The New Zealand Equivalent to International Financial Reporting Standard 17 Insurance Contracts (NZ IFRS 17) is a newly introduced accounting standard for all categories of insurance contracts, superseding NZ IFRS 4. The new standard sets out principles for the recognition, measurement, presentation and disclosure of insurance contracts, applicable for reporting periods commencing on or after 1 January 2023.

It is a significant change in the way insurance contracts are reported, aimed at enhancing transparency, consistency and comparability across the industry. The transition to NZ IFRS 17 impacted policies and processes to ensure all information is available to account for and disclose transactions in accordance with reporting requirements.

This report provides insights from the FMA’s review of the implementation of NZ IFRS 17 by New Zealand insurers. It will be useful for statement preparers, audit committees and auditors of insurers.

Introduction

The New Zealand Equivalent to International Financial Reporting Standard 17 Insurance Contracts (NZ IFRS 17) is a newly introduced accounting standard for all categories of insurance contracts, superseding NZ IFRS 4. The new standard sets out principles for the recognition, measurement, presentation and disclosure of insurance contracts, applicable for reporting periods commencing on or after 1 January 2023.

It is a significant change in the way insurance contracts are reported, aimed at enhancing transparency, consistency and comparability across the industry. The transition to NZ IFRS 17 impacted policies and processes to ensure all information is available to account for and disclose transactions in accordance with reporting requirements.

Insurers have shown a high level of commitment to implementation. Their efforts have laid the foundation for more reliable and insightful financial disclosures. In time, this will strengthen stakeholder confidence and market integrity.

What we have seen

Our regulatory approach in the first year of NZ IFRS 17 implementation was to gain an understanding of disclosures, identify any gaps for insurers to consider, and take a collaborative and supportive approach to improving future disclosures. To facilitate this, we conducted a thematic review to better understand how New Zealand insurers navigated the change.

Insurers in New Zealand have encountered challenges during the implementation period, including:

- Complexity of the standard: The new reporting requirements are significantly more complex than those under NZ IFRS 4 in terms of measurement and presentation.

- Data requirements: Gathering and processing the data needed to support the new valuation methodologies.

- System changes: Upgrading financial reporting systems to accommodate revised reporting processes.

- Training and expertise: Ensuring staff are adequately trained to implement NZ IFRS 17.

Overall, the quality of disclosures in the financial statements was good. Insurers demonstrated a real commitment to transparency and meeting the requirements of the standard. However, there were notable differences in the quality and detail of disclosures across the entities within the sector.

Life insurers generally provided higher-quality and more-comprehensive disclosures, likely reflecting the greater impact of the standard on their operations and the corresponding investment in implementation efforts.

When moving into the post-implementation period, we expect to see further improvements in the quality of disclosures. Insurers should build on the lessons learned from the first year, and draw on insights from this report, as well as from industry and peers, to refine their practices. Our focus will be on enhanced comparability, consistency and clarity in financial reporting, which will ultimately lead to better-informed stakeholders and a more robust financial reporting environment.

Implementation snapshot

This snapshot highlights key approaches we observed from the implementation of the standard, covering reporting periods between 31 December 2023 and 30 September 2024. We obtained a high-level overview of the entire market, followed by a deep-dive review of disclosures from a representative sample of insurers. The analysis covers 73 insurance providers. Of these, 27 offer life insurance products, while the rest provide non-life insurance.

