- Since 1993, the Indian rupee (INR) has traded under a managed floating regime without a fixed or pre-announced target or band. Any intervention by the Reserve Bank of India (RBI) typically depends on the volume of Foreign Institutional Investor (FII) and corporate inflows, and is undertaken to smooth out volatility in the exchange rate movements.

- Over the past ten years the annualised 30 day volatility for USD/INR returns averaged 1.25%. The most recent spike in Sep 2013 saw the volatility gauge rise more than three times from the average. Moreover, the average annualised 30 day volatility has been higher over the past five years than the preceding five years.

- The SGX INR/USD futures are quoted in an inverse price format in order to facilitate a settlement in USD. At a trading price of 160.00 US cents to 100 Indian rupees, and a contract size of 2 million INR, the minimum USD value of a long or short position in the SGX INR/USD futures is USD 32,000.

Over the past ten years, the Indian rupee (INR) has depreciated at an annualised rate of 2.6% to the US Dollar (USD). Currently 1.00 USD will purchase 60.20 INR. Ten years ago, one USD purchased 46.60 INR. Hence, while the Indian economy has been growing faster than the United States, its currency has been weakening. Real GDP growth has averaged 7.6% in India since Q2 2004, in contrast to below 2.0% for the United States (US). However, despite India’s relatively higher growth, its currency has depreciated against the USD on two grounds – firstly, the recent cut backs on Quantitative Easing (QE) by the US Federal Reserve has strengthened the USD against emerging market currencies, and secondly India’s industrialization has been accompanied by persistent current account deficits.

INR Fundamentals

The key distinctions between the world’s biggest and world’s tenth largest economy is that the Indian economy is in a developing phase, as opposed to being considered as advanced or developed like the US. With the challenges and opportunities associated with a developing economy, government and Central Bank policies tend to be more outright and less subtle than what is applied in the advanced economies. Hence, as a developing economy integrates with the world, its exchange rate can become a key policy tool. An appreciation or depreciation of the INR to the USD will affect the balance of trade through the change in relative prices of imports and exports in India and the US, in addition to the value of investment funds and foreign direct investments.

The INR can hence be used by policymakers as a key policy tool. In a recent IMF working paper titled India’s Recent Macroeconomic Performance: An Assessment and Way Forward (click here), results were presented that indicated both economic activity (home and abroad) and real exchange rate movements have the expected impact on exports and imports. Hence, real appreciation of the currency reduced exports and increased imports. Thus, the estimates in the paper suggested that real effective exchange rate appreciation can lead to a widening of the trade and current account balances, and vice versa for real depreciation.

INR Policy

Currently the foreign exchange policies in India are managed by the Foreign Exchange Department (FED) of the Reserve Bank of India (RBI). Under the Foreign Exchange Management Act effected in 2000, the objectives of the FED include facilitating external trade and payment and promoting an orderly development and maintenance of the foreign exchange market in India.

As maintained by the RBI, the exchange rate policy of India has progressed from a fixed exchange rate regime towards a flexible regime. Currently, the INR is governed by a managed float policy whereby the exchange rate is determined by market forces of demand and supply & the RBI intervenes in the market when necessary by buying or selling foreign currencies to minimize fluctuations and maintain an adequate level of reserves.

Statistical deviation of USD/INR returns

Over the past ten years, the volatility of the USD/INR has generally risen and seen occasional spikes. The chart below illustrates the historical volatility of the USD/INR returns over the past ten years using a 30 day rolling window. Note the chart is based on logarithmic returns in order to take out any size bias. Over the preceding ten years, the annualized 30 day volatility for USD/INR returns averaged 1.25%. This means that on average, over a one year period, USD/INR returns would swing around by 1.25%

In some instances, there were significant spikes, such as between 30 August 2013 and 10 October 2013, when the volatility gauge was consistently above 4.00%. The average historical volatility at 1.25% over the past ten years compares with 0.92% for the USD/SGD over the same period.

