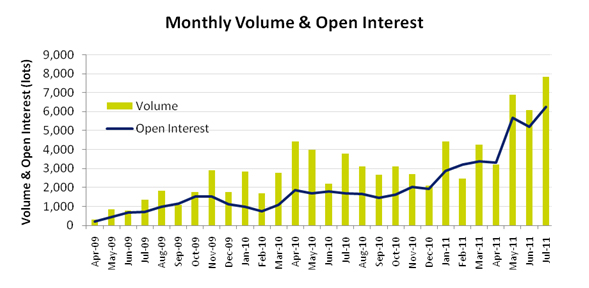

SGX OTC Iron Ore Swap in July 2011 saw a record monthly total of 7,845 lots (3.9 million metric tonnes) cleared and open interest standing at an all-time high of 6,255 lots (3.1 million metric tonnes).

The year-to-date volume of 35,483 lots (17.7 million metric tonnes) cleared has already surpassed the total volume cleared in the whole of 2010.

Open interest for Iron Ore Swaps has also increased significantly, reaching a record high of 6,255 lots, an increase of more than three times the open interest at the end of 2010.

The exchange has also seen increased activity from a diverse group of global participants, including financial institutions, regional producers and consumers of both iron ore and steel products.

Contract Specifications

|

|

Product Name |

SGX OTC Iron Ore Swap |

|

|

|

Contract |

Iron Ore CFR China (62% Fe Fines) Swap |

|

|

|

Contract Size |

1 lot = 500 metric tonnes |

|

|

|

Ticker Symbol |

FE |

|

|

|

Minimum Price Fluctuation |

US$0.01 per dry metric tonne (US$5.00) |

|

|

|

Contract Months |

Up to 36 consecutive months starting with current month, |

|

|

|

Position Limits* |

3,000 contracts |

|

|

|

Trade Registration Hours (Singapore Time) |

8.00am - 4.00am Last Trading Day: 8.00am - 8.00pm Note: System is not be available from 4.00.01am to 7.59.59am daily |

|

|

|

Last Trading Day |

Last publication day of The Steel Index (TSI) iron ore reference prices in the contract month |

|

|

|

Final Settlement Price |

Cash settlement using the arithmetic average of all The Steel Index (TSI) iron ore reference prices in the expiring month, rounded to 2 decimal places |

|

|

* |

Clearing Members may apply to the Exchange for higher position limits on behalf of their customers. Approval is based on the financial standing of the Member and their customer on a case by case basis. |

||