Osaka Exchange, Inc. (OSE) is pleased to announce that, effective September 1, 2025, it will expand the number of single stock options (SSOs) eligible for market making to 32 from the current 12 by adding issues on 20 new individual stocks. Eligible underliers will now comprise 30 individual stocks and 2 ETFs.

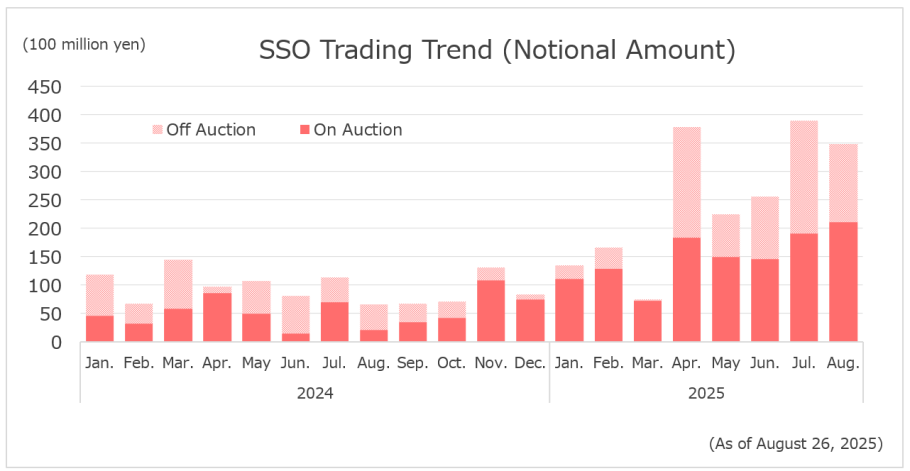

SSO Trading is on the Increase

To enhance the convenience of the SSO market, since fall 2024, OSE has had market makers continuously quote prices for SSOs on ten new individual stocks in addition to the existing two ETFs, creating a more accessible trading environment for investors for 12 securities in total. As a result, a diverse range of investors have started utilizing the market, and there has been a noticeable increase in transactions, particularly during auction sessions. We have also received requests from investors for further expansion of issues eligible for market making.

- ・"Market making" is a system that ensures market liquidity and promotes price stability by continuously offering buy and sell orders for specific issues.

SSOs Eligible for Market Making From September 2025

In response to these investor needs, OSE will expand the SSOs eligible for market making by adding issues on 20 individual stocks, bringing the total to 32 as of September 1, 2025. The newly added underliers, while centered on the TOPIX Core30, will cover a broader range of industries than before including the TOPIX Large70 and TOPIX Mid400, providing a lineup that meets the wider needs of investors.

| Code | Issue Name | Code | Issue Name |

| 1306 | NEXT FUNDS TOPIX Exchange Traded Fund | 7267 | HONDA MOTOR CO.,LTD. * |

| 1321 | NEXT FUNDS Nikkei 225 Exchange Traded Fund | 7741 | HOYA CORPORATION * |

| 2914 | JAPAN TOBACCO INC. * | 7974 | Nintendo Co.,Ltd. |

| 4063 | Shin-Etsu Chemical Co.,Ltd. * | 8001 | ITOCHU Corporation * |

| 4502 | Takeda Pharmaceutical Company Limited * | 8035 | Tokyo Electron Limited |

| 5401 | NIPPON STEEL CORPORATION | 8058 | Mitsubishi Corporation |

| 6098 | Recruit Holdings Co.,Ltd. * | 8306 | Mitsubishi UFJ Financial Group,Inc. |

| 6301 | KOMATSU LTD. * | 8316 | Sumitomo Mitsui Financial Group,Inc. * |

| 6367 | DAIKIN INDUSTRIES,LTD. * | 8604 | Nomura Holdings, Inc. * |

| 6501 | Hitachi,Ltd. * | 8766 | Tokio Marine Holdings,Inc. * |

| 6752 | Panasonic Holdings Corporation * | 8801 | Mitsui Fudosan Co.,Ltd. * |

| 6758 | SONY GROUP CORPORATION * | 9101 | Nippon Yusen Kabushiki Kaisha |

| 6861 | KEYENCE CORPORATION * | 9107 | Kawasaki Kisen Kaisha,Ltd. * |

| 6920 | Lasertec Corporation | 9432 | NTT,Inc. * |

| 7011 | Mitsubishi Heavy Industries,Ltd. * | 9983 | FAST RETAILING CO.,LTD. |

| 7203 | TOYOTA MOTOR CORPORATION | 9984 | SoftBank Group Corp. |

- These are the issues to be made eligible for market making from September 1, 2025.

With this expansion of SSOs eligible for market making, investors will find it easier to trade a wider range of issues in auction sessions, allowing for a broader range of investment strategies. Additionally, we expect the SSO market to be further invigorated by participation of a more diverse group of investors.

OSE will continue to strive to enhance the convenience of the single stock options market, aiming to provide an attractive investment environment for investors.

For Reference (More on the SSO market)

Please utilize the following links for more information on the SSO market: