The number of brokerage accounts in Poland reached a record high of 1.798 million at 30 June 2024, including 1.679 million online accounts. The number of active accounts, rose to 246,000, the highest level in 12 years (YoY). The Warsaw Stock Exchange, which attracts both domestic and international investors, recorded the highest-ever foreign investor participation of 67%.

- The share of foreign investors in GPW Main Market equity trading as record high at 67%

- Domestic individual investors remain in the lead on the alternative market with a 84% share

- Share of foreign investors in futures trading on GPW increased by 4 p.p.

Capital market investors

The Warsaw Stock Exchange presents the latest survey on the participation of different investor groups in market turnover and the activity of Poles on the capital market. According to data from brokerage firms, the number of online investment accounts reached 1.679 million, accounting for 95% of all brokerage accounts. According to KDPW, the number of all brokerage accounts was the highest ever at 1.798 million at 30 June 2024. Interest in the stock market is also reflected in the number of active accounts which represents investors’ actual participation in the market: it reached 246,000, the highest in 12 years (year on year). These figures testify to the recovery of the capital market in Poland and suggest growing confidence in the stock exchange.

“The increase in the number of online accounts to 1.679 million, accounting for 95% of all investment accounts, reflects the dynamic development of digitalisation in the Polish capital market. Increasing numbers of individual investors are using modern tools to manage their investments, which demonstrates the growing awareness of Poles and their commitment to actively participate in the stock market. This positive trend supports the development of the market and the availability of investments to a wider range of participants,” said Arkadiusz Detyniecki, Director of the GPW Trading Department.

GPW application in numbers

GPW’s mobile app allows users to track quotes on the Warsaw Stock Exchange directly on their phone or tablet. As a result, all iOS or Android users can at all times monitor their investments and follow recent market events. The application is available in two language versions: Polish and English, which allows a wide range of users to benefit from its features.

Since the launch of its first version, the GPW app has been downloaded more than 200,000 times, including around 70,000 devices which have recently had the app permanently installed. The app is actively used by some 30,000 users each month, attesting to its popularity and utility in tracking the Polish capital market.

GPW Main Market

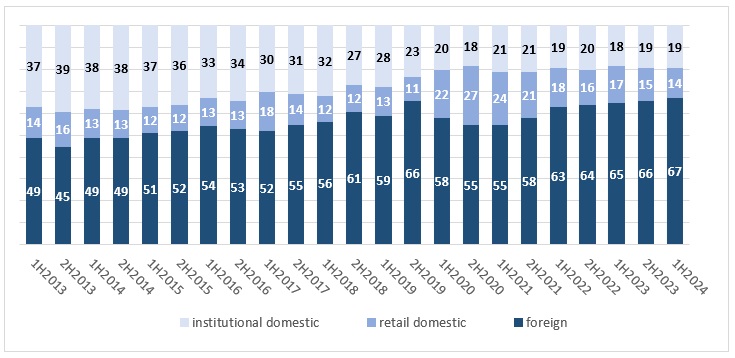

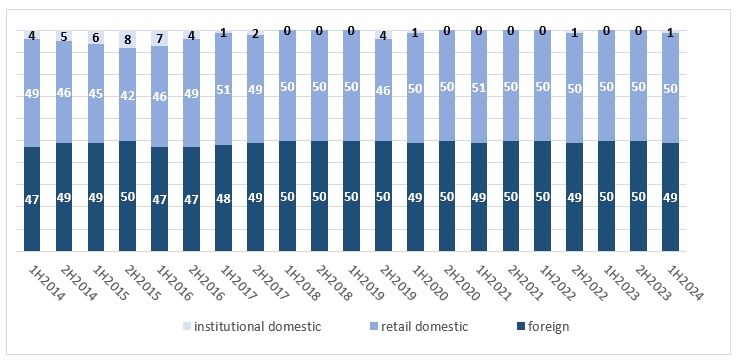

Foreign investors have for years generated the largest share of equity trading on GPW’s Main Market, amounting to 67% in H1 2024, 2 p.p. more than in the previous year. It was the highest H1 share in the last 11 years. Domestic retail investors generated 14% of turnover, a decrease of 3 p.p. compared to the previous year. Domestic institutional investors generated 19% of turnover, 1 p.p. more than in H1 2023. Among all domestic institutions, other institutions were in first place with a share of 31.0% in H1 2024, followed by market makers with 23.3%, and investment fund companies (TFI) with 16.7%.

