Following last week's Central Banks paper releases and members comments, MNI PINCH sees markets pricing in a lower probability of interest rates rising in the Eurozone and UK, while slightly higher in US.Please see below MNI PINCH calculation of probabilities of interest rate change:

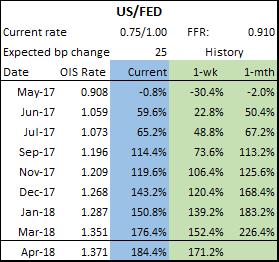

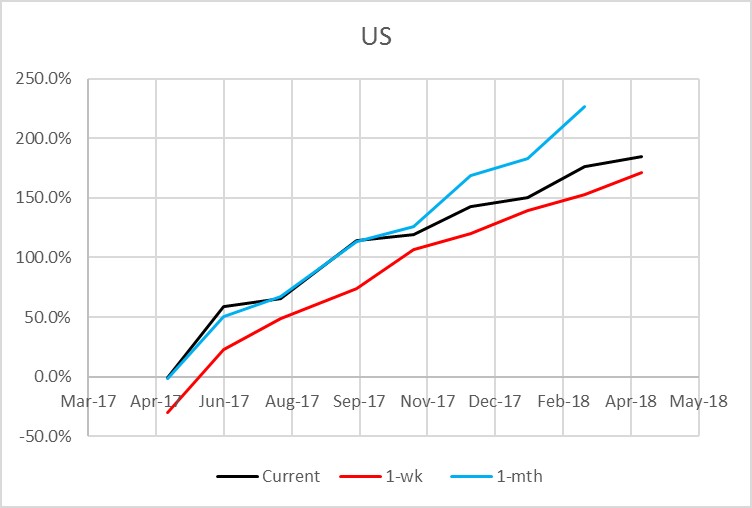

FED: MNI PINCH see markets pricing in a slightly higher chance of interest rate rises compared to Monday last week. FOMC Minutes were release last Thursday suggesting that FED expects to change its reinvestment policy "later this year" in an attempt to reduce the Balance Sheet. This is despite much lower than expected US NFP data Friday. Whilst MNI PINCH still see no chance of a 25bp rate hike at the next meeting on May 3, it now sees 60% in June (vs. 50% last Monday). July markets are pricing in a 65% chance of a hike (vs. 62%). The nextfull 25bp rate hike is still priced in for Sep 2017, according to MNI PINCH calculations.

ECB: MNI PINCH is now calculating around 9% chance of a 10bp rate hike in December 2017, down from 27% last Monday. The move comes in the wake of dovish comments from ECB President Draghi last Tuesday that "ECB needs more inflation confidence to change stance" and that he sees "no need to deviate from wording of forward guidance". Constancio also delivered comments in the same direction Monday, saying he has "no timeframe for change in monetary policy" and that "change will depend on data".

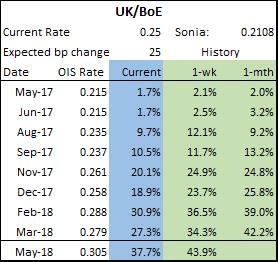

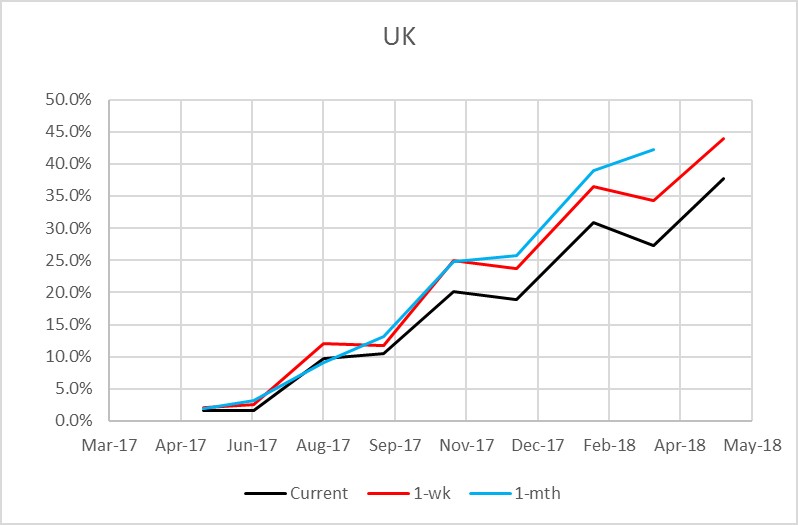

BoE: In the UK, MNI PINCH see markets pricing in a very slight lower possibility of a rise in BoE rates. UK MonPol news was limited last week. Of interest were comments from BoE MPC member Vlieghe who argued for a cautious approach to tightening policy was justified. MNI PINCH still calculates markets pricing a20% chance of a 25bp rate hike in November, and a 38% chance of a rate hike by May 2018 slightly down from 40% last Monday.

|

|

| Source:MNI/Tradition/Bloomberg | |

|

|

| Source:MNI/Tradition/Bloomberg | |

.jpg) |

|

| Source: MNI/ICAP/Bloomberg | |

.jpg) |

|

| Source: MNI/ICAP/Bloomberg | |

|

|

| Source: MNI/ICAP/Bloomberg | |

|

|

| Source: MNI/ICAP/Bloomberg | |