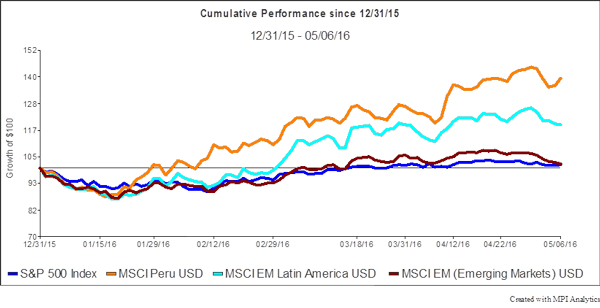

In new geo-specific analysis announced today, MPI (Markov Processes International) identifies the effect that Peruvian stock indices that have outperformed the S&P by nearly 40% this year have had on fund managers covering Latin America.

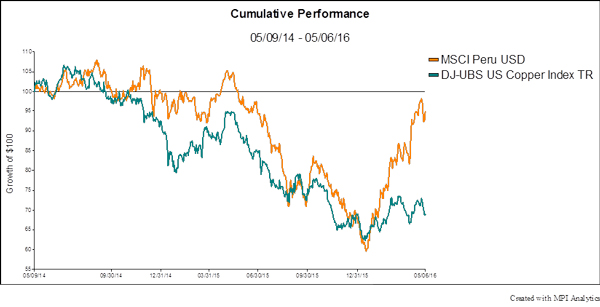

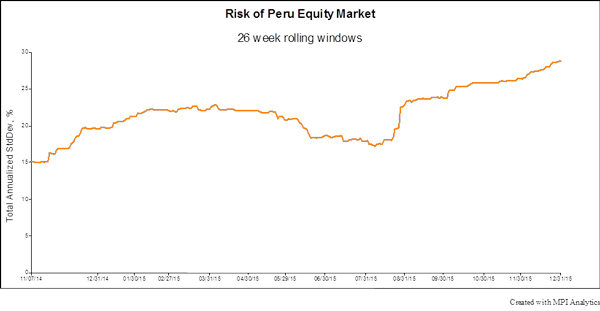

Although Peruvian stock indices typically follow returns of the DJ-UBS US Copper Index, in the past six months the MSCI Peru equity index has broken out against this historical pattern. This shift of equity markets away from the alignment with copper is not something seen for some time, according to MPI, specialists in the systematic analysis of factors influencing investment performance, which provides analytics and reporting solutions to the financial services industry.

By analyzing daily performance of mutual funds in the Morningstar’s Latin American stock category, MPI analysts uncovered the apparent 50% average decrease in their exposure to Peru, right before the rally in Peruvian stock. While such exposures produced by utilizing MPI’s proprietary Dynamic Style Analysis (DSA) do not represent the actual true holdings composition of the portfolios, which can be unknown, especially for recent periods, they provide understanding of what could be driving a portfolio’s performance and of recent changes in manager strategy and behavior.

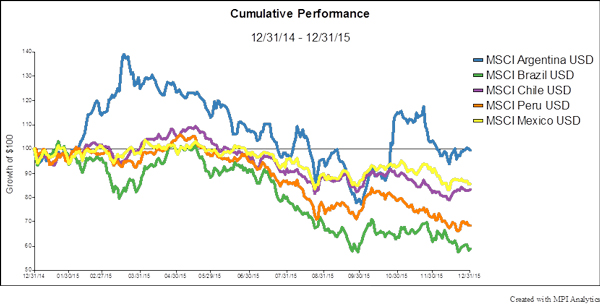

“Hindsight is 20/20 and fund managers surely had a right to be skeptical about Peru,” says MPI CEO Michael Markov. Apart from the China slowdown and an overall increase in risk, Peru suffered declining performance in 2015, coming in ahead of only Brazil in the region. “Still, Peru’s strong economic performance this year has surprised many people in the market, including, based on our research, portfolio managers specializing in Latin American stock. Even without the slowdown of China, posting more than a 40% return in an equity index over a six-month period is rare.”

MPI’s analysis can be read in full at http://markovprocesses.com/blog/2016/05/2016s-emerging-market-surprise-peru-breaks-out-performs-strong-at-nearly-40/, supported by five detailed exhibits below.