- The STI’s price gain of 3.1% in 2014 YTD is resilient vs other US, Europe, Japan and HK stock benchmarks

- The SPDR STI ETF has generated annualised returns of 9.2% over the past 10 years ending 30 April 2014.

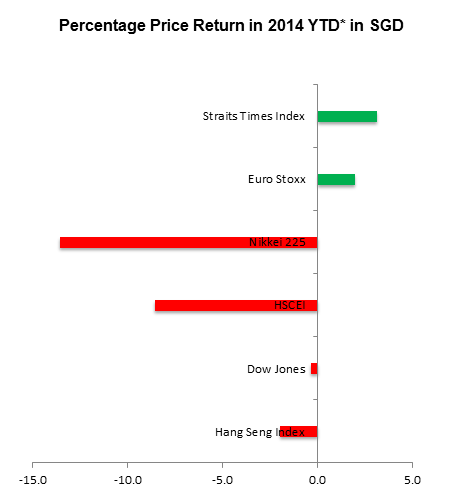

- The wide differences in returns of global stock indices in the first 21 weeks of the year showed that different markets reacted differently to global factors

As of Monday, the Straits Times Index (STI) had gained 3.1% in the 2014 YTD on a price basis, or 4.7% on a combined price and dividend basis. Some market segments have outperformed this 4.7% total return over 21 weeks. For example, Singapore’s 26 REITs averaged a 9.4% total return over the same time.

However, when contrasted to the other major benchmarks of the United States, Europe, Japan and Hong Kong, the STI’s price gain of 3.1% was relatively resilient. Over the same time, on a Singapore Dollar basis, the Dow Jones Industrial Average – despite recent record highs – actually declined 0.4%, the Nikkei 225 Index declined 13.6%, Hong Kong’s Hang Seng Index and Hang Seng China Enterprises Index declined 2.0% and 8.6% respectively while the Euro Stoxx 50 Index increased 1.7%.

The above illustrated 3.5% outperformance of the STI to the Dow Jones and 16.7% outperformance to the Nikkei 225 in the first 21 weeks of 2014 came after the STI underperformed relative to those two indices in 2013. In addition, the Singapore Dollar gained against the US Dollar in the year thus far but declined in value to the US Dollar in 2013. There are no rules on how indices will relatively perform to each other in the remaining 31 weeks of the year as relative performances will largely depend on relative index differences. Also past performance does not indicate future returns. The fact that 2014 has generated such different index returns in the first 21 weeks of the year showed that different markets reacted differently to global risk factors.

The STI is made up of 30 blue chip stocks and is an investable index using two associated ETFs that are also accessible via Regular Shares Savings plans (RSS Plans). The 30 constituent stocks of the STI make up more than half of the market capitalisation of all stocks listed on SGX. The 30 STI companies, as a whole, derive significant portions of their revenue from the region. They also represent as many as 14 sectors of the Industry Classification Benchmark.

Over the past 10 years, the STI has had both periodic quarters of relative outperformance and underperformance to other global indices. Appreciation of the Singapore Dollar to the US Dollar has supported relative outperformance, while depreciation of the Singapore Dollar might have led to relative underperformance. According to SPDR (click here to view), the SPDR STI ETF over the past 10 years ending 30 April 2014 has generated investors’ annualized returns of 9.2%. This is based on 143.5% total return according to Bloomberg. Over the same time, the Dow Jones Industrial Average generated a 109.8% return on a US Dollar basis, however taking into account Singapore Dollar appreciation over those 10 years, on a Singapore Dollar basis, that 10 year return of the Dow Jones Industrial Average was trimmed to 55.0%.

The 30 STI constituents and their price performances and total returns in 2014 as of 11 April are detailed in the table below. The two ETFs listed on SGX that track the STI are the Nikko AM Singapore STI ETF and SPDR® STI ETF. ETFs are open-ended investment funds listed and traded on an exchange, where they can be easily bought and sold.

