In 2020, facing the sudden onslaught of COVID-19 and complex and grave changes in the situations, SZSE resolutely implemented the decisions and plans of the CPC Central Committee and the State Council, and actively practiced the principles of “system building, non-intervention, and zero tolerance” and the working requirements of “revering the market, revering the rule of law, holding high professionalism, staying alert to risks, and obtaining support from various parties”. SZSE advanced with reforms and innovation, and propelled market reform and development with high quality. We smoothly implemented the ChiNext Board reform and registration-based IPO system, further refined market functions and steadily expanded the market size. As a result, market resilience was clearly improved, basic systems were optimized, and the capacity of the market to serve the real economy was enhanced. As at December 31, there were 2,354 companies listed on SZSE, with a total market capitalization of CNY 34.2 trillion; there were 7,954 fixed-income products, with a face value of CNY 2.5 trillion; and there were 487 fund products, with an asset size of CNY 266.86 billion. Core SZSE indexes such as Shenzhen Component Index, ChiNext Index and Shenzhen 100 Index were among the biggest gainers in the world this year.

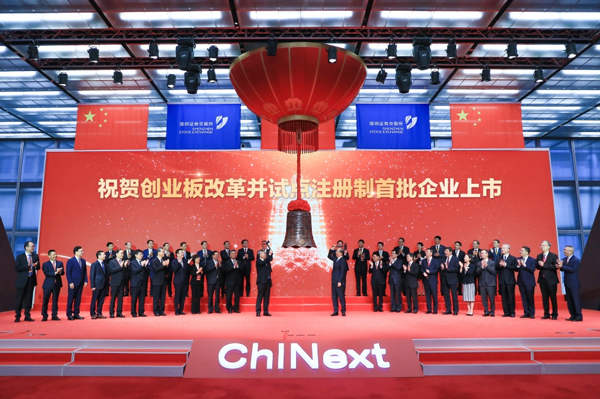

The ChiNext Board reform and registration-based IPO system were successfully implemented. Advancing the ChiNext Board reform and registration-based IPO system is a major decision and plan of the CPC Central Committee and the State Council and an important arrangement to drive existing business reform through incremental business reform and improve the basic systems of the capital market. With information disclosure at the core, we adhered to the market- and rule-of-law-based reform direction, upheld the working philosophy of “openness, transparency, integrity and impartiality”, and focused on achieving our goals with obvious effect in a smooth way, to advance the reform steadily. Since the first group of companies were listed on the ChiNext Board under the registration-based IPO system on August 24, the market is stable overall, major institutional rules and technical systems were under smooth operation, issuance and listing conditions, and pricing and issuance were advanced in a more market-based pace. In addition, review progress and results have become stable and predictable, while review standards, process and results and regulatory measures have been all made public to the market. The reform has produced results, further enhancing the confidence in the existing business reform of the capital market. As at December 31, we have accepted IPO applications from 533 companies, refinancing applications from 263 companies, and applications for major assets restructuring from 15 companies. So far, 74 IPO applications, 131 refinancing applications and 6 major assets restructuring applications have been effectively registered, and 63 IPOs have been successfully listed, raising a total of CNY 66 billion. The IPO applicants are widely distributed in 58 sectors. Four of those IPO applicants had deficit to make up at the end of 2019, and 18 selected the market capitalization indicator as their listing criterion, indicating clear improvement in diversity and coverage of sectors. The 63 companies that have been listed are from diversified sectors, including high-tech and strategic emerging industry companies and companies of innovation, creativity and originality and traditional industries that are deeply integrated with new technologies, new industries, new business forms and new models. In the first half of 2020, their average net profit rose 72.8% year on year, and average R&D intensity was 4.4%, showing prominent growth and innovation characteristics. The issuance review efficiency has improved significantly. For the first-time application of the quick refinancing program, it takes eight working days to obtain registration and get the approval from the time of submission of an application; for the first-time application for major assets restructuring, the application review and registration take 31 working days. Through the reform, the right of choice has been given to the market, effectively enhancing market participants’ gain of sense from the reform.

Pandemic prevention and control and support of the development of market entities were advanced in a coordinated manner. SZSE made adequate, careful preparations for business connection, technical guarantee and safe operation maintenance, which ensured normal opening and stable operation after the Spring Festival and effectively stabilized market sentiment and investors’ confidence. We provided flexible and considerate frontline regulation and market services, optimized business handling during the special period, by properly handling applications for postponed disclosure of annual reports from 80 listed companies, and relaxing time restrictions of such business as M&A and reorganization and bond issuance, to fully support market entities in winning the battle against the pandemic. We issued 80 special fixed-income products for pandemic prevention and control, totaling CNY 83.5 billion, reviewed issuance of fixed-income products by 11 Hubei-based enterprises via the green channel, and launched the first group of credit protection contracts for pandemic prevention corporate bonds and the first intellectual property ABS that supports enterprises in “fighting the pandemic” to make financing channels more smooth, which provided strong support to companies in resuming work and production. In addition, we fully leveraged our advantages in technology and actively carried out online services such as “Cloud Listing” “Cloud Connecting” “Cloud Training” and “Cloud Roadshow”, which were widely commended by the market. We also supported the economic and social development of Hubei, by reducing or exempting the listing premium, annual listing fee and online voting service charge of Hubei-based listed companies for 2020, holding “Hubei Capital Market Service Week” and organizing “SZSE-listed Companies Visiting Hubei”, to effectively support Hubei’s economic recovery after the pandemic.

