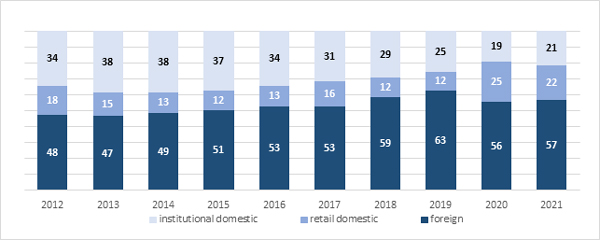

- Retail investors generated 22 percent of equity turnover on the GPW Main Market in 2021 (-3 pps YoY). Foreign investors contributed 57 percent of turnover (+1 pps YoY) while Polish institutional investors generated 21 percent (+2 pps YoY).

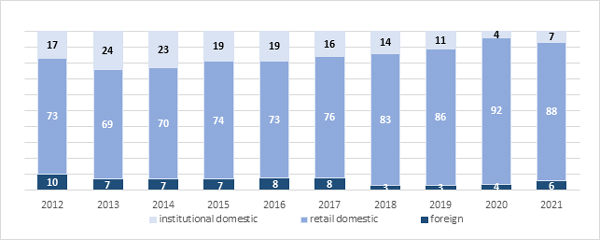

- On NewConnect, retail investors remained in the lead: their share in turnover was 88 percent (-4 pps YoY). The share of institutional investors grew to 7 percent (+3 pps YoY). The share of foreign investors increased to 6 percent, up by 2 pps YoY.

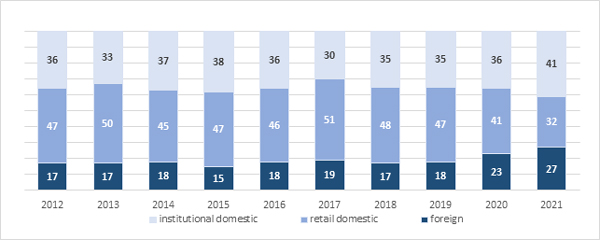

- Polish institutional investors had the biggest share in futures turnover in 2021 for the first time in 10 years: they generated 41 percent (+5 pps YoY). The share of retail investors dropped by 9 pps YoY to 32 percent of turnover. The share of institutional investors increased by 4 pps to 27 percent, an all-time high.

GPW Main Market

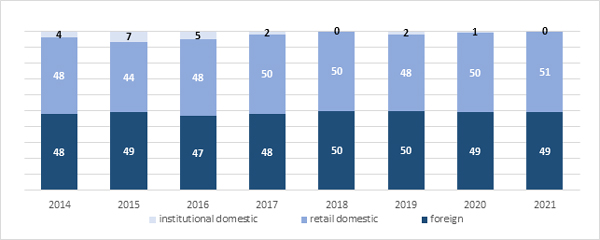

Foreign investors generated the biggest share of equity turnover on the GPW Main Market in 2021, as in previous years. They generated 57 percent of turnover, i.e., 1 percentage point more than in 2020. Foreign investors generated 58 percent of turnover in H2 2021, i.e., 3 percentage points more than in H1 2021. Domestic institutional investors generated 21 percent of turnover in H2 2021, the same as in H1 2021 and 2 percentage points more than in 2020. The share of retail investors in turnover on the GPW Main Market was 22 percent in 2021, down by 3 percentage points year on year and down by 3 percentage points compared to H1 2021.

Market makers (with a share of 27.6 percent) were the leading group of institutional investors in H2 2021, followed by other institutions[1] (27.4 percent) and investment funds (17 percent).

Table 1. Structure of investors on the Main Market in equities [%]

Source: GPW data based on Exchange Members’ broker orders

NewConnect

On NewConnect, retail investors had the biggest share of turnover at 88 percent in 2021, down by 4 percentage points year on year. The share of foreign investors in turnover was 6 percent, an increase of 2 percentage points year on year. The share of institutional investors was 7 percent (up by 3 percentage points year on year). Market makers were the leading group of domestic institutions, accounting for 41.2 percent of equity turnover on NewConnect in H2 2021, followed by firms at 34 percent and other institutions at 15.4 percent.