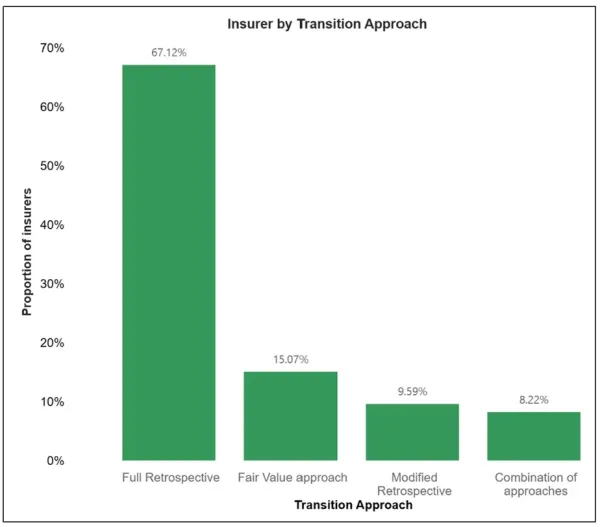

NZ IFRS 17 transition approach

NZ IFRS 171 requires retrospective application unless impracticable, in which case insurers may apply either the modified retrospective approach or the fair value approach for each group of insurance contracts.

- 67% of insurers, predominantly non-life insurers, adopted the full retrospective approach.

- Life insurers, often constrained by availability of historical data, tended to favour fair value or hybrid methods.

- Within the modified retrospective and fair value approaches, measurement choices varied depending on the availability of prior-year information.

- Hybrid approaches typically combined full retrospective and fair value methods, based on contract issuance timing, coverage periods or specific business lines.

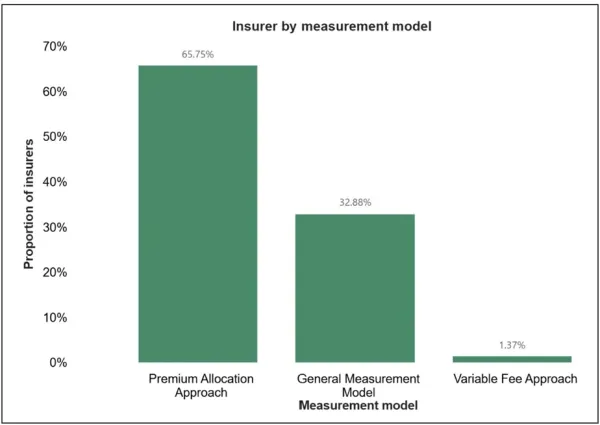

Measurement models

NZ IFRS 17 includes the General Measurement Model (GMM), the Premium Allocation Approach (PAA) for qualifying contracts, and the Variable Fee Approach (VFA) for investment contracts with discretionary participation features. Modifications to the GMM also apply for reinsurance contracts held.

- Most non-life insurers adopted the PAA, reflecting their short- duration contracts.

- Life insurers primarily used the GMM, with the PAA applied for eligible contracts and the VFA for direct participating contracts.

- A small number of life insurers used the PAA exclusively, with disclosures confirming eligibility criteria were met.

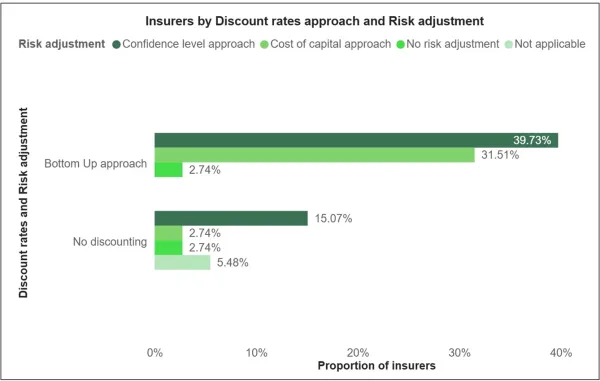

Discount rates and risk adjustment for non-financial risk

NZ IFRS 17 (paragraphs 36 and B72-B85) allows for either a top-down or bottom-up approach to determining discount rates. Disclosure of the method (paragraph 117(c)(iii)) and the yield curve(s) used (paragraph 120) is required.

- 74% of insurers applied a bottom-up approach.

- 26% did not discount their insurance contract liabilities, with disclosures indicating that liabilities were short-tail and expected to settle within one year, making discounting unnecessary.

- No insurers reported using a top-down approach.

Paragraph 37 of NZ IFRS 17 requires an adjustment to the estimate of the present value of the future cash flows, to reflect the compensation required for bearing the uncertainty about the amount and timing of the cash flows that arises from non-financial risk.

