ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs ecosystem, reported today that in January, 25 of the top 50 overseas securities purchased by Korean retail investors were ETFs listed in the United States and Japan. The number of ETFs on the list is down by 1 from 26 in December. (All dollar values in USD unless otherwise noted)

Highlights

- Fourteen of the twenty-five ETFs on the top 50 list provide leverage or inverse exposure.

- The largest purchase was US$1.47 billion of the Direxion Daily Semiconductors Bull 3X SHS ETF listed in the United States.

Top 10 overseas ETF purchased in January 2024

|

ETF Name |

Purchase Amount in USD |

|

DIREXION DAILY SEMICONDUCTORS BULL 3X SHS ETF |

1,468,758,144 |

|

DIREXION DAILY SEMICONDUCTOR BEAR 3X ETF |

676,305,292 |

|

PROSHARES ULTRAPRO QQQ ETF |

420,662,345 |

|

DIREXION DAILY 20 YEAR PLUS DRX DLY 20+ YR TREAS BULL 3X SPLR 953438320 US25459W5408 |

311,330,723 |

|

PROSHARES ULTRAPRO SHORT QQQ ETF |

303,036,129 |

|

DIREXION DAILY TSLA BULL 1.5X SHARES |

222,767,683 |

|

PROSHARES TRUST II ULTRA BLOOMBERG NTURL (R/S) SPLR 948514771 US74347Y8701 |

190,070,182 |

|

T-REX 2X LONG TESLA DAILY TARGET ETF |

159,952,521 |

|

DIREXION DAILY FTSE CHINA BULL 3X SHARES |

151,122,160 |

|

INVESCO QQQ TRUST SRS 1 ETF |

130,125,120 |

Source, Korea Securities Depository.

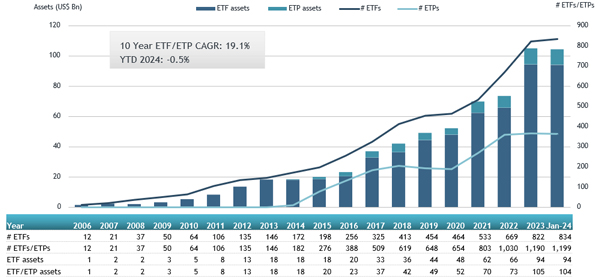

The ETFs industry in South Korea has 1,199 products, with assets of $104 Bn, from 37 providers listed on the Korea Exchange at the end of January 2024. According to data from ETFGI, 27.1 percent of the ETFs provide leverage or inverse exposure which account for 12.2% of the assets in the ETFs industry in South Korea.

Looking at the global ETFs industry, leverage and inverse ETFs account for 9.80% of the 11,975 products but only $128.49 Bn of the $11.73 trillion in assets under management at the end of January 2024.

Asset Growth in South Korean ETF and ETP as of the end of January 2024