foreign investors generated 58 percent (-3 pps YoY), and individual investors generated 20 percent (-6 pps YoY) of GPW Main Market equities turnover in H1 2020.

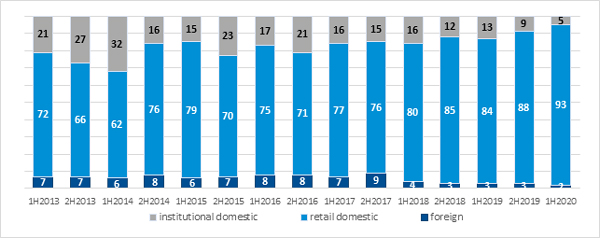

- Individual investors remained in the lead on NewConnect as their share in turnover increased by 9 pps YoY to 93 percent. The share of institutional investors decreased to 5 percent (-8 pps YoY) and the share of foreign investors decreased by 1 pps to 2 percent.

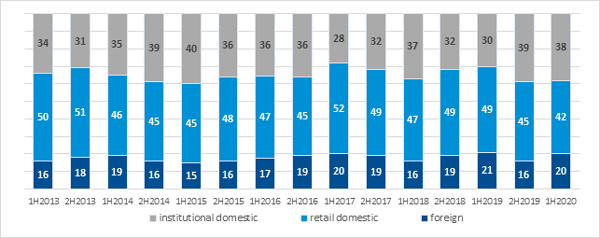

- The share of individual investors in futures turnover decreased by 7 pps to 42 percent and the share of institutional investors increased by 8 pps to 38 percent in H1 2020. The share of foreign investors decreased by 1 percentage point to 20 percent.

GPW Main Market

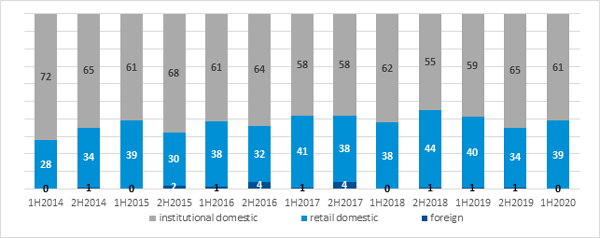

Foreign investors had the biggest share in GPW Main Market equities turnover in H1 2020. It stood at 58 percent, representing a decrease of 3 pps year on year. The share of domestic institutional investors in turnover increased significantly by 9 pps. It stood at 22 percent in H1 2020. Domestic individual investors generated one-fifth of turnover in H1 2020, a decrease of 6 pps year on year. The increase of the share of individual investors is reflected in KDPW statistics which show that 73,500 new securities accounts were opened in H1 2020.

Market makers were the leading group of domestic institutional investors in H1 2020 (with a share of 32 percent), followed by investment funds (30 percent). Firms came third with a share of 14 percent of turnover in H1 2020.

Fig. 1. Structure of investors on the Main Market in equities [%]

Source: GPW survey of investment firms, estimates

NewConnect

Domestic retail investors are in the lead on New Connect and their share is steadily rising. They generated 93 percent of turnover in H1 2020, an increase of 9 pps year on year. Foreign investors generated 2 percent of turnover in H1 2020, down by 1 percentage point year on year. The share of institutions in turnover was 5 percent, down by 8 pps year on year and down by 4 pps compared to H2 2019. Investment funds were the leading group of institutional investors trading on NewConnect in H1 2020, accounting for 44 percent of turnover. Market makers generated 18 percent of turnover and firms - 17 percent.

Fig. 2. Structure of investors on NewConnect [%]

Source: GPW survey of investment firms, estimates

Derivatives market

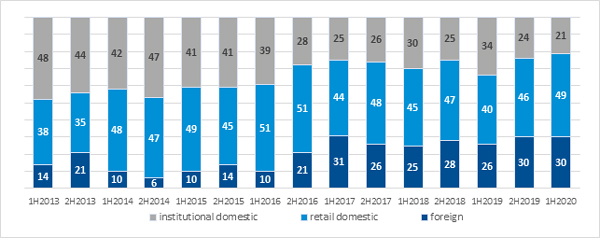

Domestic retail investors were in the lead also on the derivatives market in H1 2020. Their share in futures turnover volume was 42 percent (down by 7 pps year on year) while their share in options turnover was 49 percent (up by 9 pps year on year). The share of foreign investors decreased by 1 percentage point year on year for futures (to 20 percent) and increased by 4 pps for options (30 percent). The share of institutional investors in futures turnover increased to 38 percent in H1 2020 (up by 8 pps) while their share in options turnover decreased to 21 percent (down by 13 pps year on year). Market makers were in the lead both on the futures and options markets. They generated respectively 44 percent and 53 percent of total turnover of domestic institutional investors in H1 2020.

Fig. 3. Structure of investors on the futures market [%]

Source: GPW survey of investment firms, estimates

Fig. 4. Structure of investors on the options market [%]

Source: GPW survey of investment firms, estimates

Catalyst

The share of domestic retail investors in bonds turnover on Catalyst decreased by 1 percentage point to 39 percent in H1 2020. The share of institutional investors increased by 2 pps year on year to 61 percent. The share of foreign investors decreased to almost 0. Market makers were in the lead with a share of 38 percent, banks generated 21 percent, and investment funds generated 19 percent of institutional investors’ turnover.

Fig. 5. Structure of investors on the bonds market [%]

Source: GPW survey of investment firms, estimates

The detailed results of the survey concerning the share of investors in financial instruments turnover are published on the GPW website: https://www.gpw.pl/analysis-investor-share-in-trading.

GPW conducted a survey of the share of different investor groups (foreign investors, domestic institutional investors, domestic retail investors) in financial instruments turnover on the market in H1 2020. According to the applied methodology, the share of each investor group is based on the results of a survey of domestic brokerage houses, as well as turnover data of remote exchange members. The activity of market makers and management of clients’ portfolios were included in the category of domestic institutional investors. The survey covered GPW Electronic Order Book turnover.

***

The Warsaw Stock Exchange Group (GPW Group) operates trading platforms for shares, Treasury and corporate bonds, derivatives, electricity and gas, and provides indices and benchmarks including WIBOR and WIBID. The index agent FTSE Russell classifies the Polish capital market as a Developed Market since 2018. The markets operated by the GPW Group are the biggest in Central and Eastern Europe. For more information, visit www.gpw.pl