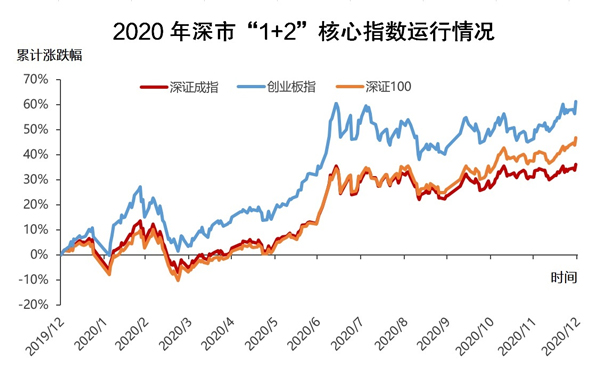

Overall market resilience was clearly improved. In 2020, although global financial markets were undergoing drastic fluctuations, the Shenzhen financial market was stable on the whole and showed strong resilience, reflecting the great achievements that China has made in pandemic prevention and control and the bright prospects of its economic development and enhancing the market’s confidence. Core SZSE indexes led the world in gains. The Shenzhen Component Index, the ChiNext Index and the Shenzhen 100 Index rose 38.7%, 65% and 49.6% throughout 2020 respectively. The ChiNext Index has topped among major global indexes in terms of gains for two years straight. Market transactions were active. In 2020, CNY 123 trillion stocks were traded on SZSE, ranking third in the world. Innovative technology stocks performed positively. A total of CNY 50 billion stocks of the industries of electronics, computer, communications and pharmaceuticals were traded, accounting for 41% of the volume of transaction on SZSE. SZSE-listed companies saw their performance improve quarter by quarter and change from a negative number to a positive one. In the first three quarters of 2020, their earnings growth went up by 7.5% year on year. The performance of ChiNext Board listed companies in the first three quarters rose 21.5% year on year, far better than the market average.

The direct financing function was effectively leveraged. In 2020, there were 161 IPO companies on SZSE, with a financing amount of CNY 126.5 billion, up by 96% year on year; 349 equity refinancing companies raised CNY 437.3 billion (excluding preferred stocks and convertible bonds); and 78 major assets restructurings were completed, with a transaction amount of CNY 348.3 billion. Over 1,300 fixed-income products were issued throughout 2020, achieving a financing amount of CNY 1.8 trillion, including CNY 692.2 billion local municipal bonds, over CNY 660 billion corporate bonds, CNY 24.5 billion policy financial bonds and nearly CNY470 billion asset-backed securities. The registration-based issuance system for corporate bonds ran stably. The average review time of publicly-offered bonds under the system is 11 trading days, 31% shorter from 2019. A total of 15 publicly-offered short-term bond products were launched, with an amount of CNY 23 billion. Credit protection tools and mechanisms were improved. The first three pilot projects of credit protection certificates were launched, through which we supported eight private companies in obtaining CNY 6.7 billion financing. The supply chain financial ABS service fields were expanded. CNY 175 billion ABS were issued in 2020, supporting more than ten thousand upstream suppliers in financing and development.

The market cultivation system was further refined. SZSE provided custom services based on local characteristics and enterprises’ demands. We held “Capital Market Service Week” in Hubei, Guizhou, Shaanxi, etc., and carried out services and activities in various forms including training, roadshow and investor education, to expand the depth and breadth of localized services. We extended the service chain. The V-Next platform has provided business matchmaking services to 14,000 small and medium-sized Chinese and foreign technology companies. With investors’ needs as the orientation, we publicized and interpreted major reforms, released about 450 investor education products of various types, and made innovations in and optimized investor education service mechanisms to effectively protect investors’ legitimate rights and interests.

