Following both the FED and BoE rates decisions last week,

MNI PINCH calculation of market pricing of interest rate change are below:

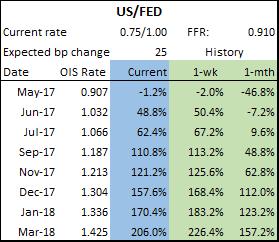

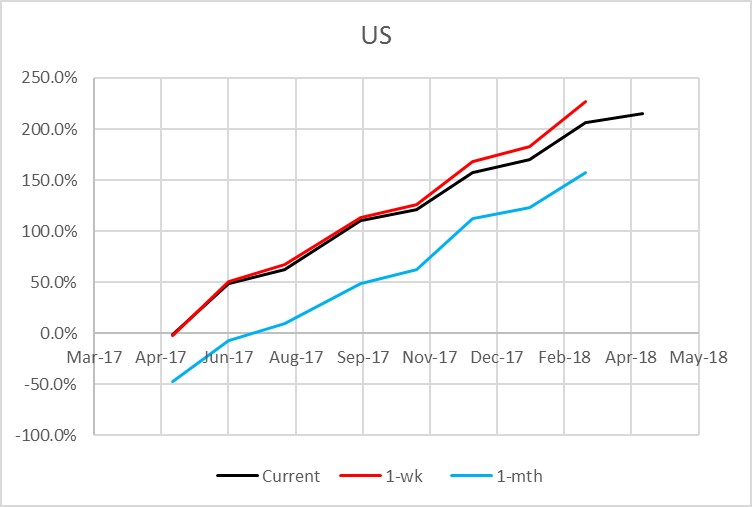

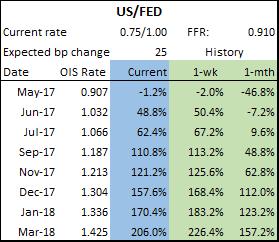

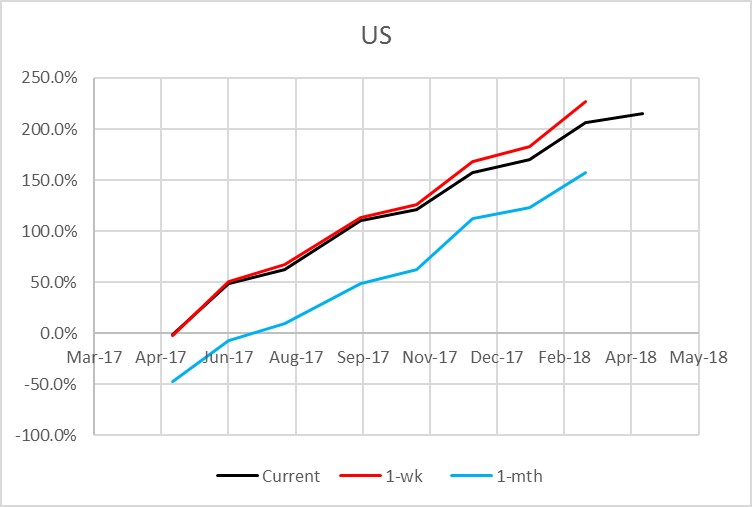

FED: Following the FOMC decision to raise rates last Wednesday MNI PINCH

sees market pricing no chance of a 25bp rate hike at the next meeting on May 3, a

50% chance of a hike on Jun 14 and a 63% of a hike on Jul 26. The next full 25bp

rate hike is priced in for Sep, with a further 25bp rate hike seen in Mar 2018.