“The record-high share of foreign investors on GPW's Main Market in H1 2024 is a clear sign of growing confidence of international capital in the Polish market. According to the Federation of European Securities Exchanges (FESE), the Warsaw Stock Exchange recorded one of the highest increases in equity turnover in Europe at 43.9% year on year. Main Market EOB turnover reached PLN 88.4 billion, the best result in more than two years. Meanwhile, growing activity of individual investors on the futures market shows that Poles are increasingly bold in using advanced investment tools,” said Arkadiusz Detyniecki.

Table 1. Investor mix on the Main Market in equities (%)

Source: GPW data based on Exchange Members’ broker orders

NewConnect

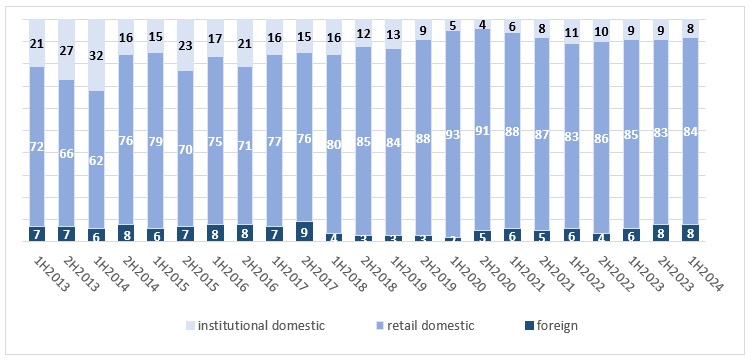

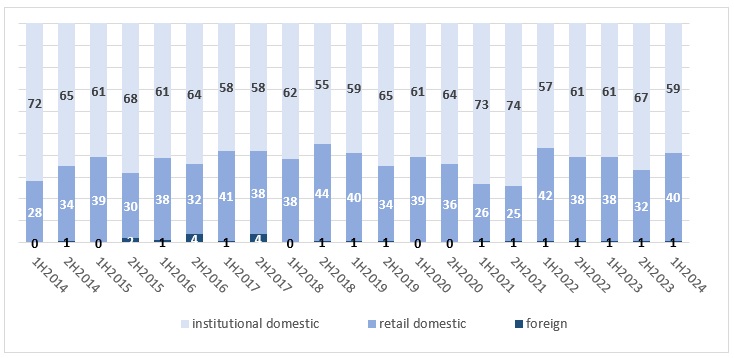

Domestic individual investors have for years been in the lead on NewConnect. They accounted for 84% of turnover in H1 2024, down 1 p.p. year on year. Foreign investors generated 8% of turnover in H1 2024, 2 p.p. more than a year ago. Domestic institutions also accounted for 8% of turnover, 1 p.p. less than in H1 2023. Among all institutional investors trading on NewConnect in H1 2024, market makers accounted for 44.3% of turnover, firms generated 31.9%, and other institutional traders 14.3%.

