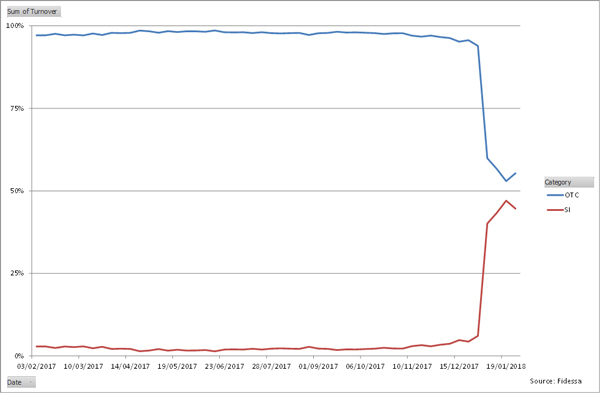

"As expected, we've seen a significant jump in SI reported volumes and a reduction in corresponding OTC flow*. This is because volume previously transacted by brokers directly with their clients now falls under the SI regime. This cannot be broken down any further, however, and so volume that was previously lumped into the OTC category is just now in a similarly opaque bucket called SI. What will be interesting, though, is how the SI volume grows as new electronic market makers enter the SI space."

"The second anticipated trend that the data supports is a jump in LIS volumes in response to the dark pool caps that were expected in January."

Who the winners and losers are

"MiFID II is all about transparency which benefits those firms with clear and relevant business models. Right now it seems that firms are adopting an approach either towards scale or specialism and so these firms will be able to demonstrate their relevance more easily. Those without a clear niche may find that the impact of unbundling and direct payments for research may leave them with a lot to prove to their customers. What is clear, however, is that technology is going to be even more important to both the scale and the specialist players in achieving and demonstrating the true value of their execution services."

What we can expect from the next year

"We're now getting to the interesting part of the MiFID II regulation as market structure adjusts to meet the new rules. Doubtless this will create new categories of winners amongst those firms who can predict these changes and invest accordingly. We would also expect to see changes in market participants' behaviour as the best execution obligation is extended to the buy-side and into other asset classes."