NZ IFRS 17 does not prescribe a specific method for calculating the risk adjustment for non-financial risk, allowing insurers to choose their approach. The confidence level method and cost of capital method are commonly used. If a method other than confidence level is applied, the equivalent confidence level must be disclosed.

- 55% of insurers used the confidence level method.

- 34% used the cost of capital method. All disclosed the corresponding confidence level.

- The remainder either had no liability for incurred claims or reported immaterial amounts.

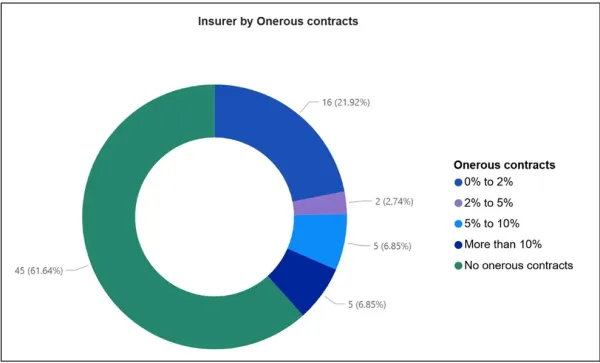

Onerous contracts

Under NZ IFRS 17, insurers must identify and disclose any onerous contracts – those expected to result in a loss over their lifetime. The following data highlights how insurers have reported this loss component relative to their total insurance contract liabilities:

- 62% of insurance providers reported no onerous contracts. Most entities with no onerous contracts were non-life insurers, likely reflecting the use of the simplified PAA model.

- 7% classified more than 10% of their contracts as onerous.

- The rest had onerous contracts comprising less than 10% of their total insurance contract liabilities.

Impact on equity at transition date

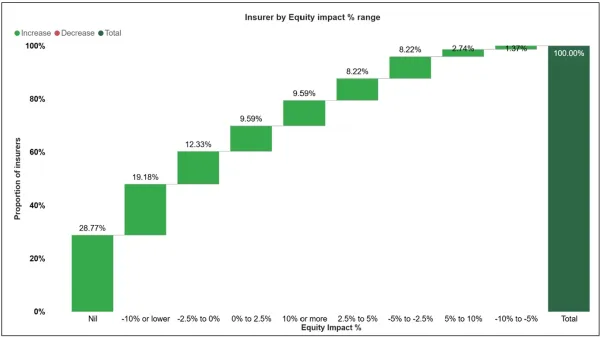

Approximately 29% of insurers experienced no change in equity from the transition to NZ IFRS 17. 41% reported a negative impact on equity (ranging from 0% to 10%), while the remaining 30% saw an increase in equity. The impacts varied across the industry with no clear pattern, although most entities reporting no impact were non-life insurers.

The key drivers of equity impact were:

- Transition approach: Adoption of a fair value or modified retrospective approach can significantly affect equity at transition date.

- Contractual service margin treatment: Deferred profits under NZ IFRS 17 reduce equity.

- Assumptions and estimation techniques: Including risk adjustment methods and yield curves modifications.

- Treatment of acquisition costs.

Other implementation decisions

Insurance acquisition cashflows: 66% of insurers capitalised acquisition cashflows over the life of the contracts; 34% chose to expense insurance acquisition cashflows, consistent with the PAA.

NZ IFRS 17 and NZ IFRS 92 interaction: 87% of insurers had already implemented IFRS 9 with no redesignation of financial instruments. A few insurers redesignated financial instruments to align with NZ IFRS 9, while others adopted IFRS 9 concurrently with NZ IFRS 17.

1 NZ IFRS 17.C3, C5A

2 Amendments to NZ IFRS 4 permitted insurers to defer NZ IFRS 9 ‘Financial Instruments’ adoption until IFRS 17 became effective, or apply an overlay approach, enabling alignment of financial asset classification, measurement, and impairment with the new insurance contract accounting model.