Annualized Volatility of USD/INR

Source: SGX

As observed in the chart above the average annualised 30 day volatility has been higher over the past five years than the preceding five years. This annualised volatility is based on daily returns, not the swings from highs to low which would generate a higher level of volatility. Taking into consideration the swings from daily highs to daily lows, the annualised volatility of the USD/INR currently stands at 7.6%, while the ten year average stands at 4.6%.

Record Performance for SGX INR/USD Futures

SGX INR/USD futures can facilitate offshore investors' needs to separately manage the currency risk premium associated with their exposure to the India market. As noted above there is more volatility in the USD/INR exchange rate in its daily trading range, than there is on its end of day returns. Hence futures contracts, which track the intraday moves, enable investors or hedgers to buy or sell on leverage, can become an efficient medium for real-time risk management.

At a trading price of 166.00 US cents to 100 India Rupees, the minimum value of a long or short position in the SGX INR/USD futures is approximately US$32,000. Note the futures contract is quoted in an inverse price format in order to facilitate a settlement in the US dollars. Thus if the futures contract which is quoted as INR/USD is priced at 166.11, the equivalent USD/INR rate will be 60.20.

In the month of May 2014, coinciding with the Indian general elections, SGX INR/USD futures achieved new record volumes, with a total of 18,621 contracts traded, up 235% from April 2014 which saw a total of 5,552 contracts traded. The increased participation in this contract culminated in a new single-day volume high of 2,325 contracts traded on 23 May 2014.

Source: SGX

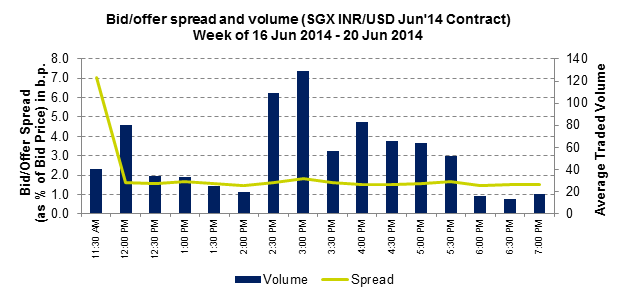

As illustrated in the chart above, the bid/offer spread for SGX INR/USD futures has averaged less than 2 basis points during onshore opening hours (11.30am to 7.30pm Singapore time), which is very competitive with other liquidity venues such as the over-the-counter (OTC) market for non-deliverable forwards (NDFs).

SGX INR/USD Futures – Contract Specifications

|

Product Name |

SGX INR/USD Futures |

|

Contract Size |

INR 2,000,000 |

|

Contract Symbol |

IU |

|

Contract Months |

12 monthly |

|

Minimum Price Fluctuation |

0.010 US cents (per 100 Rupees) |

|

Tick Value |

US$ 2.00 |

|

Trading Hours (Singapore Time) |

T session: 7.40am – 7.35pm

T+1 session: 8.15pm – 2.00am (next day) |

|

Last Trading Day (LTD) |

2 business days prior to the last business day of the contract expiry month |

|

LTD Trading Hours |

T session: 7.40am – 2.35pm |

|

Daily Price Limits |

Nil |

|

Position Limits |

10,000 contracts |

|

Settlement Basis |

Cash settled (USD) |

|

Final Settlement Price |

Equal to the reciprocal of the RBI USD/INR Reference Rate at 2.45pm – 3.00pm (Singapore Time), multiplied by 10,000 to convert such spot exchange rate to United States Cents per 100 Indian Rupees, rounded to 2 decimal places. |

|

Negotiated Large Trade |

Minimum 50 lots |

|

Price Information |

Thomson Reuters: SDIU:<F3> |

|

(Vendor: Ticker) |

Bloomberg: XIDA <CURNCY> CT |

Please note that Futures contracts have been categorised as Specified Investment Products (SIPs) as part of an MAS initiative to introduce stronger measures and enhance requirements to further safeguard the interests of individual investors. SGX has introduced two online initiatives, a Customer Account Review Module and an Online Education program, to improve the understanding and trading of SIPs listed on SGX. Please click here to access these initiatives