CryptoCompare has just released its latest Digital Asset Management Review, a monthly report that focuses on key developments in global digital asset ETPs and tracks adoption of these products by analysing assets under management, trading volumes, and price performance.

March was a relatively quiet month for digital asset investment products as volumes dropped by 17.6% to $772mn and average weekly investment inflows slowed by 70.5%. Nonetheless, total AUM continued to rise month on month and now stands at roughly $58.7bn.

Here are the key takeaways:

- Institutional flows slow while total AUM increases to $58.7bn

- Volumes drop across all major products

- Bitcoin products by Grayscale and 3iQ trade at a discount

- 21Shares BNB Tracker product sees highest 30-Day returns at 34.7%4.

AUM – Assets Under Management

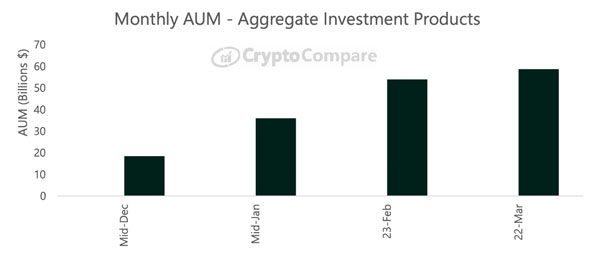

Since the end of February 2021, total AUM across all digital asset investment products have increased 8.76% to $58.7bn (as of 22 Mar).

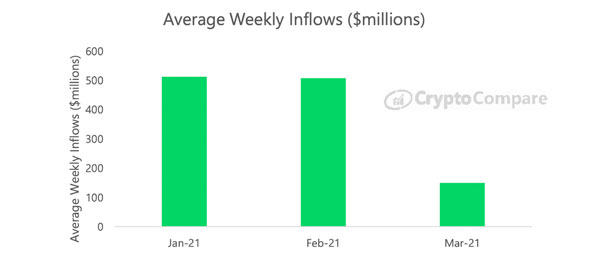

Average weekly asset inflows across all major digital asset investment product providers decreased by 70.5% since February to $149.6mn.

Trading Volumes

Aggregate daily volumes across all digital asset investment product types have decreased by an average of 17.6% in March 2021 compared to February 2021. Average daily volumes now stand at $772mn compared to $936mn in the previous month.

Price Performance

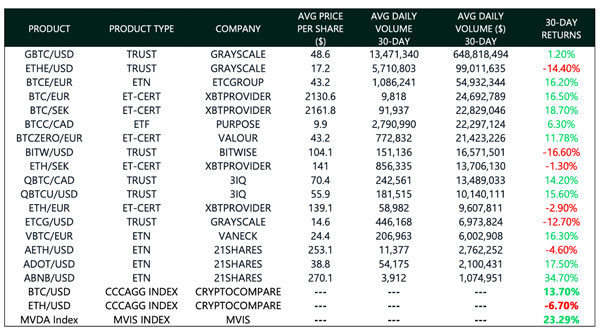

The best performing Bitcoin products by market price over the last 30 days were XBT Provider’s BTC products: Bitcoin Tracker Euro (trading into EUR, up 16.5%) and Bitcoin Tracker One (trading into SEK, up 18.7%). This exceeds CryptoCompare’s CCCAGG BTC/USD Index performance (13.7%) but not MVIS’s MVDA Index performance (23.29%).

Other top performing Bitcoin products (among the most liquid exchange traded products by volume) include VanEck’s VBTC product with 16.3% in 30-day returns and ETC Group’s BTCE product with 16.2% returns.

21Shares BNB Tracker product outperformed all other products with 34.7% returns over the last 30 days.

Grayscale’s Ethereum Trust product (ETHE, down 14.4%) and Bitwise’s BITW product (down 16.6%) underperformed relative to other top products. This constitutes almost double the loss in comparison to CryptoCompare’s ETH/USD CCCAGG Index performance (-6.7%).

The MVDA index outperformed all but one (21Shares BNB Tracker product, up 34.7%) of the top digital asset investment product markets by volume with 23.29% in 30-day returns. The MVDA index is a market cap-weighted index that tracks the performance of a basket of the 100 largest digital assets. The index serves as a benchmark and universe for the other MVIS CryptoCompare Digital Assets Indices.

Market Premiums – Grayscale and 3iQ Listed Trust Products

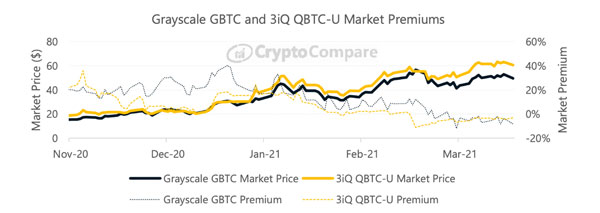

Since January, market premiums for both Grayscale’s and 3iQ’s Listed Bitcoin products have dropped dramatically and now both trade at a 4-5% discount on average. Grayscale’s average premium dropped from 6.72% in February to a discount of 4.66% in March. Meanwhile, 3iQ’s QBTC product traded at a discount of 1.88% and now trades at a larger discount of 4.34%. This shift may be a reflection of increased competition from alternative digital asset investment product providers.

|

|