The global ETF industry broke the $9 Trillion AuM barrier over July, according to the latest data from Trackinsight (all data in this article 1st Jan 2021 – 31st July 2021, unless otherwise stated).

From January 1st to July 31st 2021, ETFs gathered in excess of $700 Billion of new flows, bringing the total AuM to $9.05 Trillion. In the same period 376 ETFs have been launched bringing the total universe to 7,273 ETFs.

Assets and flows: All regions have seen significant growth in terms of both assets and flows this year. European-listed ETFs have risen to $1.5 Trillion in AuM, propelled by $128 Billion of flows between January and July while ETFs listed on North American exchanges have seen $548 Billion of new flows over the same period, bringing their total assets to a record $6.8 Trillion. The far smaller Asia-Pacific market makes up the balance, with $701 Billion in AuM and a modest $24 Billion of flows.

ESG: ETFs which follow a sustainable investment approach or theme continue to reach new records with $325 Billion of AuM and $100 Billion of flows year-to-date. This already exceeds the total flows into ESG ETFs in 2020 of $88.5 Billion. The number of ESG ETFs listed worldwide has grown explosively in 2021 with 174 new ETFs being launched between January and August as issuers rush to capture this asset windfall.

Active ETFs: In contrast, flows into Active ETFs have fallen dramatically with July being the worst month this year for new flows – only $3.7 Billion of assets were added to active strategies and weakening performance has seen assets fall slightly from their previous high of $353 Billion to $352 Billion. 127 Actively-managed ETFs have been brought to market this year as many traditional fund managers launch ETF offerings or reprofile their existing funds as ETFs.

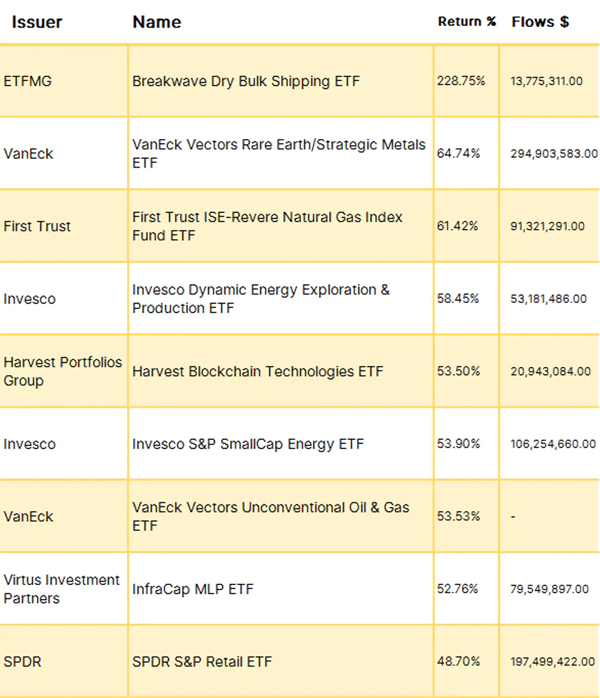

Top performing ETFs: Five of the top ten performing ETFs of the year focus on the energy sector which has witnessed sharp price rises for natural gas and other fossil fuels. The First Trust ISE-Revere Natural Gas Index Fund leads its peers, rising 61.4% Year-to-Date.

As economies unlock from the most drastic COVID restrictions and pent-up consumer demand is expected to pop, ETFs that focus on the growth in the retail sector have also seen strong performance - The SPDR S&P Retail ETF has risen 48.7% so far this year but has been left in the dust by the Breakwave Dry Bulk Shipping ETF that has risen $228.7% Year-to-Date. This ETF tracks the cost of shipping dry goods – a cost that has risen dramatically on the basis of over-capacity ports and stretched availability of shipping containers.

Top Performing ETFs Year-to-Date, 2021

Anaelle Ubaldino, Head of ETF Research and Investment Advisory at Trackinsight commented:

"2021 has been an historic year for the ETF industry in many ways. Not only have flows averaged over $100Bn a month for the first time, but the pace of issuance indicates that the traditional fund industry has finally embraced ETFs as a distribution technology for the future. In terms of population and wealth, Europe and Asia-Pacific significantly lag the North American markets, indicating that there is still incredible upside potential when issuers can crack their distribution strategies for these regions and local regulators can introduce legislation that allows ETFs to compete and bring their well-documented efficiencies to new markets.”