Table 2. Structure of investors on NewConnect [%]

Source: GPW data based on Exchange Members’ broker orders

Derivatives Market

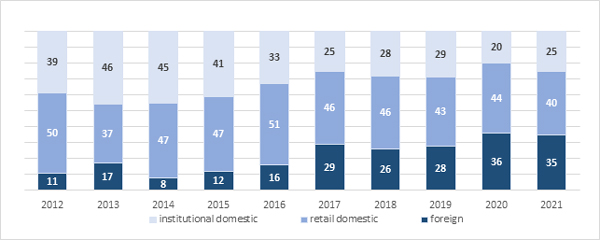

Domestic retail investors were outperformed on the derivatives market in 2021 by institutional investors. For the first time in 10 years, domestic institutions generated the biggest share in futures turnover at 41 percent in 2021, up by 5 percentage points year on year. The share of institutional investors in options turnover increased by 5 percentage points year on year to 25 percent. The share of individual investors in futures turnover was 32 percent in 2021 (-9 pps YoY) while their share in options turnover was 40 percent (-4 pps YoY). The share of foreign investors in futures turnover increased by 4 pps year on year to 27 percent, an all-time high. The share of foreign investors in options turnover was 35 percent, down by 1 percentage point year on year. The share of foreign investors and the share of retail investors on the structured products market was 49 percent and 51 percent, respectively.

Market makers were in the lead among all domestic institutions trading in futures in H2 2021: they generated 55.7 percent of total turnover, followed by other institutions (24.8 percent) and firms (13.7 percent). Firms generated the biggest part of options turnover (70.5 percent), followed by market makers (28.6 percent). Structured products turnover in H2 2021 was principally generated by firms (84.1 percent), followed by Exchange Members (13.6 percent) and market makers (2.3 percent).

Table 3. Structure of investors on the futures market [%]

Source: GPW data based on Exchange Members’ broker orders

Table 4. Structure of investors on the options market [%]

Source: GPW data based on Exchange Members’ broker orders

Table 5. Structure of investors on the structured products market [%]

Source: GPW data based on Exchange Members’ broker orders

Catalyst

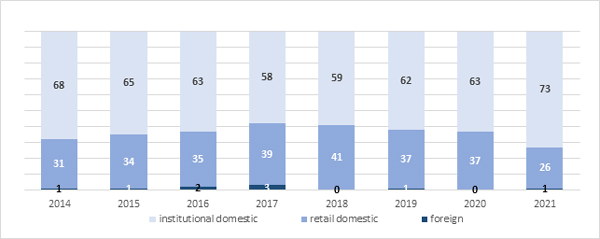

Bond turnover on Catalyst is dominated by domestic institutions which generated the biggest part of turnover since 2015: 73 percent in 2021 vs. 63 percent in 2020. Retail investors generated 26 percent of turnover (-11 pps YoY) while foreign investors generated 1 percent (+1 percentage point YoY).

Table 6. Structure of investors on the Catalyst bond market [%]

Source: GPW data based on Exchange Members’ broker orders

The detailed results of the survey concerning the share of investors in financial instruments turnover are published on the GPW website at https://www.gpw.pl/analysis-investor-share-in-trading.

In presenting the data for 2021, GPW changed the method used to obtain data for calculating the share of investor groups in turnover on the exchange. Such information is now based on broker orders submitted to the Exchange’s trading system. As a result, the method of aggregating and presenting data on the percentage share of domestic retail investors was modified. The information on the number of online accounts is sourced from surveys conducted by GPW among domestic brokerage houses. The information on the number of active investment accounts comes from the Exchange’s trading system: it is the number of accounts for which at least one order was placed with GPW in the period under review.

[1] OTHER: Other institutional entities not included in any of the other categories - in particular state institutions and enterprises, cooperatives, foundations, associations, local government units, as well as KDPW and transactions concluded on the basis of aggregated orders and pending allocation orders referred to in Art. 2 clause 3. Commission Delegated Regulation (EU) 2017/580.