CryptoCompare's Exchange Benchmark report was launched in 2019 to bring clarity to the digital asset exchange sector. The report has since become an industry standard for ranking digital asset exchanges.

The latest edition of the benchmark includes an updated methodology that reflects the increased scrutiny of financial regulators. In line with these changes, the requirements for an exchange to be classified as Top-Tier have increased.

Out of the 79 Top-Tier exchanges, 4 received an AA rating, 11 received an A rating, 27 received a BB rating, and 37 received a B rating. 69 exchanges were ranked as Lower-Tier.

Four exchanges in CryptoCompare's latest benchmark received an AA ranking, with Coinbase receiving the highest score, followed by Gemini, Bitstamp, and Binance.

You can access the Exchange Benchmark here.

Key Findings:

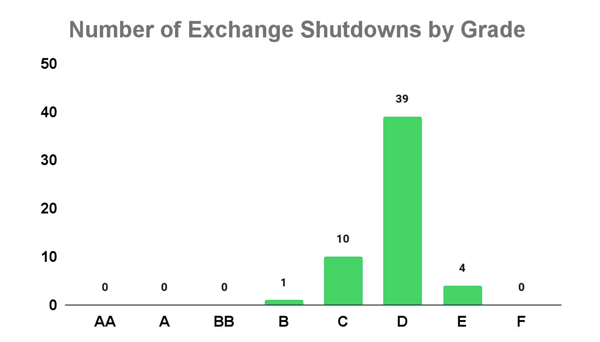

- Since the first Exchange Benchmark the industry has seen extensive consolidation, with top-tier exchanges now dominating trading volumes across the industry. Uncompetitive exchanges have had to shut down, with 54 exchanges closing down since the rankings began in June 2019 Exchange Benchmark.

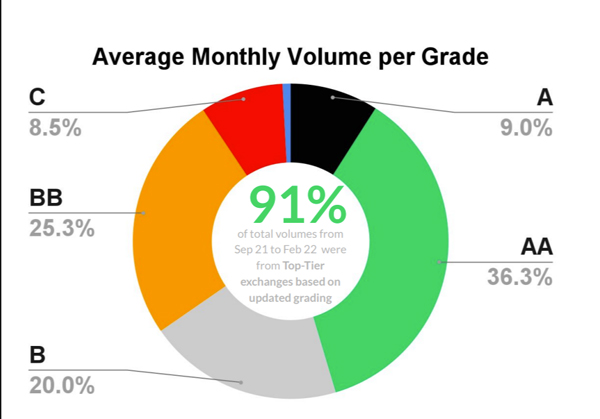

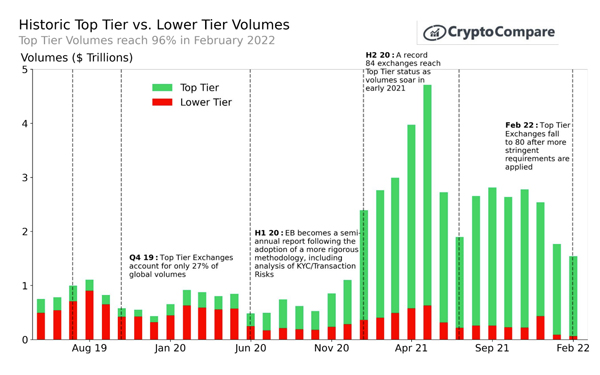

- Top-Tier exchanges gained a market share of total exchange volumes since August 2021, increasing from 89% in July 2021 (based on Aug 2021 rankings) to an average of 91%. Top-Tier exchanges traded a total of $1.5tn in Feb 2022 compared to $62bn for Lower-Tier exchanges.

- KYC stringency still requires improvement on many exchanges, with 35% rated as having poor or inadequate KYC programs (vs 34% in Aug 2021). 27% of exchanges were also found to send funds to higher-risk entities for more than 4% of transactions.

Top-Tier Ranked Exchanges Dominate Volumes

CryptoCompare has established the notion of Top-Tier volume whereby investors can segment the market into higher and lower risk volumes.

CryptoCompare currently define Top-Tier volume as volume derived from exchanges scoring a B and above. This equates to a total of 78 exchanges (vs 87 in Aug 2021 and 84 in Feb 2021 Benchmark) that CryptoCompare has rated Top-Tier for the current review.

Top-Tier Exchanges Gain Market Share

Top-Tier exchanges have increased their market share from 89% in Aug 2021 (based on Aug 2021 rankings) to 96% in February 2022 (based on the latest Feb 2022 rankings) as both retail and professional traders move to lower risk exchanges.

Industry Consolidation: Exchange Closures Since 2019

Since the Exchange Benchmark was released in 2019 the industry has seen extensive consolidation, with top-tier exchanges now dominating trading volumes across the industry.

Uncompetitive exchanges have had to shut down - there have been 54 exchange closures

since June 2019. Most of these exchanges were scattered globally, however, Chinese-based exchanges saw the largest amount of closures with 6, primarily caused by the crackdown by the Chinese government on the industry.