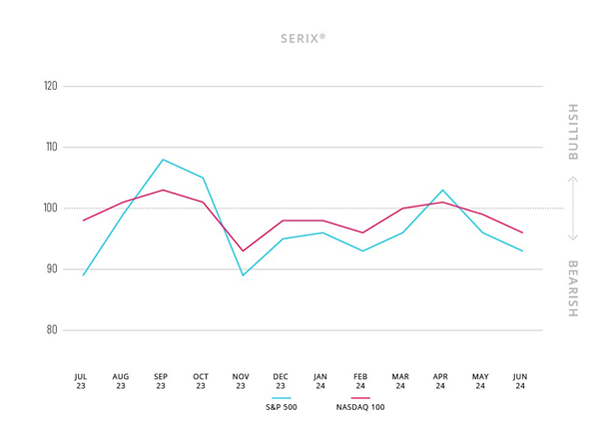

- Spectrum's SERIX sentiment indicates a bearish trend for both the S&P 500 and NASDAQ 100, despite recent rises in points for the index

- Both US indices are strongly driven by ‘Glorious Seven’ stocks: NVIDIA, Meta, Amazon, Microsoft, Alphabet, Apple and Tesla

- NVIDIA remains the strongest single stock driving US indices, with Artificial Intelligence (AI) being a suspected primary driver of this trend

Spectrum Markets (“Spectrum”), the pan-European trading venue designed for retail investors, has published its SERIX sentiment data for European retail investors for June, revealing bearish trading behaviour for both US indices, S&P 500 and NASDAQ 100.

The SERIX value for the S&P 500 fell to 93 points, whereas on June 28th at market closure, the S&P 500 index climbed up to 5,460 points. Similarly, SERIX sentiment on NASDAQ 100 fell to 96 points while the index itself rose to 19,682 points.

The SERIX value indicates retail investor sentiment, with a number above 100 marking bullish sentiment, and a number below 100 indicating bearish sentiment. (See below for more information on the methodology).

Market opinion

“The strong performance of NVIDIA has significantly boosted both US indices. However, some retail investors may now be sceptical about the sustainability of this growth or may simply be engaging in profit-taking,” says Michael Hall, Head of Distribution at Spectrum Markets.

“Both US indices are strongly driven by the ‘Glorious Seven’ stocks: NVIDIA, Meta, Amazon, Microsoft, Alphabet, Apple and Tesla. Eight of the ten largest companies in the world are based in the United States, five of which are pure technology stocks closely tied to Artificial Intelligence (AI). The development and impact of AI will continue to play a crucial role and strongly influence both major US indices,” Hall concludes.

Spectrum’s June data

In June 2024, order book turnover on Spectrum was €201.5 million, with 34.7% of trades taking place outside of traditional hours (i.e., between 17:30 and 9:00 CET)

The order book turnover was distributed among various underlying assets as follows: 76.2% on indices, 5.1% on currency pairs, 8.9% on commodities, 8.1% on equities and 1.7% on cryptocurrencies. The top three traded underlying markets were NASDAQ 100 (26.2%), DAX 40 (23.9%), and DOW 30 (11.3%).

Looking at the SERIX data for the top three underlying markets, the NASDAQ 100 and DOW 30 both remained bearish at 96 and 99 respectively, and the DAX 40 increased from a bearish 98 to a bullish 101.

|

Calculating SERIX data The Spectrum European Retail Investor Index (SERIX), uses the trading venue’s pan-European trading data to shed light on investor sentiment towards current development in financial markets. The index is calculated on a monthly basis by analysing retail investor trades placed and subtracting the proportion of bearish trades from the proportion of bullish trades, to give a single figure (rebased at 100) that indicates the strength and direction of sentiment: SERIX = (% bullish trades - % bearish trades) + 100 Trades where long instruments are bought and trades where short instruments are sold are both considered bullish trades, while trades where long instruments are sold and trades where short instruments are bought are considered bearish trades. Trades that are matched by retail clients are disregarded. (For a detailed methodology and examples, please visit this link). |