Serving the development of the Guangdong-Hong Kong-Macau Greater Bay Area and the Shenzhen Pilot Demonstration Zone of Socialism with Chinese Characteristics achieved tangible results. Seizing the opportunity of developing the Guangdong-Hong Kong-Macau Greater Bay Area and the Shenzhen Pilot Demonstration Zone of Socialism with Chinese Characteristics, we advanced the authorization list of comprehensive reform pilots of the pilot demonstration zone across the board, and shoulder the responsibility as a trailblazer in the capital market. We launched the pilot project of publicly offered infrastructure REITs, and intensified financial support to traditional and new-type infrastructure. We also promoted the development of the trading center for intellectual property and property rights of scientific and technological achievements, and built the whole-chain service system for transfer and transformation of scientific and technological results. Besides, we advanced the establishment of the bond platform of the Greater Bay Area, and improved the level of integration of financial markets in the Greater Bay Area. Over the past year since the CSI 300ETF options were listed, a total of 78.22 million units of options were traded, with a face value of CNY 3.5 trillion. The transaction and operation were stable, market regulation was effective and investors were rational. We continued to intensify product innovation. 11 types of innovative bonds including Greater Bay Area bonds, green bonds and innovation & entrepreneurship bonds, with a scale of over CNY 160 billion, were issued. We also refined the financial product system of the Greater Bay Area.

High-level opening-up was advanced in an orderly manner. We continued to optimize the Shenzhen-Hong Kong Stock Connect trading mechanism. The volume of transaction of the Shenzhen-Hong Kong Stock Connect continued to increase, and its market influence further improved. In 2020, the transaction amount totaled CNY 14.3 trillion. Both the proportion of the transaction amount of stocks for northbound trading in that of SZSE-listed A shares and the proportion of the transaction amount of stocks for southbound trading in that on the Hong Kong stock market exceeded 5%. We successfully opened the Shenzhen-Hong Kong ETF Connect. The first four products were listed in Shenzhen and Hong Kong respectively. By expanding and making innovations in interconnection channels, we have provided diversified choices for investors in Chinese mainland and Hong Kong in cross-border investment. Besides, we revised and released the implementation rules for QFII and RQFII, which expanded the scope of investment and facilitated investment operation. The shareholding ratio in overseas fund transactions increased steadily. In 2020, the transactions of overseas funds accounted for 6.3%, up 2.4 percentage points year on year, indicating that SZSE’s investment attraction and international influence further improved.

The quality and efficiency of frontline regulation steadily improved. We earnestly implemented the Opinions on Further Improving the Quality of Listed Companies issued by the State Council, advanced the Three-year Action Plan for Reform of State-owned Enterprises, and adopted targeted measures to improve the quality of listed companies. We deepened the reform of the delisting system in all respects, refining delisting standards and simplifying delisting procedures. In 2020, we made decisions to delist 11 companies, to help form a market ecosystem in which only the fittest survives. Recurring market problems such as that delisting is difficult and slow were gradually solved. Adhering to the principle that we can only do well by focusing on a few first, we focused on the “critical minority” and outstanding problems, and implemented in depth classified regulation, targeted regulation and technology-based regulation. In 2020, we sent out 1,691 inquiry letters and attention letters, to help improve listed companies’ information disclosure quality and standard operation level. Using the implementation of the new Securities Law as an opportunity, we vigorously cleared and optimized self-disciplinary rules. Since the beginning of the year, we have formulated or revised 72 business rules, and abolished 78 business rules. Currently, SZSE has a total of 240 business rules, and an initial form of a simple, efficient system of rules with basic business rules at its core, guidelines as its trunk and guides as its supplement has taken shape. We deepened reforms to streamline administration, delegate powers, and improve regulation and services, and formulated and released the list of self-disciplinary regulation items and the list of market service items.

Risks in key fields were effectively controlled. We supported dissolution of stock pledge risk in market-, rule-of-law-based ways. In 2020, the number of pledged stocks in the exchange and OTC of the SZSE decreased by 18.7% from the beginning of the year, and the number of high-risk companies whose controlling shareholder’s pledge proportion is over 80% reduced by 92. We refined the bond risk clearing and disposal & trading system, launched such debt management tools as resale revocation, resale, repurchase, swap, etc., and reduced issuers’ debt repayment pressure, which involved AUM totaling CNY 28 billion. In addition, we strengthened monitoring of market operational risk, made public the transaction monitoring standard of the ChiNext Board, and deepened joint regulation of transaction and information disclosure, to prevent market volatility risk. We maintained the advanced nature of our technical architecture, improved system operation and maintenance security, and ensured stable, orderly operation of the market.

In 2021, entering into a new development stage, we will apply the new development philosophy, and integrate into the new development pattern. Under the leadership of China Securities Regulatory Commission (CSRC), we will continue to serve the real economy, vigorously support technological innovation, and consolidate the achievements of the registration-based IPO system reform. Besides, we will promote market reform and opening-up, strengthen infrastructure development, help improve the quality of listed companies, and facilitate healthy, stable development of the market. We will strive to become a quality innovation capital center and world-class exchange, and assist in building a standard, transparent, open, dynamic, and resilient capital market.