MNI PINCH

MNI are introducing PINCH (Probability of INterest rate CHange) for major central banks including the Federal Reserve, European Central Bank and the Bank of England.

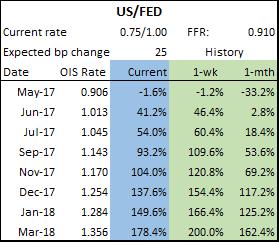

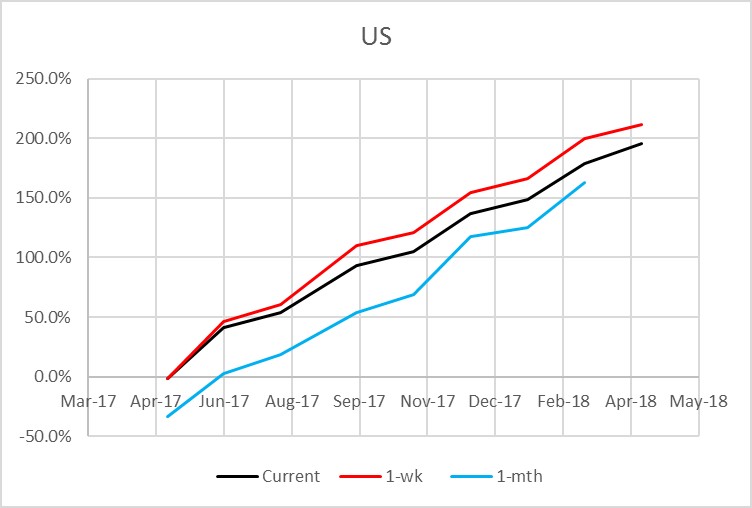

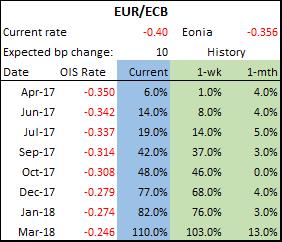

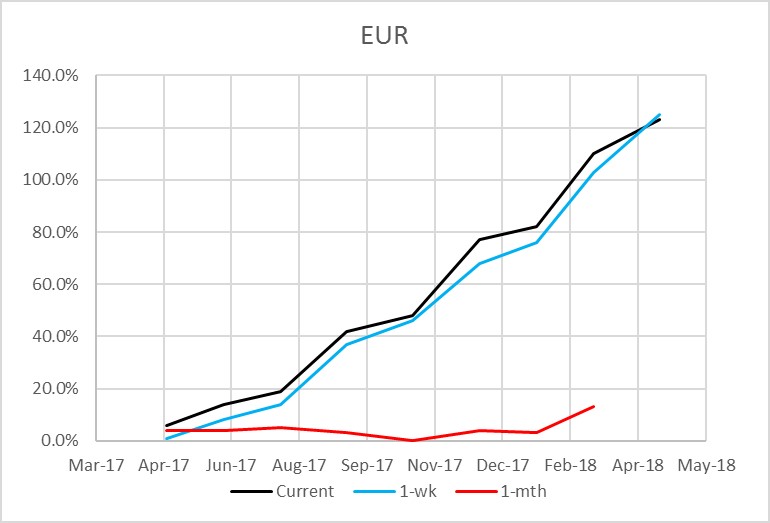

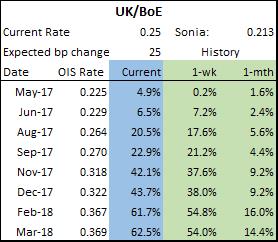

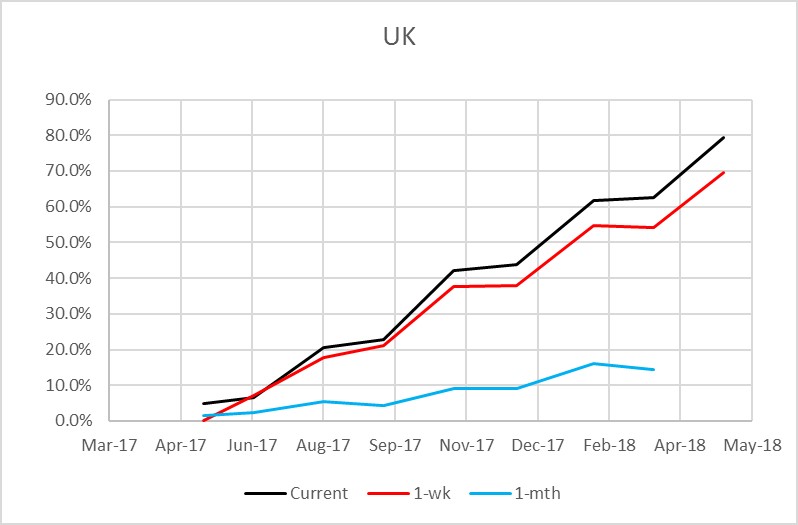

PINCH sets out the market probability of a change in interest rates, calculated from each region's forward dated OIS rates compared to the daily fixings. PINCH is more finely calibrated than many other generic market calculators. MNI aims to produce weekly reports, but will add updates if there are significant changes in market pricing. Please see tables and graphs for explanation.

FED:

Currently MNI PINCH calculates markets are pricing in a 85.5% chance of a 25bp rate hike at the next FOMC meeting on Mar 15, a further 25bp rate hike at the Sep 17 meeting and then close to a 3rd 25bp rate hike at Jan 31, 2018 meeting.

ECB:

For the ECB, MNI PINCH calculates market implied probability of a 61% chance of a 10bp rate hike at Dec 14 GC meeting, while a full 10bp rate hike is seen at Mar 8, 2018 meeting.

BoE:

The pricing for rate hikes at the BoE are lower than in Europe, with market pricing in only a 25% chance of a 25bp rate hike by the end of the year and just above 40% at Mar 22, 2018 meeting.

|

||||