CryptoCompare is delighted to announce the release of its latest research report - 2022 Outlook: Market Dynamics And Evolving Trends.

CryptoCompare's Outlook Report examines the current macroeconomic environment following the release of the latest CPI Inflation figures to distinguish if high inflation could prove beneficial for digital assets such as Bitcoin.

The report also explores the key digital asset trends that we expect to see in 2022; covering Institutional adoption, exchange trends, DeFi, NFTs, Web3 and more.

You can access the report here.

- One of the largest opportunities for cryptocurrencies in the coming years remains the continued entrance of institutional monies e.g. pension funds. Each regulatory triumph crypto achieves inches the industry closer to this largely untapped market.

- The dominance of Bitcoin-based products has fallen notably this year – from 74.9% in January 2021, to 67.8% of total AUM by year-end. Institutional investors, who most prominently utilize digital asset management products for crypto exposure, are shifting their attention towards other cryptocurrencies.

- VC firms and other allocators of capital are flooding into the industry in the search of promising crypto projects - 2021 saw a record $30bn of investments from VCs alone, compared to just $6.5bn in 2020. We explore if the increasing availability of digital asset products will act as a catalyst for more institutions to enter the space in 2022.

- In 2021, the DeFi landscape changed dramatically – TVL grew over 10x to $244bn, and while Ethereum remains the leader in the sector, its dominance has faded to 62.8% of the market. If the institutionalization process for crypto began in 2021, we expect to see the institutionalization of DeFi beginning in 2022.

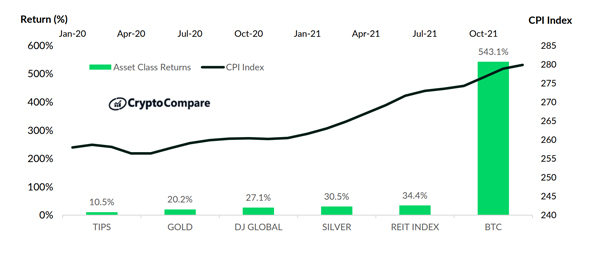

CPI & Return of Common Inflation Hedges since January 2020

Traditional inflation hedging assets have seen a lot of activity over the past two years, however, none have performed better than Bitcoin, which has returned over 600% since January 1st 2020. The worst performing hedging assets were, ironically, Treasury Inflation-Protected Securities (TIPS) and gold, which returned 10% and 17% respectively.

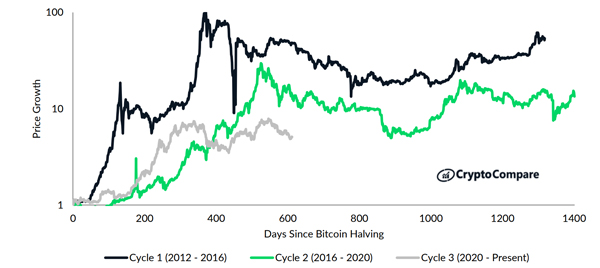

Bitcoin Halving Cycles

Many cryptocurrency investors are familiar with the theory that crypto follows a ‘4-year cycle’, mainly driven by the Bitcoin halving events. This 4 year cycle assumes a ‘blow-off top’ where Bitcoin leads the market in a significant move upwards, before a destructive crash of ~80% that ends the cycle.

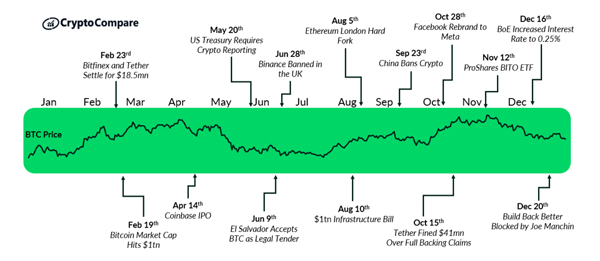

Timeline of Regulatory Events in Crypto Markets

Regulatory pressures from China were in the spotlight last year. China officially banned financial institutions from utilizing cryptocurrency for payments in May, while also abolishing the Bitcoin mining industry in June. These two regulatory actions led to a steep decline in Bitcoin’s price – from $57,758 at the start of May to a low of $28,908 in June.