|

Name |

SGX Code |

Mkt Cap S$B |

Total Return YTD % |

Total Return 12M % |

Dvd Ind Yld % |

ICB Subsector Name |

|

SINGAPORE TELECOMMUNICATIONS |

Z74 |

61.2 |

5.7 |

-0.6 |

4.3 |

Mobile Telecommunications |

|

JARDINE MATHESON HLDGS LTD |

J36 |

52.1 |

16.2 |

-7.1 |

2.3 |

Diversified Industrials |

|

JARDINE STRATEGIC HLDGS LTD |

J37 |

48.4 |

7.9 |

-13.0 |

0.7 |

Diversified Industrials |

|

DBS GROUP HOLDINGS LTD |

D05 |

41.2 |

0.3 |

-0.5 |

3.4 |

Banks |

|

UNITED OVERSEAS BANK LTD |

U11 |

35.6 |

9.3 |

6.1 |

3.1 |

Banks |

|

OVERSEA-CHINESE BANKING CORP |

O39 |

33.3 |

-3.4 |

-10.3 |

3.5 |

Banks |

|

WILMAR INTERNATIONAL LTD |

F34 |

20.7 |

-4.9 |

-2.7 |

2.5 |

Food Products |

|

HONGKONG LAND HOLDINGS LTD |

H78 |

20.5 |

19.8 |

-2.1 |

2.6 |

Real Estate Holding & Development |

|

KEPPEL CORP LTD |

BN4 |

19.2 |

-2.7 |

0.5 |

3.8 |

Oil Equipment & Services |

|

GENTING SINGAPORE PLC |

G13 |

16.3 |

-9.7 |

-10.6 |

0.7 |

Recreational Services |

|

JARDINE CYCLE & CARRIAGE LTD |

C07 |

16.1 |

27.5 |

0.1 |

3.0 |

Specialty Retailers |

|

THAI BEVERAGE PCL |

Y92 |

15.2 |

13.4 |

-7.5 |

2.6 |

Brewers |

|

GLOBAL LOGISTIC PROPERTIES L |

MC0 |

13.5 |

-1.7 |

-3.4 |

1.4 |

Real Estate Holding & Development |

|

CAPITALAND LTD |

C31 |

13.3 |

5.6 |

-15.1 |

2.6 |

Real Estate Holding & Development |

|

SINGAPORE AIRLINES LTD |

C6L |

12.1 |

-2.1 |

-3.6 |

2.2 |

Airlines |

|

SINGAPORE TECH ENGINEERING |

S63 |

11.8 |

-1.6 |

-9.1 |

1.9 |

Aerospace |

|

SEMBCORP INDUSTRIES LTD |

U96 |

9.7 |

2.4 |

12.9 |

2.8 |

Oil Equipment & Services |

|

CITY DEVELOPMENTS LTD |

C09 |

9.3 |

8.3 |

-5.9 |

0.8 |

Real Estate Holding & Development |

|

CAPITAMALLS ASIA LTD |

JS8 |

9.2 |

20.8 |

16.1 |

1.5 |

Real Estate Holding & Development |

|

NOBLE GROUP LTD |

N21 |

8.7 |

23.1 |

22.5 |

0.9 |

Diversified Industrials |

|

SEMBCORP MARINE LTD |

S51 |

8.3 |

-9.5 |

-9.1 |

2.8 |

Oil Equipment & Services |

|

HUTCHISON PORT HOLDINGS TR-U |

NS8U |

7.8 |

9.1 |

-8.4 |

8.0 |

Transportation Services |

|

SINGAPORE EXCHANGE LTD |

S68 |

7.4 |

-3.4 |

-6.5 |

4.0 |

Investment Services |

|

GOLDEN AGRI-RESOURCES LTD |

E5H |

7.4 |

5.5 |

0.1 |

1.9 |

Farming & Fishing |

|

STARHUB LTD |

CC3 |

7.1 |

-0.9 |

0.3 |

4.8 |

Mobile Telecommunications |

|

CAPITAMALL TRUST |

C38U |

7.0 |

9.5 |

-6.6 |

5.1 |

Retail REITs |

|

SINGAPORE PRESS HOLDINGS LTD |

T39 |

6.8 |

5.1 |

5.6 |

3.5 |

Publishing |

|

SIA ENGINEERING CO LTD |

S59 |

5.5 |

-2.2 |

3.0 |

4.0 |

Transportation Services |

|

OLAM INTERNATIONAL LTD |

O32 |

5.4 |

45.3 |

25.8 |

1.8 |

Food Products |

|

COMFORTDELGRO CORP LTD |

C52 |

4.9 |

20.7 |

17.9 |

2.9 |

Travel & Tourism |

Source: Bloomberg (Data as of 20 May 2014)