Table 2. Investor mix on NewConnect in equities (%)

Source: GPW data based on Exchange Members’ broker orders

Derivatives Market

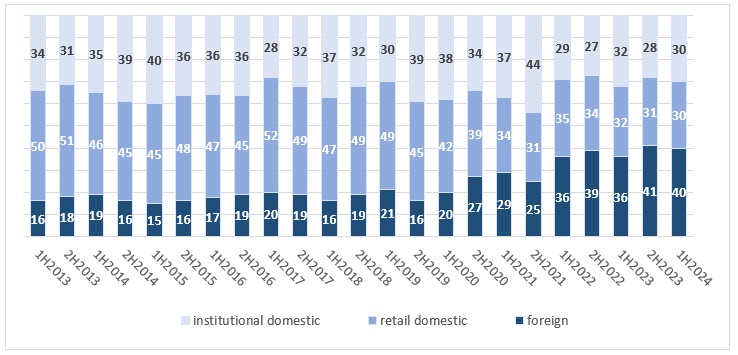

The share of domestic individual investors in futures trading volume stood at 30% in H1 2024 (-2 p.p. YoY). Foreign investors generated 40% of futures turnover, 4 p.p. more than a year ago. Institutional investors’ share in futures turnover fell to 30% in H1 2024 (-2 p.p. YoY).

Table 3. Investor mix on the futures market (%)

Source: GPW data based on Exchange Members’ broker orders

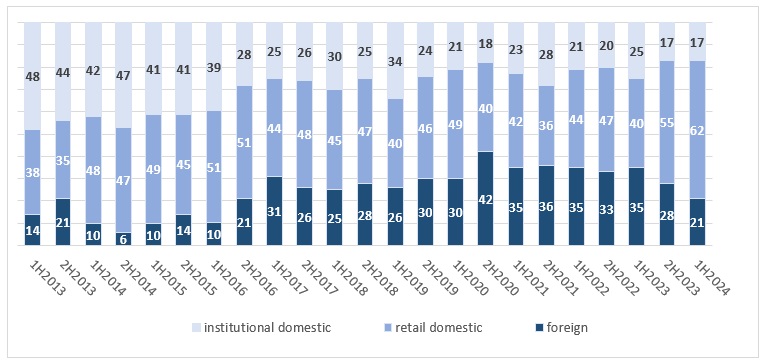

The share of domestic individual investors in options turnover volume stood at 62% in H1 2024 (+22 p.p. YoY), the highest share since 2012. The share of foreign investors in options turnover fell by 14 p.p. to 21%, and the share of institutional investors fell to 17% (-2 p.p. YoY).

Table 4. Investor mix on the options market (%)

Source: GPW data based on Exchange Members’ broker orders

The share of individual investors in the structured products market was 50% (the same as a year ago), while the share of foreign investors fell by 1 p.p. to 49%. Institutional investors accounted for 1% of turnover in structured products (+1 p.p. YoY).

Table 5. Investor mix on the structured products market (%)

Source: GPW data based on Exchange Members’ broker orders

Catalyst

The share of domestic individual investors in bond turnover on Catalyst increased by 2 p.p. YoY to 40% in H1 2024. The share of foreign investors remained stable at 1%. The share of institutional investors fell to 59% (-2 p.p. YoY).

Table 6. Investor mix on the bond market (%)

Source: GPW data based on Exchange Members’ broker orders

In 2021, GPW modified its methodology of sourcing data necessary to calculate the share of different groups of investors in turnover on the exchange. Such data are now sourced from broker’s orders placed in the Exchange’s trading system. As a result, the aggregation and presentation of data on the percentage share of domestic individual investors was modified. The number of online accounts is determined in a GPW survey covering domestic brokers. The number of active investment accounts is sourced from the Exchange’s trading system and represents the number of accounts for which at least one order was placed on GPW in the period under review.

The detailed results of the survey concerning the share of investors in financial instruments turnover are published on the GPW website: https://www.gpw.pl/analysis-investor-share-in-trading.

***

The Warsaw Stock Exchange Group (GPW Group) operates trading platforms for shares, Treasury and corporate bonds, derivatives, electricity and gas, and provides indices and benchmarks including WIBOR and WIBID. The index agent FTSE Russell classifies the Polish capital market as a Developed Market since 2018. The markets operated by the GPW Group are the biggest in Central and Eastern Europe. For more information, visit www.gpw.pl