Following the large set of data released Friday and Monday, MNI PINCH sees markets pricing in a lower probability of interest rates rising in both UK and Eurozone, while slightly higher in US. Please see below MNI PINCHcalculation of probabilities of interest rate change:

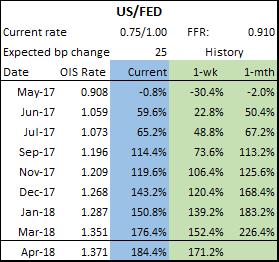

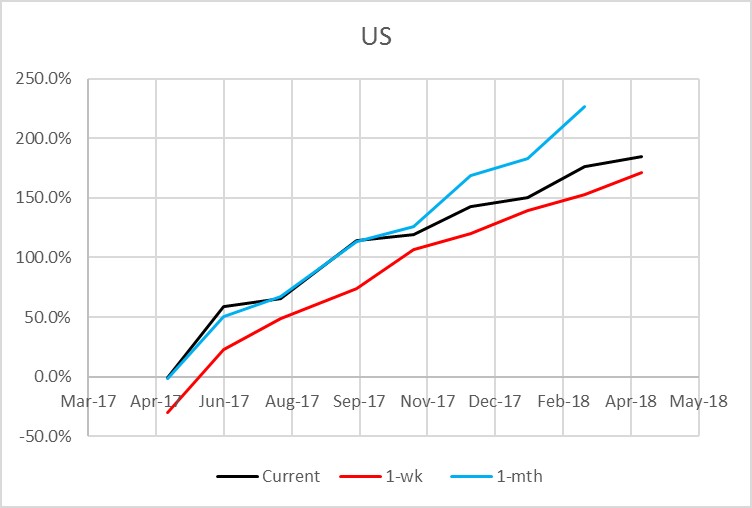

FED: MNI PINCH still see markets pricing in a slightly higher chance of interest rate rises compared to Thursday last week, as US data came in line with expectations Monday. MNI PINCH still see no chance of a 25bp rate hike at thenext meeting on May 3, 50% in June (vs. 45% last Thursday), and in July markets are pricing in a 62% chance of a hike (vs. 55%). Next full 25bp rate hike is now priced in for Sep 2017 (vs. Nov 17 last week), according to MNI PINCHcalculations.

ECB: MNI PINCH now calculating around 27% chance of a 10bp rate hike in December 2017, down sharply from 49% last Thursday, following Praet comments that despite a large set of Eurozone globally in line Monday morning, "theimportant question is whether the adjustment of the path of inflation towards below, but close to, 2% would continue without [the] expansionary monetary policy". However, he also added that "monetary policy stance remainsappropriate".

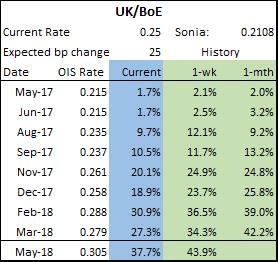

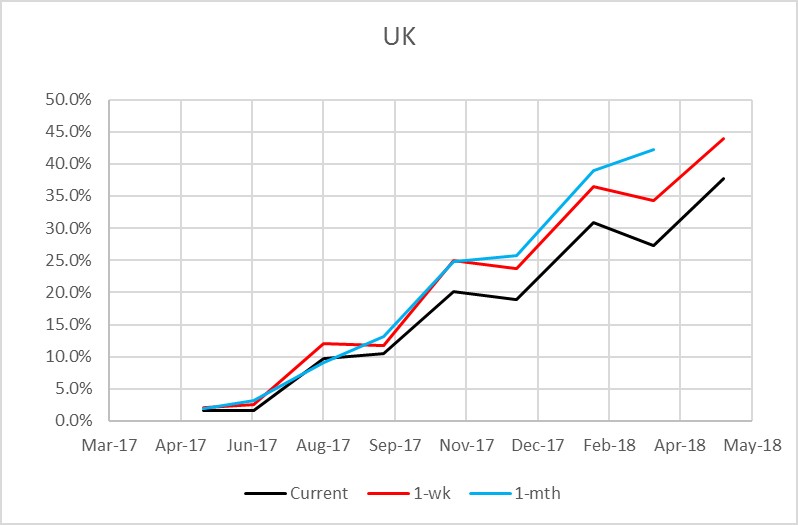

BoE: In the UK, MNI PINCH see markets pricing in a slightly lower possibility of rise in interest rates following softer than expected Markit UK PMI Manufacturing March data. MNI PINCH calculates markets pricing a 27% chanceof a 25bp rate hike in November down from 33% last Thursday and 42.5% last Monday, and a 1 in 2 chance of a rate hike by May 2018 down from 65% Thursday and 80% Monday.

|

|

| Source:MNI/Tradition/Bloomberg | |

|

|

| Source:MNI/Tradition/Bloomberg | |

|

|

| Source: MNI/ICAP/Bloomberg | |

|

|

| Source: MNI/ICAP/Bloomberg | |

|

|

| Source: MNI/ICAP/Bloomberg | |

|

|

| Source: MNI/ICAP/Bloomberg | |