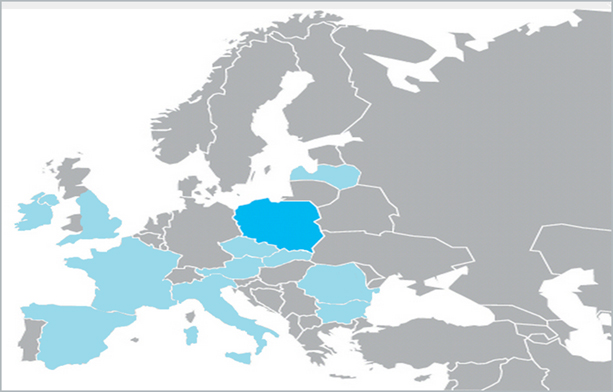

It has been one year since the KDPW_TR Trade Repository launched its business. Over that period, the Trade Repository has accepted 105 Million reports of 25,5 Million trades in derivatives. KDPW_TR has 171 Participants in 12 countries.

The KDPW Trade Repository is one of six institutions in the European Union to be registered as a trade repository by the European Securities and Markets Authority (ESMA).

“For one year now, we have supported companies across the European Union in reporting under the EU requirements. We offer a service which not only complies with the EU norms but is also available at an attractive price. All entities active on the derivatives market can use the service. We serve clients established in Poland and several other EU member states. The trust that KDPW_TR participants have put in us demonstrates that we are well prepared for the challenges we face,” said Iwona Sroka, CEO and President of KDPW.

The obligation to report details of derivatives contracts to trade repositories took effect on 12 February 2014. It was also the first day in business for the KDPW Trade Repository (KDPW_TR).

Looking back, 267 reports were sent for more than 112 thousand transactions on the first day of KDPW_TR’s operational activity. The highest number of reports from a single entity was 69 thousand.

The reporting obligation applies to all legal entities trading in derivatives but it does not apply to individuals. The obligation can be met in several ways:

- direct reporting to the trade repository (subject to participation in KDPW_TR);

- reporting via an intermediary;

- reporting via the clearing house KDPW_CCP.

In order to report details to a trade repository, entities are required to hold a unique legal entity identifier: the LEI code. The requirement is imposed by EU regulations. LEI codes can be obtained directly from KDPW. KDPW has issued more than 4,700 LEI codes by 12 February 2015.

The KDPW trade repository service addresses the requirements of the Regulation of the European Parliament and of the Council (EU) No 648/2012 of 4 July 2012 on OTC derivatives, central counterparties and trade repositories (EMIR). EMIR introduces among others the obligation to report all derivatives contracts to trade repositories and defines the rules of operation of trade repositories.

KDPW_TR in numbers:

|

|

12.02.2014 |

12.02.2015 |

|

Direct participants of KDPW_TR |

73 |

171 |

|

Accepted reports |

267 000 |

104 476 649 |

|

Reported trades |

112 000 |

25 490 125 |

|

Issued LEI codes |

2 600 |

4 715 |

Source: KDPW

KDPW_TR Participants: Country of origin

Source: KDPW