Areas for improvement

To assess disclosure quality we conducted a focused review of 13 insurers, examining actual reporting practices.

We have identified recurring themes that point to opportunities for further enhancement. While these represent areas where disclosures did not fully comply with the standard, they have not been assessed as significant or concerning, and are expected to improve as industry understanding deepens and practices continue to evolve.

Where disclosure did require further clarity or supporting detail, we engaged directly with insurers. All enquiries were resolved with their cooperation. Feedback letters were issued where appropriate, but most reviews were concluded without the need for individual follow-up.

| Reference to NZ IFRS 17 | Observations and areas for improvement |

|

Paragraphs 125 & 127 Quantitative disclosures on insurance risk exposures, including concentrations |

Disclosures on insurance risk exposures, particularly concentrations, varied in clarity and level of detail. Common themes included:

Effective disclosures should clearly outline the nature, magnitude and financial impact of risk concentrations, to help stakeholders assess potential vulnerabilities. |

|

Paragraphs 128-129 Sensitivity analyses for market risks, including methods and assumptions |

For sensitivity analyses related to each type of insurance risk and market risk, some financial statements lacked sufficient detail in the following areas:

Enhanced transparency in these areas will support a more comprehensive understanding of risk exposures. |

|

Paragraph 130 Claims development disclosures |

Among non-life insurers, claims development disclosures were sometimes unclear, misaligned with expectations, or omitted entirely. In cases where disclosures were absent, there was often no explanation as to whether claims are typically resolved within one year. Providing historical claims data is essential for assessing reserving accuracy and identifying trends. |

|

Paragraphs B65(l), 103(b), 88- 89, 93, 110 Disclosure of accounting policies and methods |

Some accounting policies were presented in generic or boilerplate language, lacking the specificity needed to understand key judgements made by the entity. Notable gaps included:

Insurers are encouraged to provide granular, tailored disclosures that clearly explain accounting policy choices and methodologies, especially in areas where NZ IFRS 17 allows discretion. |

|

Paragraph 28A, B35(A-D) Asset for insurance acquisition cash flows |

Disclosures related to insurance acquisition cash flow assets were sometimes missing or inconsistent, particularly in relation to:

Such disclosures offer insights into the timing and effectiveness of acquisition efforts and the recoverability of related costs. |

|

Paragraph 117 Significant judgements and changes in judgements |

Disclosures of significant judgements often lacked quantitative support or clear rationale. To improve transparency, insurers should:

Where estimation uncertainty exists, insurers should outline the methods used to determine amounts at risk of material adjustment, including meaningful sensitivities or ranges of possible outcomes. |

|

Paragraph 109 Contractual service margin (CSM) – expected release |

While most life insurers provided qualitative disclosures on the CSM, including methodologies for coverage units and profit recognition, some did not comply with IFRS 17.109 as they omitted the required quantitative disclosures showing the expected release of the closing CSM in appropriate time bands. As clarified in IFRS 17 B119-B121, such disclosures are critical for users to assess the timing of future profit recognition. Their absence reduces transparency, impairs comparability across insurers, and limits the usefulness of financial statements for forward-looking analysis and performance evaluation. |

Future focus

We will continue to review financial statements of insurance providers as part of our ongoing financial reporting monitoring. Our objective is to support the industry in enhancing the quality and transparency of financial disclosures under NZ IFRS 17.

Looking ahead, our reviews will focus on:

- Post-implementation issues and compliance with the standard, in areas including accounting policies, determination of risk adjustments, discount rates, estimation of future cash flows, and the contractual service margin.

- Assessment of whether measurement models, key judgements, and estimates such as assumptions and sensitivity analyses have been appropriately applied.

- Evaluating the sufficiency of disclosures, particularly regarding the nature and extent of risks arising from contracts within the scope of NZ IFRS 17.

We are committed to maintaining open communication and engagement with stakeholders. We will continue to share our findings and provide feedback and guidance from our monitoring work.