Key stats from Morgan McKinley’s 2025 London Employment Monitor:

- 3% increase in jobs available quarter-on-quarter (Q2 2025 vs Q1 2025)

- 14% increase in jobs available year-on-year (Q2 2025 vs Q2 2024)

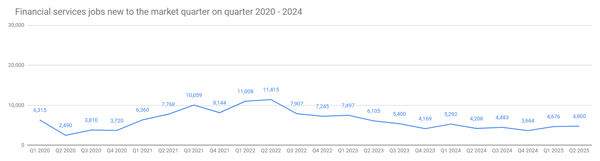

The latest employment figures from Morgan McKinley suggest that the number of job openings across London’s financial services rose by 3% in the first quarter of 2025 compared to the previous quarter and 14% compared to the corresponding period last year.

Mark Astbury, Director, Morgan McKinley commented: “The latest figures from our London Employment Monitor points to a continued rebound in London’s financial services hiring. Following a 12% seasonal bounce in Q1, we’ve seen a further 3% increase this quarter and a 14% year-on-year uplift. While the start of the year brought renewed confidence, momentum has been tempered by global market volatility, tensions in the Middle East and confusion around new US trade tariffs. Importantly, while the numbers reflect improved market sentiment, hiring volumes remain below 2023 hiring levels, highlighting that recovery is in motion but not yet complete.”

“Fintech continues to be a standout driver of growth, with strong demand for compliance and risk professionals. Greater London is projected to see a 72% rise in vacancies in 2025, making it the UK’s leading sector for hiring. However, many firms remain cautious on headcount due to ongoing cost-cutting and economic uncertainty and the government’s decision to raise employer National Insurance contributions have tempered business confidence and impacted hiring.”

“Structural changes are also reshaping recruitment. The rise of AI and automation is driving firms to streamline operations and reduce reliance on traditional entry-level roles. Investment is increasingly directed toward technology and operational transformation, with many employers prioritising long-term efficiency over short-term headcount growth. While permanent hiring has held steady, up 3% over the quarter, the contract market has cooled since Easter. From what I’m seeing on the ground, interim recruitment has been subdued with firms prioritising stable, permanent teams in core business areas over short-term cover.”

Astbury concluded: “Looking ahead, the Chancellor’s Mansion House speech on 15 July will be closely watched. With expected focus on economic growth and the future of the City with initiatives such as unlocking pension capital for investment in UK businesses, improving financial services competitiveness and fostering long-term economic stability. While these ambitions are welcome, the industry is hoping for clear, actionable measures that translate into real-world hiring and business confidence. Despite ongoing headwinds, employers that remain agile and deliberate in their planning will be best placed to adapt, navigate and grow in this evolving market.”