- Forty-five fines for money laundering failures issued in 2020; on par with 45 issued in 2019

- Fines for anti-money laundering (AML) failings globally five times higher in 2020 than 2019, totalling USD 2.2 billion

- Total fines for AML failings in January – June 2021 stand at 45% of 2020 total, totalling USD 994 million

Kroll, the world’s premier provider of services and digital products related to valuation, governance, risk and transparency, has today published new data showing that the COVID-19 pandemic has not stunted global enforcement action for anti-money laundering (AML) failings.

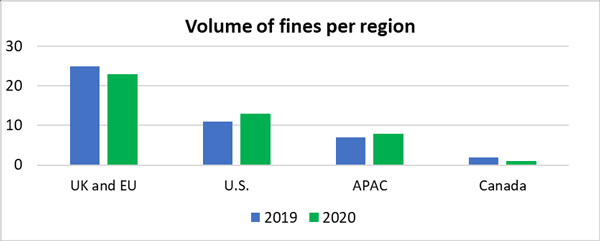

The findings come from the company’s annual Global Enforcement Review 2021, which shows that, globally, 45 fines for AML failures were issued in 2020, the same as in 2019. Moreover, the first half of 2021 seems to be following suit, with 17 fines issued between January and July this year, just under half of 2020’s year-end total.

Despite the consistency in the volume of fines issued, the total value of AML enforcement has rocketed, reaching USD 2.2 billion (bn) at the end of 2020, which is five times higher than in 2019 and over two-thirds of the record levels recorded in 2018 (USD 444 million (mn) and USD 3.3 bn, respectively). Similarly, the total value of AML fines as of June 2021 is nearly half of the 2020 total, standing at USD 994 mn.

Claire Simm, Managing Director, Financial Services Compliance and Regulation at Kroll, said:

“The figures show that investigations were not paused for COVID-19. While the number of fines remained constant, the value of fines surged as regulators imposed tougher penalties, continuing to send the message that despite any obstacles, enforcement remains a top priority for non-compliant behaviour.”

Key failings

Kroll’s report also highlights the four key AML failings from 2016-2021 that regulators across the world have consistently identified through the fines they imposed:

- AML management (124 cases)

- Suspicious activity monitoring (98 cases)

- Customer due diligence (94 significant cases)

- Compliance monitoring and oversight (57 cases)

Simm continued:

“Despite the increasing value of fines and consistent enforcement from regulators worldwide, we still see the same key AML failings being sanctioned. This year, the FCA launched criminal proceedings against a bank for inadequate AML systems and controls. Interestingly, a separate bank was fined GBP 102 mn by the FCA in 2019 for the same AML failings.

“The FCA’s decision to exercise its criminal powers is the first of its kind in the UK and a clear warning from the regulator that compliance failures will not be tolerated, on top of the already significant deterrents of mega-fines and reputational damage.”

Global breakdown

Over the past 18 months, a number of global regulators have joined the U.S. in imposing significant fines for AML failures. In 2020, Australia imposed the greatest proportion of the global total (41%), followed by Sweden and Hong Kong. The Netherlands is currently leading the way in 2021, accounting for 59% of the total value of global fines to end of June 2021 following a single fine of $582 million.

Simm concluded:

“These fines show that across the world, regulators continue to put high importance on financial crime enforcement. We can expect to see mega-fines and criminal enforcement continue through 2021 and beyond.

“Domestically, a lot of attention is focused on how the FCA will assert its regulatory powers post-Brexit. We expect the UK’s Sanctions and Anti-Money Laundering Act 2018, which came into force following Britain’s exit from the EU in December 2020, to lead to greater levels of enforcement action in the future.”

Notes:

The following data is part of Kroll’s eighth annual Global Enforcement Review, which can be accessed here: https://www.kroll.com/en/insights/publications/financial-compliance-regulation/global-enforcement-review