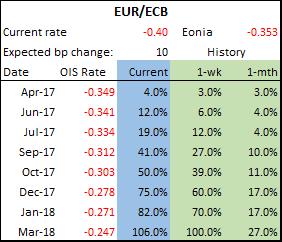

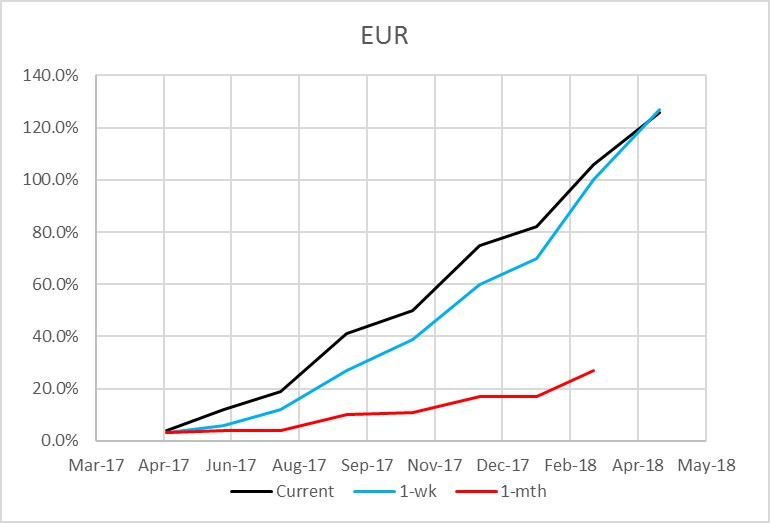

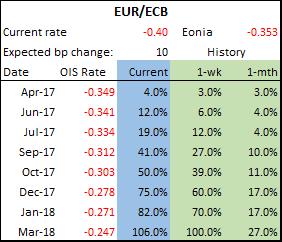

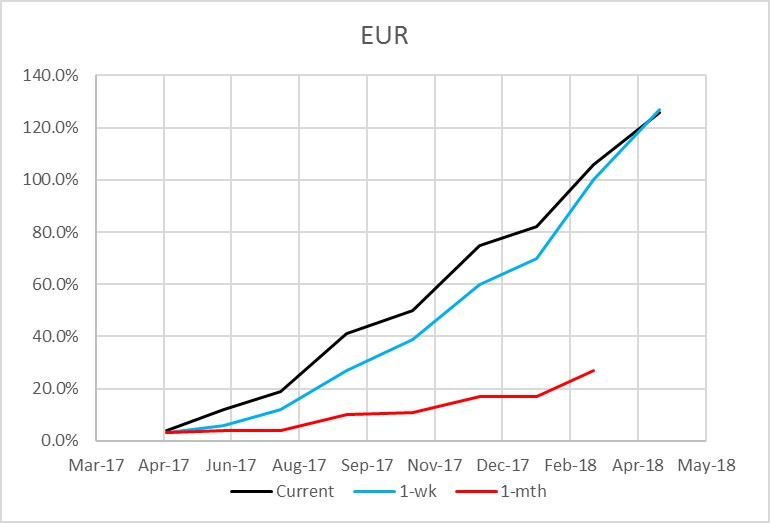

ECB: MNI PINCH see pricing of rate hikes at the ECB have risen since last

week, with the market now pricing in a 75% chance of a 10bp deposit rate hike in

December, up from 60% seen last Monday.

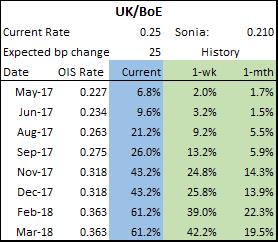

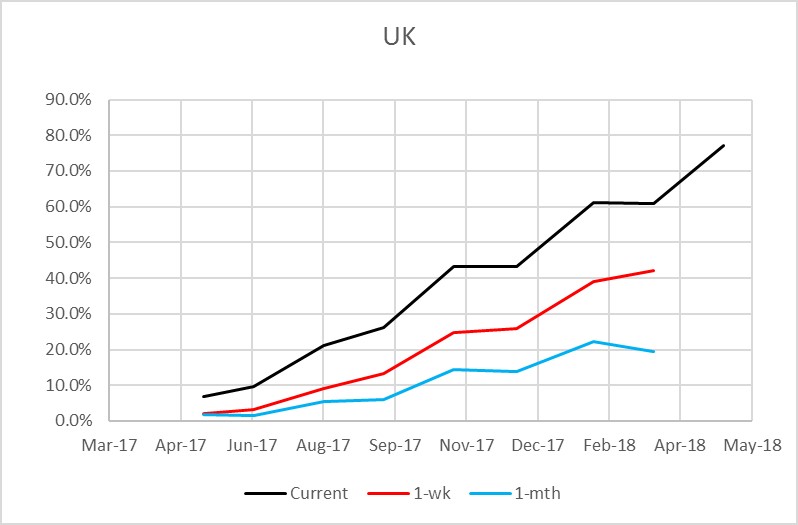

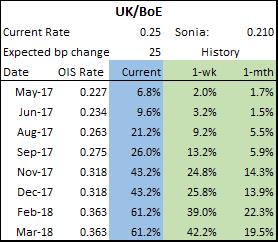

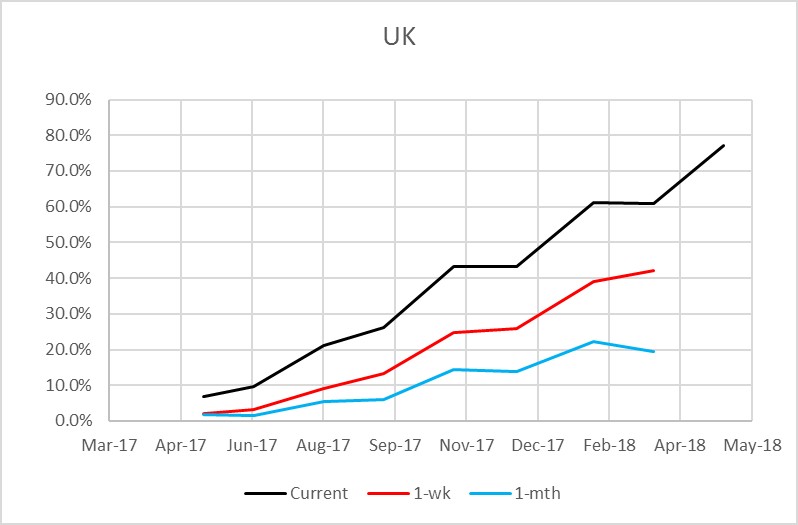

BoE: In the UK, MNI PINCH see market is now pricing in a 44% chance of a

25bp rate hike in Nov 2016, up from 25% last Monday as Kristen Forbes calls for

a 25bp rate hike due to rising inflation and better growth, while there was some

hawkish undertones from some other members in the MPC minutes as well.

Source: MNI/Tradition/Bloomberg

Source: MNI/Tradition/Bloomberg

Source: MNI/ICAP/Bloomberg

Source: MNI/ICAP/Bloomberg

Source: MNI/ICAP/Bloomberg

Source: MNI/ICAP/Bloomberg